This sample Economic Theory Of Criminal Behavior Research Paper is published for educational and informational purposes only. If you need help writing your assignment, please use our research paper writing service and buy a paper on any topic at affordable price. Also check our tips on how to write a research paper, see the lists of criminal justice research paper topics, and browse research paper examples.

The economics of crime started with the seminal article by Nobel Laureate Gary Becker in 1968. He suggested the well-known high-fine-low-probability result, in a framework where rational criminals compare the benefit of violating the law with the possible cost (in terms of probability and severity of punishment). Legal economists have developed a theory of deterrence in the last 40 years to explain optimal punishment in multiple contexts. The main results as well as new insights provided by behavioral law and economics are reviewed.

Basic Model

The economic theory of criminal behavior is an application of the neoclassical theory of demand. Formalized by Nobel Laureate Gary Becker in 1968, it states that potential criminals are economically rational and respond significantly to the deterring incentives by the criminal justice system. They compare the gain from committing a crime with the expected cost, including the risk of punishment, the possibility of social stigma, and eventual psychological costs. If Becker’s theory is correct, increasing the resources that society devotes to the arrest, conviction, and punishment of criminals may be the best policy prescription for reducing the amount, and social costs, of crime.

Consider an example. Suppose an individual considers violating speed limits. S/he should consider, on one side, the benefit from such behavior (arriving earlier to his/her destiny or the simple pleasure of driving above the speed limit) and, on the other side, the possible punishment. However, a fine for violating speed limits is not paid with certainty, although there is a certain probability that such behavior is detected and effectively punished. Furthermore, there might be other elements to be considered such as reputation (which could go both ways, depending on the social group of reference) as well as possible consequences (for example, loss of one’s driving license at some point in the future). If the benefit is more important than the costs, this individual is expected to violate speed limits. If the benefit is not sufficient to compensate for the costs, the individual is deterred and therefore no violation of speed limits takes place.

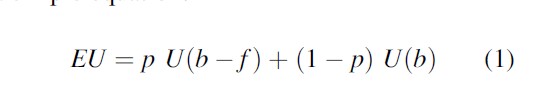

Becker’s seminal paper posits that criminals follow rational utility maximization choosing in conditions of risk. The model resolves around a simple equation:

Formula 1

Formula 1

where EU stands for expected utility (more rigorously, a Von Neumann-Morgenstern expected utility function), U for the utility function, p for the probability of capture and punishment, f is the severity of punishment, b is the income if undetected, and b -f is the income if detected. All incomes include psychic components such as fear, excitement, and pain which are assumed to be convertible to monetary equivalents.

In Eq. (1) crime is a risky activity which is reflected by the probability and severity of punishment. Technically, crime is a lottery that offers an income b with probability 1-p and an income b -f with probability p. If the punishment were zero, there would not be any risk. Hence, it can be said that severity of punishment increases risk. If the probability of punishment were zero or one, there would not be any risk (either because the individual is never punished or always punished). Consequently, when the probability moves away from zero and from one (presumably closer to ½), crime is riskier. For risk-averse individuals, crime imposes a risk disutility since they would be willing to accept a certain punishment in return for avoiding the uncertainty of the crime lottery.

Becker differentiated (Eq. 1) with respect to p and f, concluding that the negative partial differentials show that certainty and severity of punishment deter crime. Will an individual accept the gamble? The answer depends upon the individual’s attitude to risk as embodied by the utility function U, the sizes of income b, probability p, and severity f as well as the opportunity cost (which can be normalized to zero for convenience). Even if an individual is risk averse, s/he will accept the gamble if the gains are sufficiently large (b is significant while p and f are relatively low).

In order to optimally deter crime, a fundamental result is proposed by Becker (1968): the fine f should be maximal since it is a costless transfer whereas detection (as expressed by the probability p) is costly. The fine refers to an amount of resources that is lost by the convicted criminal and gained by the government. However, the probability reflects the investment on an operational criminal justice system that can be quite expensive. Naturally the fine should be taken to the highest possible amount and the probability a mere complement. In the limit, the fine would equalize the entire wealth of a convicted criminal while the probability would be minimal.

Consider again the example of speeding. The policy implication derived by Becker (1968) is that if a driver is caught above the speed limit, s/he should lose his/her entire accumulated wealth (including the right to future earnings). However, the probability of such event taking place should be close to zero. The police should, for example, choose randomly 1 h per year to check speed limits and those caught violating them should lose their entire wealth. Although the intuition for this insight is powerful (probability and severity of punishment matter but the latter is much cheaper than the former), the policy implication seems hardly realistic. Not surprisingly, legal economists have taken an interest on this puzzle.

Polinsky and Shavell (2001, 2007) have developed an original economic model to assess Becker’s claim in a variety of situations. In fact, the standard model of the economics of law enforcement (assessing the extent to which sanctions should be maximal and other legal implications) is now the so-called Polinsky-Shavell framework. This model has been developed throughout a long series of papers, not necessarily with the aim of an established unified theory of law enforcement, but more as an economic assessment of multiple problems encountered by scholars and policymakers in law enforcement.

The Polinsky-Shavell model is based on a couple of important assumptions. First, individuals are rational utility maximizing agents choosing in conditions of risk. They compare the benefit from not complying with the law with the corresponding costs. Second, optimal enforcement of the law should be derived from the maximization of social welfare as the objective of public policy. The social welfare function is given by the sum of the benefits minus the costs for everyone. It is usually assumed the gains from noncompliance should be considered when determining efficient law enforcement. The exclusion of the gains from noncompliance might undermine efficiency implications since it is outside of the standard Kaldor-Hicks analysis (a certain legal policy is said to be more efficient if the winners can potentially compensate the losers).

One important conclusion by Polinsky and Shavell is that there are many circumstances where nonmaximal sanctions are efficient. In other words, albeit seminal, Becker’s results apply in a very limited set of assumptions. Under richer assumptions, increasing the probability and decreasing the sanction could actually be the efficient policy. It can be said that the main results offer interesting insights concerning the probability and severity of punishment in a multitude of situations.

Consider the most basic version of PolinskyShavell’s model. Risk-neutral individuals choose whether to commit an act that benefits the actor by b and harms society by h. This act is punished with a sanction f and a probability p. A riskneutral individual compares the gain b with the expected sanction pf. Everyone with a benefit higher than the expected sanction is not deterred; everyone with a benefit lower than the expected sanction is deterred. From a social perspective, all acts that generate more harm than benefit should be deterred; all acts that generate more benefit than harm should not be deterred. Therefore, if the expected sanction equals the harm, the private decision by each individual is socially efficient. However, this result presupposes that the probability and the severity of punishment are costless.

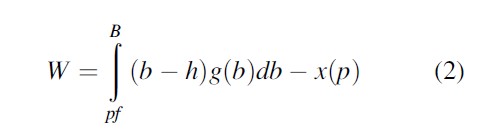

Assume that the distribution of parties by type is described by a density function g(b) with a cumulative distribution G(b); the distribution is known by the policymaker. The benefit b lies in the interval [0, B]. The probability of punishment p is costly, whereas the sanction is not (a fine is the simplest example). The cost function for the probability is x(p) satisfying standard convexity properties. The maximum feasible sanction is F, which can be interpreted as the maximum wealth of individuals.

Risk-neutral individuals commit an offense if and only if b is greater than the expected fine, pf. Given individuals’ decision of being honest or dishonest, social welfare is given by the sum of benefits minus costs as derived in the Polinsky-Shavell’s framework and as shown by Eq. 2:

Formula 2

Formula 2

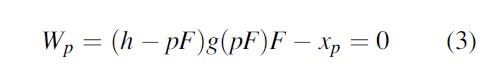

Social welfare is maximized in the probability and in the fine. Immediately recognizing that the probability is marginally costly whereas the fine is not, it can be concluded that the optimal fine is maximal. The optimal probability satisfies the following first-order condition:

Formula 3

Formula 3

There are two important results to be highlighted in Eq. 3:

- The optimal probability is based on the harm caused by the offense and not on the illegal gain generated by noncompliance; that is because the objective is efficient deterrence and not full deterrence (further discussion by Polinsky and Shavell 1994);

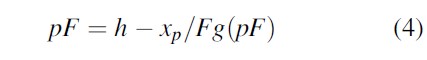

- The optimal expected sanction is less than the harm caused by the offense (there is underdeterrence); that is because enforcement is costly. Hence, the so-called multiplier principle (p=h/F) is inefficient. The following expression is easily derived from rearranging Eq. 3:

Formula 4

Formula 4

When punishment is costly, the results are a bit more complicated. Suppose if an individual engages in the harmful activity, s/he faces some probability of being caught and fined and/or imprisoned. Imprisonment is costly. Therefore, the optimal fine is still maximal (since it is costless), but it could be efficient to supplement a fine with an imprisonment term (when the maximal fine is not very large due to lack of assets by offenders or when the marginal cost of imprisonment is reasonably small). The reason for this result is that the fine is socially costless; hence, it is advantageous to use it to its limits before using socially costly means of enforcement (Polinsky and Shavell 1984; Shavell 1985).

Extensions Of The Basic Model

Since Becker (1968), the economic literature has taken the high-fine-low-probability result in the context of the assumptions and inquired as to its validity in a more general framework. Alternative setups have been considered including the possibility of legal errors; costs of imposing fines; general enforcement; marginal deterrence; settlements (or plea-bargaining); self-reporting; repeat offenders; imperfect knowledge about the probability and magnitude of sanctions; corruption; incapacitation; costly observation of wealth; private enforcement; behavior of potential victims; social norms; and the fairness of sanctions (Garoupa 1997; Polinsky and Shavell 2001; 2007). It has been shown that the high-fine-low-probability result does not survive more realistic contexts.

For example, consider the model of marginal deterrence. In a seminal article, Stigler (1970) has noticed that individuals choose among a set of possible actions. Therefore, not only does general deterrence matter (compliance with the law), but also marginal deterrence (if an individual does not comply with the law, then s/he should commit the least serious offense). In other words, when faced with the possibility of committing several harmful acts, individuals should have clear incentives to choose the least harmful act. The important trade-off is that the marginal deterrence principle induces individuals to commit acts with lower harm (since they entail a lower expected sanction) but more individuals are induced to commit the act in the first place. Suppose, for example, that individuals may commit two acts if they are willing to. Some individuals may prefer to commit only one of them, but others certainly prefer to commit both. Repeat offenses could be framed in this context (although usually they are not discussed as a pure marginal deterrence problem).

A maximal fine should only be imposed on those who commit two offenses in order to satisfy the principle of marginal deterrence as explained by Polinsky and Rubinfeld (1991) in a nice application to recidivism. Polinsky and Shavell (1998) have a twist on the argument for enhancing penalties for recidivism based on the existence of records of prior convictions: When an individual contemplates committing an offense in the first period, s/he will realize that if s/he is punished, not only will s/he bear an immediate fine but a record will be issued (thus making her/him bear in the second period a sanction higher than it would be otherwise).

Another version of the model of marginal deterrence looks at situations where individuals have to choose between act 1 or act 2; they cannot commit both. Marginal deterrence issues arise as long as enforcement is general. If enforcement is specific to the act, then fines should be maximal and the probabilities chosen in the appropriate way. However, if enforcement is general, the optimal probability will be the same for both acts, and hence, the fines should reflect this interdependence (Shavell 1992).

A second example is punishment of attempts. An attempt is defined to be a potentially harmful act that does not happen to result in harm. If an individual commits an act, s/he will obtain a benefit and s/he will suffer a sanction with a probability that depends on whether or not s/he causes harm. Let us say that with probability q an act will result in harm. Hence, with probability 1 -q, the act is only an attempt. Suppose that the fine for a crime is f and for an attempt is s. Also, the probability of apprehension for a crime is p and for an attempt is r. The expected sanction faced by an individual who commits an act is qpf + (1=q)rs.

Punishing attempts increases deterrence by raising the probability of effectively imposing sanctions. Punishing attempts thus increases deterrence by expanding the set of circumstances in which sanctions are imposed. By the usual argument, there is an upper bound to sanctions. Once that bound has been set, the only way to deter it is by raising the probability of punishment. Therefore, punishing attempts is socially valuable. However, in many circumstance, courts cannot determine the probability of harm. Shavell (1990) shows that sanctions for attempts and for causing harm are uniquely determined in this scenario: (i) the sanction for attempts is never larger than the sanction for causing harm (hence, the sanction for attempts is typically nonmaximal); (ii) both are nondecreasing with the potential harm h.

A final example is the possibility of corruption. Corruption in law enforcement is a serious problem. It can include the payment of bribes or kickbacks to enforcers, threats to frame innocent individuals to get money from them (extortion), and actual framing (entrapment). In all these forms, corruption reduces deterrence and should be discouraged. One possibility is to make corruption a crime, thus creating a typical case of marginal deterrence. A second possibility is to reward enforcers for reporting violations; however, this option might create serious incentives to entrap and extort. Hence, the appropriate reward should balance the benefits of reducing bribery against the cost of expanding extortion and entrapment (Bowles and Garoupa 1997; Polinsky and Shavell 2001; Echazu and Garoupa 2010). Finally, a solution is to lower the sanction to eliminate the possibility of a bilateral agreement between an offender and a corrupt official; a corruption-proof solution requires the fine to equal the opportunity cost borne by the official and not the maximal upper bound (Becker and Stigler 1974).

Important extensions are also the application of the economic model to cooperative crimes. Two examples are relevant: corporate crime and organized crime. In the context of corporate crime, the debatable issue is the extent to which the fine should be paid by the managers or by the company. Corporate crime is not committed by companies, as such, but by different individuals within the corporation who are eventually criminally liable. In a perfect world, with complete contracting and without liquidity constraints, individual liability alone would induce efficient behavior. Consequently, corporate liability would not be necessary. Conversely, corporate liability is worthy of investigating when contracts are incomplete or when solvency matters. A socially optimal criminal sanctioning policy would favor large corporate fines for these individuals involved in the criminal activity (Garoupa 2000). This claim, based on Becker’s analysis, assumes that corporate directors and shareholders who could be subject to large fines will provide the correct amount of employee monitoring, and eventually ex post sanctions on their employees to ensure that socially harmful crimes are not committed. However, large corporate fines could also induce corporate directors and shareholders to cover up for crimes committed by managers (in particular, when there is asymmetry of information, covering up might be the only available strategy to avoid liability). Therefore, large fines could be counterproductive and hinder rather than help deterrence.

A similar counterproductive effect can be detected in the context of organized crime. Severe punishment could shape criminal organizations in ways that make detection and conviction less likely. For example, it could induce strategies such as hostage taking or political corruption. If so, less severe punishment could be optimal when it assures an organizational structure that makes detection by law enforcement agencies easier or cheaper (Garoupa 2007).

Behavioral Criminal Law And Economics

On the modeling of criminal behavior, the economic approach has faced the standard criticism of using the expected utility framework, in particular the realism of economic rationality. The classical model assumes that individuals respond significantly to the incentives created by the criminal justice system. Nevertheless, there is some recent literature on behavioral criminal law and economics (Garoupa 2003; McAdams and Ulen 2010). This literature has shown that behavioral insights can improve the economic model to the extent that the rational model fails to gain empirical adherence in many contexts. However, the behavioral insights have not undermined the basic insights of the classical model.

Let us consider the optimism bias, a deviation from the rational choice model widely documented by behavioral economics. Such bias weakens deterrence by making individuals underestimate the probability of punishment. They could also overestimate the benefits derived from violating the law. Estimating that the costs are lower and the benefits are higher than they actually are, the overly optimistic individual commits more offenses than the rational criminal. As a result, optimal deterrence would require higher sanctions or higher probabilities (McAdams and Ulen 2010). Therefore, the optimism bias does not challenge the economic theory of deterrence, but the precise design of probability and severity of punishment.

Furthermore, Garoupa (2003) proposes a potentially offsetting effect. If the overly optimistic individual underestimates the probability of punishment, s/he might reduce avoidance activities (such as hiding illegal activities or other related precaution activities). A reduction in avoidance activities might increase the true probability of punishment, which partially cancels off the reduction of deterrence that excess optimism causes. As stated by McAdams and Ulen (2010), this example illustrates the importance of considering all the ways that some bias could affect the decision to violate the law.

Another example is cognitive dissonance and possible framing effects. Some individuals know crimes are fundamentally wrong and so they consider their behavior not to be a crime or to be morally justified. As explained by Garoupa (2003), similarly, framing could be important since most individuals do not like to feel responsible for death or violence, but they may accept a necessary death to achieve some particular goal or justified violence to reach a specific target. Manipulation of beliefs, framing effects, and cognitive dissonance impact economic rationality in significant ways. If criminal sanctions are to be understood as an incentive mechanism to induce compliance, efficient law enforcement needs to consider how individuals perceive their own criminal acts. Furthermore, social norms such as “ends cannot justify the means” or “there is no necessary death or violence” are consistent with the behavioral model.

It is important for an economic model of criminal behavior and enforcement to recognize that individuals have not only preferences over states of the world, but also over their beliefs of those states. Consequently, if the cognitive assessment of gains and losses is bounded by a reference point, it is the case that the individual objective function is no longer the expected utility functional. In such context, efficient enforcement is not only about shaping gains and losses to induce compliance, but also influencing possible reference points.

A third example mentioned in the behavioral literature is bounded self-interest, an important deviation from full rationality. Clearly individuals care about others in some, if not many, circumstances. Economists tend to use the notion of neoclassical altruism (for example, altruism is modeled in bequest decisions). Behavioralists propose a different approach by which individuals are less opportunistic if perceived to be treated fairly (positive reciprocity), but could instead be more spiteful if perceived to be treated unfairly (negative reciprocity). As observed by Garoupa (2003), formal economic models can tackle these different definitions and derive optimal law enforcement. A more challenging task is to understand how criminal law and procedure can be designed to enhance or reduce altruism (depending on the extent to which altruism increases or decreases crime rates). Certain crimes, such as hate crimes, are an illustration of negative reciprocity. It is likely to be efficient to penalize more hate motivated crimes in order to offset a possible existing negative reciprocity.

At the end of the day, the most significant challenge to the rational theory of crime as proposed by economists is empirical. The empirical literature on deterrence may be summarized as follows: increases in the probability of arrest, conviction, and punishment, and increases in the severity of punishment appear to have a deterrent effect on the population at large as well as on the small portion of the population that is most likely to commit crime (Levitt and Miles 2006, 2007). The exact magnitude of these deterrence effects is however controversial. Furthermore, the extent to which a deterrence effect can be obtained in a cost-effective manner still divides economists.

Bibliography:

- Becker GS (1968) Crime and punishment: an economic approach. J Polit Econ 76:169–217

- Becker GS, Stigler GJ (1974) Law enforcement, malfeasance and compensation of enforcers. J Leg Stud 3:1–18

- Bowles R, Garoupa N (1997) Casual police corruption and the economics of crime. Int Rev Law Econ 17:75–87

- Echazu L, Garoupa N (2010) Corruption and the distortion of law enforcement effort. Am Law Econ Rev 10:162–180

- Garoupa N (1997) The theory of optimal law enforcement. J Econ Surv 11:267–295

- Garoupa N (2000) Corporate criminal law and organization incentives: a managerial perspective. Managerial and Decision Economics 21:243–252

- Garoupa N (2003) Behavioral economic analysis of crime: a critical review. Eur J Law Econ 15:5–15

- Garoupa N (2007) Optimal law enforcement and criminal organization. J Econ Behav Organ 63:461–474

- Levitt S, Miles T (2006) Economic contributions to the understanding of crime. Annu Rev Law Soc Sci 2:147–164

- Levitt S, Miles T (2007) The empirical study of criminal punishment. In: Polinsky AM, Shavell S (eds) The handbook of law and economics. Elsevier, Amsterdam, the Netherlands

- McAdams R, Ulen TS (2010) Behavioral criminal law and economics. In: Garoupa N (ed) Criminal law and economics. Edward Elgar, Cheltenham, UK

- Polinsky AM, Rubinfeld DL (1991) A model of optimal fines for repeat offenders. J Public Econ 46:291–306

- Polinsky AM, Shavell S (1984) The optimal use of fines and imprisonment. J Public Econ 24:89–99

- Polinsky AM, Shavell S (1994) Should liability be based on the harm to the victim or the gain to the injurer? J Law Econ Organ 10:427–437

- Polinsky AM, Shavell S (1998) On offense history and the theory of deterrence. Int Rev Law Econ 18:305–324

- Polinsky AM, Shavell S (2000) The economic theory of public enforcement of law. J Econ Literat 38:45–76

- Polinsky AM, Shavell S (2001) Corruption and optimal law enforcement. J Public Econ 81:1–24

- Polinsky AM, Shavell S (2007) The theory of public enforcement of law, In: Polinsky AM, Shavell S (eds) The handbook of law and economics. Elsevier, Amsterdam, the Netherlands

- Shavell S (1985) Criminal law and the optimal use of nonmonetary sanctions as a deterrent. Columbia Law Rev 85:1232–1262

- Shavell S (1990) Deterrence and the punishment of attempts. J Leg Stud 19:435–466

- Shavell S (1992) A note on marginal deterrence. Int Rev Law Econ 12:345–355

- Stigler GJ (1970) The optimum enforcement of laws. J Polit Econ 78:526–536

See also:

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to buy a custom research paper on any topic and get your high quality paper at affordable price.