This sample International Trade and Trade Restrictions Research Paper is published for educational and informational purposes only. Like other free research paper examples, it is not a custom research paper. If you need help writing your assignment, please use our custom writing services and buy a paper on any of the economics research paper topics.

Economists disagree about many aspects of economic policy. However, few topics garner as much support in the field as the potential for free trade to make individuals and societies better off. At the same time, protests of World Trade Organization meetings and labor union opposition to free trade agreements continue to make headlines. This research paper presents the theory underlying the conclusion that trade makes people better off and discusses conditions under which certain individuals or groups may not share in these gains from trade. Empirical tests of trade theory are also discussed.

This research paper is organized around the main theories, or models, of international trade. Each model seeks to explain certain aspects of the complex interactions between trading countries. Some models are more useful than others for answering certain questions. None tells the entire story, yet all capture important insights, and together they provide a useful basis for understanding international trade.

Trade Theory and Evidence

Ricardian Model of Comparative Advantage

Absolute Advantage

One simplistic view of world trade would be to expect that whatever country is “better” at producing a good in some absolute sense will end up specializing in the production of that good. Were this the case, it would spell bad news for poor developing countries considering opening up their borders to free trade. Because industrialized countries such as the United States have high levels of productivity across all sectors, a less technologically advanced developing country would have no hope of competing in a free trade environment if absolute productivity levels were all that mattered. For example, consider the United States and Mexico. Suppose that one laborer using U.S. technology can produce a computer in 2 hours of work. That same person working with U.S. agricultural technology can harvest a bushel of corn in 1 hour. Now suppose that in Mexico, producing a computer takes a person 12 hours, and harvesting a bushel of corn takes 3 hours. In this example, Mexico is slower at producing both computers and corn. We say that the United States has an absolute advantage in producing both goods because it can produce each of them at a lower cost (measured in person-hours) than Mexico.

Comparative Advantage

In 1817, a British economist named David Ricardo turned this idea of absolute advantage on its head. Using a model with two countries and two goods, he demonstrated that even if one country has an absolute advantage in the production of both goods, both countries can still gain from trade as long as their relative productivities for each good differ. The implications of this insight were huge. A country does not have to be highly developed or technologically advanced to reap the benefits of the global economy.

To see how this works, consider the example of the United States and Mexico described before. In this case, the United States is absolutely better at producing each good. However, relative productivities differ across the countries. In the United States, making one computer takes twice as long as harvesting a bushel of corn. So for each computer produced, the United States must forgo production of two bushels of corn. This tradeoff between the outputs of each good is known as the opportunity cost of production. The opportunity cost of producing a computer in the United States is two bushels of corn, and the opportunity cost of producing a bushel of corn in the United States is one half of a computer. However, in Mexico, the opportunity cost of producing a computer is much higher. Mexico must give up four bushels of corn for every computer produced. Yet the opportunity cost of producing a bushel of corn in Mexico is only one fourth of a computer. So while the United States has the absolute advantage in producing both goods, Mexico is relatively better at making corn (e.g., they do not have to give up as many computers for each unit of corn produced). We say that the United States has the comparative advantage in computers, and Mexico has the comparative advantage in corn.

The Pattern of Trade

Both countries can benefit if they specialize based on comparative advantage. Sticking with this example, suppose that each country has 120 person hours available for production. This means that the United States can produce at most 60 computers or 120 bushels of corn. U.S. producers will most likely do something in between, say, dividing their labor evenly between the two sectors and producing 30 computers and 60 bushels of corn. If there is no possibility for international trade (a situation know as autarky), then they must consume exactly what they produce. Note that under autarky, in the United States, each additional computer the Americans want to consume requires them to give up 2 bushels of corn. Meanwhile, in Mexico, production is at most 10 computers or 40 bushels of corn and most likely something in between, such as 5 computers and 20 bushels of corn. In Mexico, each additional computer costs 4 bushels of corn. Now imagine that instead of making both goods, Mexico produces only corn and the United States produces only computers. When Mexico wants to give up some corn for computers or when the United States wants to give up some computers for corn, they can do so by trading on the world market. At what rate is the United States willing to give up its computers for corn? As long as they can get at least 2 bushels of corn for 1 computer, the United States is better off making only computers and then trading them for corn. And if Mexico can get at least one fourth of a computer for each bushel of corn (or only have to give up 4 bushels of corn or less for each computer), then they are better off producing only corn and trading for computers on the world market. The world relative price of corn and computers will end up being somewhere in between the opportunity costs in the two countries. For example, it could be 3 bushels of corn for 1 computer.

The Role of Wages

In the Ricardian model, the pattern of trade is determined by relative labor productivity, not by wages. Even if wages were much lower in one country than in the other, the relative cost of producing each good within each country would still determine the gains from trade. It does not matter if the absolute cost of producing computers and corn is lower in a given country because they are more productive or because they pay lower wages. As long as there is some difference in the relative costs of producing each good across countries, then both countries can gain from trade.

Extensions to the Ricardian Model

The standard formulation of the Ricardian model involves only two countries and two goods. However, the basic results still hold even with many countries or many goods. To incorporate many goods, simply line these goods up in order from the one in which the home country has the strongest comparative advantage (lowest opportunity cost) to the one in which the home country has the weakest comparative advantage (highest opportunity cost). There will be some cutoff point above which the home country will produce (and export) and below which the home country will import from its trading partner. So instead of completely specializing in one good, each country specializes in a subset of goods.

Incorporation of more than two countries can be handled in a similar way. When countries are lined up according to their labor productivity ratios in a given good, the country with the highest ratio will export that good and the country with the lowest ratio will import the good. Countries in the intermediate range may end up either exporting or importing the good, though all countries that export will have higher productivity ratios for that good than the countries that import.

Empirical Evidence

The Ricardian model’s simplicity, as well as its stark predictions, makes it difficult to test empirically. In the real world, production requires more inputs than just labor and we generally observe partial rather than complete specialization. However, the basic prediction of the model—that countries tend to export goods for which their productivity is relatively high—has strong empirical support. A classic 1963 study by Bela Balassa compared British and American labor productivity and trade. In the period studied, the United States had higher absolute labor productivity than the United Kingdom in almost all industries. Yet British exports were equally as large as those of the United States. Balassa found that the goods being exported by Britain were those in which the country had a relative productivity advantage, even though absolute U.S. labor productivity was higher. More recent evidence shows that, while the United States had higher overall labor productivity than Japan in the 1990s, Japan’s relative labor productivity in the automobile industry was about 20% higher than that of United States, potentially explaining the large volume of automobile exports from Japan to the United States (Krugman & Obstfeld, 2005)

Specific Factors (Ricardo-Viner) Model

One key assumption in the Ricardian model is that people working in, say, an automobile manufacturing plant can immediately switch to a job programming software or giving management consulting advice should they lose their old job to the forces of free trade. Another way to say this is that the Ricardian model assumes that labor may move freely between sectors. The Ricardo-Viner model relaxes this assumption by allowing certain factors of production to be specific to (or used exclusively in) certain industries. In the classic version of the Ricardo-Viner model, land is specific to agricultural production, capital is specific to manufacturing, and labor can move freely between the two sectors. However, the implications would be the same if we assumed that, say, certain types of labor were specific to each sector and capital could move freely between them. Capital, land, and labor are all known as factors of production. What matters in this model is that three factors exist, one of them is mobile across sectors, and the other two can be used in only one specific sector.

The existence of these specific factors leads to more subtle outcomes than the stark predictions of complete specialization in the Ricardian model. Instead of trading off production of two goods at a constant rate (e.g., two bushels of corn for one computer), production in each sector exhibits diminishing returns. Consider the agricultural sector. The country is endowed with a fixed amount of land, and this land can be used only for agricultural production. The land on its own cannot produce output, how-ever. Labor is also needed for agricultural production. In this example, labor is the factor that can move freely between the agricultural and manufacturing sectors. With no labor, production per acre of land is zero. When the first unit of labor moves to the agricultural sector, the marginal product of that one unit of labor is very large as production goes from zero to some positive amount. Each additional unit of labor also increases production, but not by nearly as much as that first unit. As more and more workers move from manufacturing to agriculture, these workers add less and less additional output (or marginal product) because they have only a fixed amount of land to work with. The same is true in the manufacturing sector. The first worker who shows up and turns on the machinery (or capital) has made an enormous contribution to output, yet the individual (or marginal) contribution of each additional worker is less and less given the fixed amount of capital. It follows that the optimal allocation of labor between the two sectors will involve at least some agricultural and some manufacturing production rather than complete specialization in one sector. It would not make sense for an economy to allow its last worker to have a very small impact working in a crowded factory when that worker could have an enormous productivity impact by moving to an empty field and producing agricultural goods. Wages are the adjustment mechanism that ensures this balance. Employers will hire an additional unit of labor up to the point at which the additional value produced by that unit of labor exactly equals the cost, or wage rate, of that labor. As described previously, the marginal product added by each additional worker in a sector is declining, so wages in a sector must also be declining as more and more workers move to that sector. Because labor can move freely across sectors, if workers could earn higher wages working in a factory than on a farm, they would quit their jobs in the farming sector and move into manufacturing instead (and vice versa). Equilibrium requires that the wage rates, and thus marginal products of labor, must be equal across sectors. Due to the diminishing product of labor, this is not likely to occur under complete specialization.

The relative price of the two goods in a country reflects the relative cost of producing those goods. If a factor of production is relatively scarce, then it will be relatively costly, translating into a relatively higher price for the good that uses the scarce factor in its production. On the other hand, the industry with the relatively abundant specific factor will have a relatively lower price. When two countries move from autarky to free trade, they are no longer constrained by their own factor endowments. For example, if one country is relatively well endowed with land versus capital when compared to another country, then agricultural goods will be relatively cheaper and manufactured goods will be relative more expensive in the first country. When the two countries open up to trade, Country 1 now has the option of importing some cheaper manufactured goods from abroad rather than making them itself. This reduces that demand for the scarce capital in Country 1, reducing both the cost of capital and the price of manufactured goods in that country. A similar process occurs with the relatively scarce land in Country 2. Trade allows this country to import some agricultural goods from Country 1, freeing up land and reducing the price of domestically produced food. At the same time, the demand for Country 1’s abundant land and cheap agricultural products goes up, raising their price, while the relative price of Country 2’s abundant capital and manufacturing products also goes up. This happens until relative prices are equalized across the two countries. The end result is that the country that is relatively abundant in land sees the relative price of goods that use land go up and the relative price of goods that use capital go down. The opposite occurs in the country that is relatively abundant in capital.

As in the Ricardian model, the country as a whole is better off under free trade than under autarky. Each country sees the relative price of its exported good go up, which increases income from exports. At the same time, the price of the imported good goes down, meaning that they can buy more of the imported good for a given amount of export production.

However, the existence of specific factors leads some individuals to be hurt by trade. Owners of the factor specific to the export industry gain from trade as the demand for their factor of production increases. Owners of the factor specific to the import-competing sector are worse off because the demand for (and thus the returns to) their factor have gone down. In the example just described, owners of the abundant land in Country 1 see the demand for their land go up and thus receive higher rental income for that land. However, the owners of the scarce capital see the demand for their factor go down and thus receive a lower return to that capital. The impact on the mobile factor (in this case, labor) is ambiguous, because workers will have to pay more for the exported good but can now consume the imported good more cheaply. This theoretical result can explain why certain individuals or interest groups may be opposed to free trade even if the world as a whole gains from trade.

Empirical Evidence

In addition to partial specialization along the lines of comparative advantage, this model also predicts that (a) each country will have both winners and losers from trade and (b) these winners and losers can be distinguished based on the industries that they are connected with. Precisely quantifying the gains and losses from trade that accrue to specific groups is not something that can be easily done with existing data. However, if we assume that individuals will either be for or against more open trade policies based on the perceived impact on their own welfare, then we can use the organization of interest groups and their voting patterns on trade policy proposals to test these predictions. If this model is correct, then we should observe support for and opposition to trade-related legislation to be divided by industry. Stephen Magee (1980) finds that this is indeed the case.

Heckscher-Ohlin Model

In the Heckscher-Ohlin model, comparative advantage comes from an interaction between the characteristics of countries and industries. It is a model with two countries, two goods, and two factors of production. Each country is endowed with a certain amount of each factor (e.g., high-skilled and low-skilled labor). By comparing the ratio of high-skilled to low-skilled labor in each country, we can say that the country with the larger ratio is relatively well endowed with (or abundant in) high-skilled labor and the country with the smaller ratio is relatively well endowed with (or abundant in) low-skilled labor. A similar comparison can be made between goods by looking at the ratio of high- to low-skilled labor used in the production of each good. The good with the higher ratio is said to be intensive in the use of high-skilled labor, and the good with the lower ratio is intensive in the use of low-skilled labor. The Heckscher-Ohlin model can be summarized by its four main theorems.

- The Heckscher-Ohlin Theorem. The country that is relatively more abundant in a factor of production will export the good that uses that factor relatively intensively. In other words, countries trade based on comparative advantage, and the source of that comparative advantage is relative factor endowments interacted with relative factor intensities.

- The Rybczynski Theorem. When the endowment of a factor increases, output of the good that uses that factor intensively increases more than proportionally and output of the other good falls.

This theorem links relative factor endowments to production. Even under autarky, this relationship holds. It is not surprising that an increase in one factor should increase production of the good that uses that factor intensively. However, the coinciding reduction in output of the other good is a unique result of this model.

- The Factor Price Equalization Theorem. If goods prices are equalized by trade, then so are factor prices.

This result relies on several key assumptions. The first is that of perfect competition. Under perfect competition, goods are priced at their marginal cost of production. If this were not the case, another producer would be able to enter the market and sell the identical good at a lower price. Marginal cost pricing results in a direct relationship between goods prices and factor prices. Another crucial assumption is that production technology is identical across countries, such that one unit of capital or labor will have the same marginal product in each country. Otherwise, we could observe marginal cost pricing and goods prices that are equalized across countries, even if wages are much lower in one country, if the low wage country is less productive. For example, if one country requires 10 person hours to produce a good and the wage is $1.00 per hour, then the cost per unit of good is the same as in a country where production requires only 1 person hour but the wage is $10.00 per hour. This result also assumes that wages are set by market forces rather than trade unions or government policies.

- The Stolper-Samuelson Theorem. When relative prices change, the factor used intensively by the good whose price has increased receives a greater reward in terms of both goods.

Trade creates clear winners and losers within each country. The winners are those who control the relatively abundant factor, and the losers are those who control the relatively scarce factor. Suppose a country is relatively well endowed with high-skilled labor. When that country opens up to trade with a relatively low-skilled country, they will specialize in high-skill intensive goods. This increases the demand for high-skilled labor and raises the wages of high-skilled workers. At the same time, there is less demand for low-skilled workers, because the goods they produce can be purchased more cheaply elsewhere. Low-skilled workers in the high-skill abundant country will see their wages fall. Focusing on high- and low-skilled workers as the two factors of production also has implications for the impact of trade on the income distribution within countries. Because more developed countries are more well endowed with high-skilled labor, trade should cause them to specialize in high-skill intensive goods, increasing the wages of high-skilled workers and decreasing the wages of low-skilled workers. Because high-skilled jobs generally pay more, this results in a wider wage gap between high-income and low-income workers. However, the opposite prediction holds for developing countries. When these countries, which are relatively more well endowed with low-skilled labor, open to trade the wages of low-skilled workers should increase, leading to a reduction in income inequality.

Empirical Evidence

John Romalis (2004) tests a version of the Heckscher-Ohlin model with many countries and many goods. He finds strong empirical evidence for the prediction that countries capture a larger share of world trade in sectors that use their abundant factors more intensively. He also finds evidence in support of the Rybczynski theorem. James Harrigan (1995) also finds support for the Rybczynski theorem by looking at the impact of changes in capital, skilled labor, and unskilled labor on industry-level production using a panel of 20 countries over 15 years.

The factor price equalization theorem is less well supported. A literal interpretation of this theorem would predict that wages and rental rates should be equal across all countries. This is clearly not the case. However, Paul Samuelson (1971) suggested that factor price convergence might be a better concept to test for than factor price equalization, because wages have been getting closer across countries as trade has increased even though they are clearly not equal. One of the strongest assumptions of the Heckscher-Ohlin model is that technology does not vary across countries. Edward Leamer and James Levinsohn (1995) summarize a number of empirical studies that suggest that once productivity differences have been accounted for, factor price equalization actually does have quite a bit of empirical support.

Support for the Stolper-Samuelson theorem is mixed. As mentioned previously, a study by Magee (1980) finds that support for trade policies is generally based on industry affiliation rather than factor affiliation. However, Ronald Rogowski (1987) does find support for the Stolper-Samuelson predictions in the formation of political coalitions. Adrian Wood (1997) examines the prediction that trade should increase the wage gap in developed countries and decrease the wage gap in developing countries. He finds strong evidence that trade is associated with increasing income inequality in developed countries, but the impact on developing countries is mixed. When several East Asian countries first opened to trade in the 1960s and 1970s, they experienced a narrowing of the wage gap. However, most Latin American countries that liberalized their trade policies in the 1980s saw their wage gaps widen. However, a number of potential mitigating factors, such as the role of skill-biased technological changes and the emergence of even more low-skill endowed countries such as China and India on the world market, make it difficult to sort out the extent to which the evidence supports or contradicts the Heckscher-Ohlin theory.

Standard Trade Model

The standard trade model is not a separate model, but instead provides a general framework in which to view the other classical models. In this framework, comparative advantage can come from (a) productivity differences across countries as in the Ricardian model, (b) differences in endowments of industry-specific factors of production as in the specific factors model, or (c) interactions between the relative factor endowments of countries and relative factor intensities of goods as in the Heckscher-Ohlin model. By keeping the sources of comparative advantage in the background, this model is able to focus on the welfare effects of trade.

In the standard trade model, each country produces the greatest value of output that it can, given the prevailing relative prices. This determines the global relative supply curve. Each country consumes the bundle that will give it the highest utility it can afford at prevailing relative prices, which determines the global relative demand curve. World equilibrium is determined by the intersection of the relative supply and relative demand curves. The primary channel through which trade impacts welfare is through a country’s terms of trade, which is defined as the price of the country’s exports divided by the price of its imports. An increase in a country’s terms of trade leads to an increase in welfare, as it allows the country to purchase more imports for the same quantity of exported goods. This framework can be used to examine how increased trade volumes, changes in preferences, trade policy instruments such as tariffs, growth, and income transfers impact relative world prices and thus the welfare of nations.

Imperfect Competition Model

The classic trade models described previously emphasize ways in which differences between countries can lead to gains from trade. Yet most trade is between countries that are very similar to each other in terms of both technology and endowments. Paul Krugman developed a model in which imperfect competition can lead to gains from trade, even between identical countries. Economies of scale lead to imperfect competition. Under economies of scale, production is more efficient at a larger scale, possibly because there exist some large fixed costs to market entry. Consider an industry that requires a large amount of research and development, such as the pharmaceutical industry. To produce a drug, a firm in this industry must invest hundreds of millions of dollars and many years of research time before the product hits the market. Once these fixed costs have been incurred, however, the marginal cost of each additional dose of the drug produced is close to zero. If the company were to charge a price equal to the marginal cost of production, it would never recover its initial investment. For this reason, we expect prices to equal average cost rather than marginal cost. If the company produced only a few doses, the average cost of production per dose would be extremely high. Yet as it produces more and more doses, the average cost per dose goes down, as does the price paid by the consumer.

Trade increases the size of the market, leading to lower average costs of production. Under autarky, each type of medication would have to be produced by each country. Thus, the fixed costs would be incurred by more than one producer and the average costs would reflect the market size in each country. If two countries were able to trade, then they could specialize such that the high fixed costs of each product had to be incurred only once, and the larger world market size would lead to lower average costs and thus lower prices for consumers.

In his model of imperfect competition and international trade, Paul Krugman focuses on a type of imperfect competition known as monopolistic competition. In this framework, each firm produces a product that is differentiated from those of its rivals. Even if there are many firms in an industry, each firm is a monopolist in its own variety of the product. Some substitution between products is possible, but they are not perfect substitutes. Thus, each individual producer behaves as a monopolist even though there is some competition between firms. Consumers not only benefit from the lower prices that result from the concentration of production, but are also able to choose between a greater number of varieties in each industry. This framework allows for trade within industries as well as between them. Consider the automobile industry. The United States is both an exporter of Fords and an importer of Toyotas. Krugman’s model can explain how countries that are similar in their technological development, such as the United States and Japan, can still gain from trade and can both be exporters of automobiles.

Empirical Evidence

The large share of intraindustry trade in total world trade flows is often cited as evidence of the monopolistic competition model. About 25% of world trade occurs within industries. Krugman points out that industries with higher levels of intraindustry trade tend to be sophisticated manufactured goods, such as chemicals, pharmaceuticals, and electrical machinery, which are likely to exhibit increasing returns to scale and allow for product differentiation. Goods with lower shares of intraindustry trade tend to be more labor-intensive products such as footwear and apparel (Krugman & Obstfeld, 2005). Elhanan Helpman (1987) tests the predictions of the monopolistic competition model using Organisation for Economic Co-operation and Development data for 1956 to 1981. He finds support for the prediction that the share of intraindustry trade should be higher for pairs of countries with similar per capita gross domestic product (GDP).

Current Topics in International Trade Theory

The Gravity Model

The gravity model, in which the volume of trade between two countries is based on the distance between them and their relative GDPs, as well as a number of other country characteristics such as population, language, common borders, colonial history, tariff rates, and so on, has been shown to be empirically very robust. While the initial motivation for the model was empirical, gravity has since been shown to be derivable from a variety of theoretical frameworks. Helpman and Krugman (1985) derive gravity predictions using a monopolistic competition model, Alan Deardorff (1998) provides a derivation using the Hecksher-Ohlin model, and Jonathan Eaton and Samuel Kortum (2002) provide a Ricardian treatment. For a survey of these and other derivations, see Robert Feenstra (2002).

Heterogeneous Firms

Most classic trade models are based on the notion that countries trade in industries. However, in actual commerce, it is firms rather than countries that conduct the transactions. Within a given industry, there may be a number of different firms, each of which may have different levels of productivity or ways of organizing production. As more detailed data on firm level transactions have become available, and as increased computing power has allowed for the analysis of these detailed microdata, the focus of both empirical and theoretical research has moved toward including firm-level heterogeneity. Andrew Bernard and J. Bradford Jensen (1999) summarize evidence documenting that exporting firms have higher levels of productivity than nonexporters. They demonstrate that this is because the better firms select into exporting, not because exporting leads to higher productivity. Marc Melitz (2003) develops a model based on Krugman’s monopolistic competition framework that incorporates firm-level productivity differences and can explain key patterns in the firm-level trade data. Much of the current research on international trade incorporates some form of the Melitz-type model of heterogeneous firms.

Trade Restrictions

Tariffs

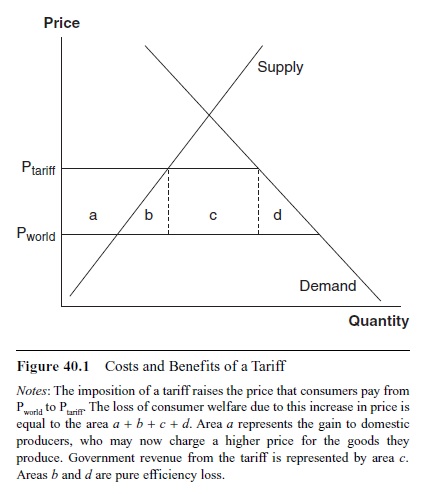

A tariff is a tax imposed on goods or services when they are sold across international borders. Ad valorem tariffs are a fixed proportion of the product’s value (e.g., 10%). Specific tariffs are a fixed amount per unit (e.g., $ 10,000 per automobile) and do not vary with price. Tariffs harm consumers, who are forced to pay higher prices for the goods they consume. Tariffs also harm producers whose goods are being taxed. However, they benefit domestic producers who are in competition with the foreign goods that are subject to the tariff. They also create government revenue. These gains and losses are depicted in Figure 40.1. Even though some groups benefit and some groups lose when tariffs are imposed, the distortionary effect on prices leads to an efficiency loss such that the negative effects of the tariff outweigh the benefits that accrue to certain individuals.

Nontariff Barriers

In addition to tariffs, which directly impact the prices paid by consumers, governments may also impose a variety of quantity-based restrictions on imports. An extreme example is an import ban, which prohibits any imports from entering the country. Import quotas, which limit the quantity of a certain good that may enter the country, are more common. Although they focus on quantities rather than prices, quota restrictions have the same effect as tariffs. Restricting the supply of a certain good will result in a price increase similar to the increase that could be observed under tariff policy. Other restrictions such as product standards or labeling requirements have a similar effect.

Figure 40.1 Costs and Benefits of a Tariff

Figure 40.1 Costs and Benefits of a Tariff

Notes: The imposition of a tariff raises the price that consumers pay from Pworld to Ptarif. The loss of consumer welfare due to this increase in price is equal to the area a + b + c + d. Area a represents the gain to domestic producers, who may now charge a higher price for the goods they produce. Government revenue from the tariff is represented by area c. Areas b and d are pure efficiency loss.

Preferential Trade Agreements

Preferential trade agreements (PTAs) are agreements in which the tariffs that participants apply to other members’ goods are lower than the rates on the same goods coming from countries outside of the agreement. The two main types of PTAs are free trade areas and customs unions. In a free trade area (FTA), each country’s goods can be shipped to the others without tariffs, but each country sets its own tariffs against nonmembers independently (e.g., North American Free Trade Agreement). A customs union is like a FTA, but the member countries agree on uniform tariff rates to apply to nonmembers (e.g., the European Union). FTAs are politically more straightforward because they do not require that member countries come to agreement on their external tariff policy. However, FTAs create a larger administrative burden than customs unions because they must prevent third-party imports from first entering the member country with the lowest external tariff and then being shipped to the member with the higher external tariff in order to avoid paying that tariff. Trade diversion is a potential negative consequence of PTAs. It occurs when a formal agreement prevents potentially beneficial trade with countries outside of the agreement.

Policy Implications

Government policies other than tariffs and trade restrictions can also distort the predictions of the standard trade models. Differences in the cost of production across countries may not accurately reflect productivity or factor abundance in the presence of such distortions. For example, wages will not be fully determined by the demand for labor in countries with a strong labor union presence. Differences in environmental and workers’ rights regulations may also impact production costs. However, the predictions of the models described in this research paper will still hold as long as the productivity and endowment differences across countries outweigh the impact of labor and environmental regulations.

The theoretical and empirical evidence points overwhelming in the direction of gains from trade. The natural policy conclusion is that restrictions on free trade are harmful and should be avoided. In spite of the net gains resulting from increased trade, there is also evidence that these benefits do not accrue universally, and that trade creates both winners and losers. However, because the gains outweigh the losses, a standard argument made by trade economists is to point out that everyone can be made better off if countries liberalize their trade policies and then use some of the income gains resulting from this liberalization to compensate those that otherwise would have been made worse off by trade. For example, a lump sum tax could be imposed and the revenues from that tax could be used to provide an income subsidy to those who would have been made worse off.

Conclusion

A number of theoretical models exist to explain the causes and effects of international trade patterns. The Ricardian model of comparative advantage was the first to demonstrate that any country can gain from trade, regardless of absolute levels of productivity. In this model, all that matters is that countries differ in their relative abilities to produce different goods. The basic result of the Ricardian framework, that specialization according to comparative advantage leads to gains from trade, has held up over time. However, the simplistic nature of the model means that it is not very well suited for answering more subtle questions, such as how trade impacts the distribution of income within a country or why we do not observe complete specialization. The specific factors (Ricardo-Viner) and Heckscher-Ohlin models add more depth to the comparative advantage story. In both of these models, countries only partially specialize. While each country as a whole gains from trade, individuals in import-competing industries are made worse off by trade, while those in exporting sectors are made better off. The Krugman model of trade under imperfect competition shows how even two identical countries can gain from trade in the presence of economies of scale and product differentiation. Current research on international trade focuses on making more direct links between the theory and data and emphasizes the role of firms, rather than countries and industries, in trade.

See also:

References:

- Appleyard, D., Field, A., & Cobb, S. (2006). International economics (5th ed.). Boston: McGraw-Hill Irwin.

- Balassa, B. (1963). An empirical demonstration of classical comparative cost theory. Review of Economics and Statistics, 4, 231-238.

- Bernard, A., & Jensen, J. B. (1999). Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 47(1), 1-25.

- Bhagwati, J., Panagariya, A., & Srinivasan, T. N. (1998). Lectures on international trade (2nd ed.). Cambridge: MIT Press.

- Corden, W. M. (1997). Trade policy and economic welfare (2nd ed.). Oxford, UK: Oxford University Press.

- Deardorff, A. (1998). Determinants of bilateral trade: Does gravity work in a neoclassical world? In J. Frankel (Ed.), The regionalization of economy (pp. 7-22). Chicago: University of Chicago Press.

- Eaton, J., & Kortum, S. (2002). Technology, geography, and trade. Econometrics, 70(5), 1741-1779.

- Feenstra, R. (2002). The gravity equation in international economics: Theory and evidence. Scottish Journal of Political Economy, 49(5), 491-506.

- Feenstra, R., & Taylor, A. (2008). International economics. New York: Worth.

- Harrigan, J. (1995). The volume of trade in differentiated intermediate goods: Theory and evidence. Review of Economics and Statistics, 77(2), 283-293.

- Helpman, E. (1987). Imperfect competition and international trade: Evidence from fourteen industrialized countries. Journal of the Japanese and International Economies, 1, 62-81.

- Helpman, E., & Krugman, P. (1985). Market structure and foreign trade: Increasing returns, imperfect competition and the international economy. Cambridge: MIT Press.

- Krugman, P., & Obstfeld, M. (2005). International economics theory and policy (7th ed.). Boston: Pearson Addison-Wesley.

- Leamer, E., & Levinsohn, J. (1995). International trade theory: The evidence. In G. Grossman & K. Rogoff (Eds.), Handbook of international economics (pp. 1339-1394). Amsterdam: Elsevier.

- Magee, S. (1980). Three simple tests of the Stolper-Samuelson theorem. In P. Oppenheimer (Ed.), Issues in international economics (pp. 138-151). London: Oriel Press.

- McKinsey Global Institute. (1993). Manufacturing productivity. Washington, DC: Author.

- Melitz, M. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695-1725.

- Rogowski, R. (1987). Political cleavages and changing exposure to trade. American Political Science Review, 81, 1121-1137.

- Romalis, J. (2004). Factor proportions and the structure of commodity trade. The American Economic Review, 94(1), 67-97.

- Samuelson, P. (1971). An exact Hume-Ricardo-Marshall model of international trade. Journal of International Economics, 1, 1-18.

- Wood, A. (1997). Openness and wage inequality in developing countries: The Latin American challenge to East Asian conventional wisdom. The World Bank Economic Review, 11(1), 33-57.

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to buy a custom research paper on any topic and get your high quality paper at affordable price.