This sample Beyond Make-or-Buy Research Paper is published for educational and informational purposes only. Like other free research paper examples, it is not a custom research paper. If you need help writing your assignment, please use our custom writing services and buy a paper on any of the economics research paper topics.

Although Ronald Coase is often credited with inspiring a line of economic inquiry that came to be -known as transaction cost economics, it is the work of Oliver Williamson, which appeared some 40 years later, that laid the foundation and provided the theoretical apparatus that has allowed scholars in this field to make headway on fundamental problems in law, economics, and the study of organizations. The magnitude of this contribution earned Williamson the Nobel Prize in Economics in 2010. This research paper sets out to familiarize the reader with central ideas and contributions of transaction cost economics and to illustrate the ongoing research trajectories that have emerged since Williamson set forth to expand on the implications of Coase’s famous 1937 article. In addition, this research paper is written with the purpose of identifying recent areas of research that offer students the opportunity to consider possible empirical and theoretical extensions of transaction cost reasoning. Clearly, given the space constraints of a research paper, this survey cannot be exhaustive but will provide a basic outline of central insights and reflect the author’s own assessment of the most promising new areas. The reader is asked to keep this caveat in mind in reading the research paper material.

The research paper is organized as follows: The first section provides a summary of the initial formulation of transaction cost economics with an emphasis on the above-mentioned “reordering” of economic organization; the next introduces the concept of discrete structural alignment and assesses the empirical evidence in predicting firm boundaries; the third section discusses contributions to problems beyond make-buy, focusing on strategic alliances, international business, and performance; the fourth section highlights emerging areas of research and research opportunities in the areas of contracts, technological evolution, and industry dynamics and concerns related to measurement and methodological issues; and the fifth section summarizes and concludes.

Formulation of Transaction Cost Economics

Economics students are certainly aware of the Coase Theorem and the fact that Ronald Coase won the Nobel Prize for Economics in 1991. What they may not be aware of is the contribution Coase made to rethinking economic organization. In a seminal paper published in 1937, Coase proposed relaxing the assumption that transactions costs are zero, and once those costs are allowed to be positive, insights surrounding the efficacy of markets and the costs of bureaucracy are altered. Coase is among a group of economists, who, beginning in the 1960s, sought to better understand institutions and the reasons for why we observe different forms of exchange. In essence, if markets work so well, why is there a need for firms at all? Why are contracts between firms specialized? With the publication of Markets and Hierarchies, Oliver Williamson (1975) began laying the theoretical foundation for modern transaction cost economics. This and his later work (e.g., Williamson, 1985, 1991, 1996), as well as the work of other economists (e.g., Grossman & Hart, 1986; Hart & Moore, 1990; Klein, Crawford, & Alchian, 1978), focused on addressing fundamental questions of the structure of economic exchange and how firms resolve the risks inherent in exchange in a world where there are no perfect governance solutions. (Note that throughout this research paper, the term governance is used to refer to the structure of economic exchange. This is how the term is used in the transaction cost literature. It is assumed that economic agents can choose and create governance structures that best protect them from the hazards of opportunistic behavior on the part of others, but no governance solution offers complete protection. More on this in the second section.)

Williamson (e.g., 1985, 1996) in particular espouses the view that there is broad applicability of this perspective. For example, he builds the case for using transaction cost economics to understand organizational, institutional, and nation-state exchange issues ranging from the familiar problems of contracting hazards to more unique phenomena such as the presence of company towns and the utilization of franchising. As an individual scholar, his appointment to three departments—economics, business, and law—while at the University of California, Berkeley, reflects his embodiment of this broad applicability of his work, based as it is on an interdisciplinary approach.

To best appreciate the insight/contribution of transaction cost economics, it is useful to put its development/ appearance in historical context. Prior to the publication of Markets and Hierarchies in 1975, a dominant economic explanation for firms that used unusual strategies was to invoke a monopoly explanation. Indeed, Williamson (1985), in his introduction to The Economic Institutions of Capitalism, deploys the following quote from Coase (1972): “If an economist finds something—a business practice of one sort or another—that he does not understand, he looks for a monopoly explanation” (p. 67). Much of this focus was due to an era in which economists examined firm decisions with a high concern for antitrust and anticompetitive issues. Not surprisingly, this concern was driven, in part, by a period in which there were high levels of mergers and acquisitions. With the rise of the conglomerates in the 1960s, many economists, often those directly employed by the U.S. government antitrust divisions, sought to provide economic explanations for why these organization decisions led to anticompetitive practices revealed in unfair pricing, restraint of trade, and reduction in choice. While the concern was certainly warranted, Williamson sought to correct an overreliance on such antitrust explanations for firm behavior. His work was groundbreaking at the time because it carefully examined the same cases that had been deemed anticompetitive and offered an explanation that revealed transaction cost economizing and thus competitive rather than anticompetitive logic. For example, in his discussion of cable TV franchise bidding, Williamson (1985) elaborated a host of contracting problems that could have explained the behavior of the firm just as well as anticompetitive explanations.

Thus, Williamson illustrates that, indeed, there is an alternate logic underlying much of the actions that firms undertake. In other words, much of what we observe, within firms and within institutions that support economic activity in capitalist systems, may be explained with the understanding that the objective is to economize on transaction costs.

And what are transaction costs? These costs may be thought of as the economic equivalent of friction in physical systems. They are the costs of considering, crafting, negotiating, monitoring, and safeguarding contracts. Another powerful insight developed and elaborated by Williamson was to consider that most economic exchange can be undertaken either within or between firms (and later hybrids). Either way, understanding the ability of firms to economize on transaction costs requires recognizing that they must choose between alternate modes of organizing and that this choice must take into account both the features of the economic exchange, or transaction, as well as the features of the governance structure. In one of the most important statements in Williamson’s Economic Institutions of Capitalism, he states, “The underlying viewpoint that informs the comparative study of issues of economic organization is this: Transaction costs are economized by assigning transactions (which differ in their attributes) to governance structures (the adaptive capacities and associated costs of which differ) in a discriminating way” (p. 18).

Discrete Structural Alignment and Firm Boundaries

Beginning with his work in 1985 and perhaps best articulated in a paper that appeared in Administrative Science Quarterly in 1991, Williamson invoked the logic of discrete structural alignment. This is the theoretical apparatus that supports modern transaction cost theory. It begins with an understanding that there are different structural solutions to organizing economic exchange. These structural solutions, referred to as “governance,” can be arrayed along a spectrum with markets on one end (arm’s-length contracts, in which the identity of the parties to the exchange is not relevant—you can literally think of markets as the New York Stock Exchange) and hierarchy (a typical organization, e.g., a Fortune 500 company) on the other. Intermediate or hybrid forms of organization such as joint ventures, long-term contracts, and franchising fall somewhere in the middle between the market and hierarchy anchor points of this governance spectrum. The big differences between the two extremes have to do with the ability to adapt or coordinate action, the incentive intensity (i.e., the ability to motivate people), and the way disputes or disagreements are settled.

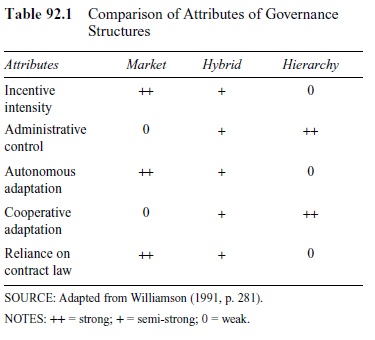

Because the theory adopts the premise that there is no such thing as a perfect governance solution (i.e., Williamson [e.g., 1985, 1996] emphasizes that there is little use in considering hypothetical ideals), there are trade-offs. Three dimensions constitute these trade-offs: incentives, adaptation, and dispute resolution (see Table 92.1). Note that markets enjoy high-powered incentives compared to hierarchy, hierarchy is better than markets when coordinated adaptation is required, and dispute resolution of last resort takes place in courts when market exchange is used, while hierarchy relies on internal mechanisms. From the table, it is clear that there is no form of governance that will score highly on all dimensions. Put differently, it is impossible to create a firm (hierarchy) that offers the dispute resolution and cooperative adaptation advantages as well as the high-powered incentive advantages reserved for markets. A common mistake managers make is to attempt to create just such governance structures. Williamson (1991) labels this problem “the folly of selective intervention.”

The question of economic exchange thus becomes one of how to select the right governance structure. The answer to this question depends on the characteristics of the transaction. Transactions are differentiated based on three variables: asset specificity, uncertainty, and frequency (i.e., is this an exchange that you intend to repeat over time), of which asset specificity is deemed to be the critical factor. Williamson (1991) first identified three different types of asset specificity, but that list has now been expanded to six.

Table 92.1 Comparison of Attributes of Governance Structures

Table 92.1 Comparison of Attributes of Governance Structures

They are physical asset specificity, human asset specificity, site specificity, brand-name specificity, dedicated assets, and temporal specificity. Think of asset specificity as the degree to which an asset has become specialized for a given exchange. Highly specific assets are those that are much more valuable to a firm in the context of a given transaction and whose value is negligible outside this exchange. For example, prior to agreeing to build components for General Motors (GM), Fisher Body had tool-and-die equipment that could be tailored to stamp out body parts for any automobile manufacturer. These industrial machines had little physical asset specificity. However, once Fisher Body agreed to produce parts for GM, these machines needed to be calibrated to technical specifications unique to the GM components. Now these same tool-and-die machines would be categorized as being highly asset specific. In other words, their value to anyone other than Fisher and GM would be their scrap value.

The central insight of transaction cost alignment is that with an increase in asset specificity (as well as uncertainty and frequency), the potential hazards of relying on marketlike forms of exchange increase. Think about the risks to both GM and Fisher Body if one party decides—after the specific investment in the tool-and-die equipment is made—to alter the terms of the contract. Fisher Body might decide to raise the price of the components. If this occurs during a period of peak demand, GM will likely be hard-pressed to find another supplier, much less find another supplier quickly enough to meet demand. Alternatively, during a period of weak demand, GM might decide to lower the price it is willing to pay. Fisher Body would find itself in a poor bargaining position and thus may likely acquiesce to this change in terms.

Recognizing ahead of time that this sort of behavior might occur is a key insight of transaction cost economics. The theory is unusual in that it specifies two important behavioral assumptions: (1) Agents are far-sighted, boundedly rational decision makers, and (2) they will behave opportunistically. Combining an appreciation for (a) unwavering differences in governance structures; (b) an ability to measure the features of transactions, particularly the level of asset specificity; and (c) these behavioral assumptions, transaction cost economics generates the following testable hypotheses, the last of which is known as the “discriminating alignment hypothesis” (Williamson, 1991):

- As asset specificity rises, contracting hazards rise.

- As contracting hazards rise, transaction costs rise.

- Thus, as asset specificity rises, we are more likely to observe hierarchical modes of governance.

Williamson (1991) articulates that managers at both Fisher Body and GM, given those stated behavioral assumptions, would recognize that the idiosyncratic (asset-specific) investments required to stamp out customized components would lead to potential contracting hazards and thus increased transaction costs—costs that could not be remedied through pricing. Instead, as the third hypothesis above indicates, managers chose the governance structure that economizes on transaction costs. Recall that these are the costs that arise not only from the contracting hazards (e.g., the potential last-minute changes in pricing depending on external demand conditions) but also the costs of writing, monitoring, and haggling over contracts to try to prevent such opportunistic behavior. As a result, transaction cost economics predicts that the best form of governance, the form that is best able to economize on these costs, is hierarchy. And indeed, after several years of exchange, GM did adjust its governance structure accordingly and acquired Fisher Body, transforming it from an exchange partner to an embedded division within the GM organization.

As outlined in the introduction, transaction cost economics has had tremendous success in predicting the mode of organization or governance choice. According to recent reviews of the empirical literature (Boerner & Macher, 2000; Macher & Richman, 2008; Shelanski & Klein, 1995), more than 600 studies have been published, the majority of which support the primary hypotheses of the discriminating alignment argument. Consistent with theoretical predictions, high levels of asset specificity lead to an increased likelihood of firms relying on vertical integration.

Even today, the vast majority of the empirical studies that have been undertaken in transaction cost economics have tested the discriminating alignment hypothesis. But as we will highlight in the remaining sections of this research paper, this is reflective of the early timing of these papers, not the state of current empirical research. Nonetheless, to highlight the contributions of these early papers is warranted. Monteverde and Teece (1982) provided what is still seen as an archetypal study of vertical integration through a transaction cost lens. Using data on the two leading U.S. automobile producers, the authors found that, as predicted, as the level of asset specificity increased, the likelihood of vertical integration did as well. Asset specificity is measured in this paper as is still commonly done today: via surveying experts as to the degree of unique, idiosyncratic investment required to support the exchange. Generally, such surveys use multiple questions in combination as a proxy for asset specificity.

Although using surveys remains a popular measurement technique, not all studies rely on survey measures of asset specificity. For example, Joskow (1985, 1987, 1990) used the measurement of physical proximity when measuring site specificity. He finds that indeed as site specificity increases, power plants are more likely to use more hierarchical forms of exchange in accessing the coal needed for power generation.

While three variables—asset specificity, frequency, and uncertainty—are theorized to affect the choice of governance, it is interesting to note that most studies deal with either uncertainty or asset specificity, but few deal with frequency. To be sure, Williamson (1985, 1991) explains that absent asset specificity, the other two variables do not pose the same sort of governance concerns. Thus, studies that have examined uncertainty do so in conjunction with inclusions of controls for asset specificity (e.g., Anderson, 1985; Stump & Heide, 1996; Walker & Weber, 1987).

Beyond Make-Buy: Strategic Alliances, International Business, and Performance

Strategic Alliances

Transaction cost economics is a branch of economics best known for its contribution to the boundary of the firm literature, with particular emphasis on vertical integration (e.g., Williamson, 1975, 1985, 1996). As discussed in the preceding section, hundreds of studies (as many as 600) have largely corroborated the primary predictions of the theory (i.e., the discriminating alignment hypothesis) regarding the likelihood of integration under certain conditions. Few theoretical perspectives on the firm have been so richly supported by the empirical evidence. But transaction cost economics has made significant contributions to other research areas, contributions that may not be as well known. This section highlights the recent application of transaction cost logic to strategic alliances, international business, and performance.

The initial governance spectrum developed by Williamson was designed to illustrate the trade-offs of the two extreme forms, markets and hierarchy. Over time, researchers began to unpack the middle of the governance spectrum, what Williamson (1991, 1996) refers to as hybrid forms of governance. Given the prevalence of strategic alliances, these became the focus of much recent work on better understanding this particular hybrid form of governance.

While there had been a handful of studies that examined hybrid modes early on (e.g., Heide & John, 1990; Palay, 1984), it was not until Oxley (1999) that the field had a means for separating the features of hybrid modes. In her paper, Oxley provides evidence that these hybrid forms of organization are being used at an increasing rate, motivating interest in better understanding them. Furthermore, her work provides a spectrum to be used in conjunction with the initial governance spectrum outlined by Williamson, to guide research in determining how market-like or hierarchical a given hybrid mode is and thus what sort of tradeoffs does this hybrid form offer.

Examining strategic alliances has gone beyond extensions of the discriminating alignment hypothesis as illustrated with the above research. For example, Reuer, Zollo, and Singh (2002) examine the evolution of strategic alliances, using data on biotech and pharmaceutical alliances. They specifically set out to determine whether collaborative agreements experience significant contractual alterations in the area of control or monitoring. Interestingly, while governance does change over time, it does so more often based on the experience of the strategic alliance partners, rather than in response to changes in conditions.

International

A review of the transaction cost empirical literature shows that it is only recently, over the past decade, that a sustained effort has been under way to expand the geographic scope of the theory. Due to both the spread of transaction cost research among scholars in institutions outside the United States as well as the research activities of U.S.-based scholars, real progress in examining issues related to international business through a transaction cost lens has been achieved. For example, work has analyzed foreign direct investment decisions, the sequence of such decisions (e.g., Delios & Henisz, 2003), the role of institutions in these decisions (e.g. Henisz, 2000), and the value created through these decisions (e.g., Reuer, 2001).

In an interesting paper that relates to both the strategic alliance and international literatures, Dyer (1996) compares the differences in governance structures used by U.S. and Japanese automobile manufacturers. He finds that U.S. firms use either end of the spectrum, relying on arm’s-length contracting or vertical integration. In contrast, Japanese manufacturers rely heavily on hybrid forms of governance, especially long-term, relational contracting. The Japanese firms are able to thereby reap some of the benefits of hierarchy (e.g., they can manage higher levels of asset-specific investment) with markets (e.g., they are able to manage technical uncertainty better by switching suppliers as needs change). An important insight, however, is that it is due to the differences in the national-level institutional supports for exchange that allow the Japanese firms to be so successful. In other words, without such institutional support, U.S. firms cannot replicate the governance structure employed by their Japanese counterparts and achieve similar results.

Understanding the role of political or country-specific institutional factors in the decisions of large firms to enter new markets has been improved through the recent work of researchers working through a transaction cost lens. Henisz and colleagues (e.g., Delios & Henisz, 2000; Henisz, 2000; Henisz & Zelner, 2001) have found a method of better measuring political risk—an oft-cited rationale for the reluctance of large multinationals to enter these markets—and used it to predict not just the likelihood of entry but the likelihood of entry mode (i.e., what form of governance does the entering firm employ to offset the likely contractual hazards that may occur as a result of institutional factors). In addition to political risk, they measure the feasibility of adaptation in the institutional environment and find results that support their hypotheses regarding the use of governance mode given more favorable institutional conditions.

Performance

As we have discussed, transaction cost economics adopts the view that firms can be thought of as bundles of transactions. And each transaction has an optimal (i.e., transaction cost economizing) way of being structured. The implication for strategy researchers is that firms that are the most optimally aligned (most efficiently structured) will outperform those that are not. The other big implication for strategy is that those firms that recognize the pitfalls of exchange will do better. These kinds of questions go beyond the basic likelihood of what governance structure is chosen by a firm. The question now becomes, if a firm does adhere to the discriminating alignment hypothesis, does it benefit as a result? Benefit, in this instance, meaning does it outperform its rivals?

Although the implications for firm performance of transaction cost economics have been of great interest to strategy scholars, the empirical demands of conducting actual tests of these potential performance hypotheses have been daunting (e.g., Masten, 1993). For example, in addition to collecting data at the microanalytic level (e.g., information on the asset specificity, uncertainty, and frequency of the transaction), as well as information on what governance mode is chosen, researchers also must collect data at the firm, industry, and/or economic levels (e.g., the performance of the firm, industry averages of performance, economic variables that might also affect performance). Note that there are also temporal differences in the nature of the data required. Researchers who study questions related to testing variations of the discriminating alignment hypothesis can use cross-sectional data. But strategy researchers interested in tracking the impact of firm decisions on performance require longitudinal data. This presents enormous empirical obstacles that must be overcome. As a result, it is only recently that progress has been made in this area.

Early studies in this area measured performance as something other than profitability. Nickerson and Bigelow (2008) summarize much of this initial performance research. They describe the finding that the transfer of technological knowledge is diminished as firms must rely on market governance given relatively high levels of asset specificity (Poppo & Zenger, 1998) while Leiblein, Reuer, and Dalsace (2002) find that the alignment of governance choice and contracting hazards ultimately improves technological performance. Using data on R&D alliances, Sampson (2004) finds that the alignment of transactions according to transaction cost predictions conferred collaborative benefits not found in transactions organized otherwise. Transaction cost economics has begun to amass a body of research that indicates that firms that achieve an efficient alignment enjoy performance benefits. However, none of these studies estimates economic performance in terms of profitability or cost savings.

The first study to provide estimates of economic performance at a transaction level was Masten, Meehan, and Snyder (1991). Their study found that cost savings in shipbuilding were achieved in conjunction with organizing governance structures as predicted by transaction cost theory. In developing their empirical estimates, they also used econometric methods that statistically remedied the endogeneity problem inherent in doing comparative analysis that accounts for the selection of discrete organizational forms. While this study offered a breakthrough in empirical transaction cost research by estimating cost savings, it still did not achieve the long-sought-after goal of estimating economic profits at the transaction level.

To date, the first and only study to provide estimates of profitability at a transaction level is Mayer and Nickerson (2005). Analyzing the contracts of an information technology company, the authors first test the discriminating alignment hypothesis. Then, using a two-stage switching regression model, they show that projects aligned according to the discriminating alignment hypothesis are, on average, more profitable than misaligned projects. Note that this is another econometric solution to the endogeneity problem endemic to transaction cost research that aims to study performance.

While measuring the impact of profitability and cost savings remains rare, researchers in this area have demonstrated creativity in adopting alternate proxies for financial performance. For example, Silverman, Nickerson, and Freeman (1997); Nickerson and Silverman (2003a, 2003b); and Argyres and Bigelow (2007) employ the duration and survivability of firms as substitutes for financial performance. The crux of the argument is that in competitive markets, firms that survive longer than their rivals must have greater profitability and/or access to financial resources. These studies find that consistent with transaction cost predictions, firms that use governance structures aligned with transaction characteristics are more likely to live longer and are less likely to fail than firms that do not organize efficiently.

Emerging Areas of Research: Opportunities in the Areas of Contracts, Technological Evolution, and Industry Dynamics

While there remain many opportunities to build on the areas of strategic alliances (and other hybrid governance structures), international business, and performance, at least two areas of research in transaction cost economics have emerged only recently: the study of contractual features and the role of technological evolution and industry dynamics.

Contracts

In a study designed to better understand the nature of contractual learning processes over time, Argyres, Bercovitz, and

Mayer (2007) examine two categories of contractual provisions that are used to manage uncertainty and asset specificity. Using data from an information technology provider over an 18-year period, the authors find that certain contractual clauses related to contingency planning and task description did change over time. They suggest that time-dependent reputation advantages may have played a role, providing an effective and efficient safeguard against opportunistic behavior.

Other studies in the contracting area have focused on the role of trust not just as a complement but as a substitute for other contractual provisions. Gulati and Nickerson (2008) argue that trust acts as a shift parameter that lowers governance costs for all modes of governance whenever exchange hazards are present and thus enhances performance regardless of the mode of governance chosen. This lowering of governance cost arises because trust, which is less formal than either contracts or ownership, facilitates adaptation—exchange partners are more likely to avoid disputes or resolve them quickly when trust is present (Gulati, Lawrence, & Puranam, 2005). Gulati and Nickerson’s (2008) theory also suggests that trust can lead to a substitution of less formal for more formal modes of governance because governance cost-reducing benefits of trust are greater for market than for hybrid and greater for hybrid than for hierarchy. These differences arise because trust proves a less useful safeguard when formal mechanisms such as contracts and ownership are used. The result of this differential impact is that the market mode of governance, with the addition of preexisting trust, may be used over a broader range of exchange hazards than can market sans trust, which in turn offers lower governance costs and enhances exchange performance. Also, a hybrid with preexisting trust can substitute over some range of exchange hazards for hierarchy, which enhances exchange performance. Drawing on a sample of 222 sourcing arrangements for components from two assemblers in the automobile industry, Gulati and Nickerson (2008) find broad support for both substitutive and complementary affects of interorganizational trust on qualitative measures of perceived exchange performance.

Other additional areas of recent interest include understanding the role of contractual features (e.g., Mellewigt, Madhok, & Weibel, 2007), the range of contractual provisions (e.g., Oxley & Wada 2009), and the development of contracting capabilities (e.g., Argyres & Mayer, 2004). Again, as in the performance area, the current obstacle to more research is accessing suitable data, not lack of interest.

Technical Evolution and Industry Dynamics

As stated earlier, in the section on performance, the ability to withstand selection pressures and survive longer than rivals as a result of adhering to the discriminating alignment hypothesis has been used in a handful of studies. A branch of this research is now focused on linking the selection environment to the evolution of the industry. Furthermore, this focus highlights the fact that selection environments change over time. Unfortunately, the presumption in transaction cost economics is that this selection pressure hinges on alignment and is made without a discussion of how factors such as the industry life cycle and degree of technological evolution might drive changes in this selection pressure.

Thus, important questions remain regarding the time required before selection pressures drive less efficient (i.e., transaction cost-economizing) firms from the industry as well as how the force of these selection pressures changes over time. Williamson (1985, p. 23) briefly suggests that efficient transaction cost economizing might occur over 5 to 10 years, though the timescale required to achieve efficient organization is rarely addressed in empirical studies. One exception is Nickerson and Silverman (2003a), who found that institutional constraints on firms in the U.S. trucking industry slowed their efforts to economize on transaction costs after deregulation.

Industry life cycle theories (e.g., Abernathy & Utterback, 1978; Klepper, 1996; Klepper & Miller, 1995) are of particular interest because they postulate general patterns in the waxing and waning of selection forces that may be and have been made subject to empirical confirmation. Thus, integrating theories of industry and technological evolution, as well as competitive intensity with transaction cost economics, may help address the need for estimating the selection pressures in operation in a given empirical context.

In the first study of this kind, Argyres and Bigelow (2007) integrate industry life cycle theory with transaction cost economics to examine the impact of organizational choice and firm survival over time. They find that firms that misalign transactions face increased risk of failure. However, this risk is mitigated by environmental selection pressures. Research on industry life cycles demonstrates that competitive pressures are more severe during the shakeout stage, which occurs later in the industry life cycle, than at other stages. Transaction cost theory, on the other hand, assumes generally competitive markets and does not address the industry life cycle. It therefore implies that transaction cost economizing is a superior firm strategy regardless of the stage of the life cycle. The authors find that, indeed, adhering to the discriminating alignment hypothesis is not a superior strategy under all time periods. Analyzing data from the early U.S. auto industry, they find that while transaction cost economizing did not have a significant impact on firm survival during the pre-shakeout stage, it did have a significant positive impact on survival during the shakeout stage. This suggests that applications of transaction cost theory, which assume uniformly severe selection pressures across the industry life cycle, could be misleading. It also suggests that theories of the industry life cycle could usefully take transaction costs into account along with production costs in their analyses of competition over the life cycle.

Discussion and Conclusion

The purpose of this research paper has been to familiarize the reader with the key insights and contributions of transaction cost economics as well as highlight the many potential applications of the theory. As chief architect, Oliver Williamson has combined ideas from economics (e.g., Coase, 1937), law (e.g., Macaulay, 1963), and organization theory (e.g., Simon, 1957,1959, 1962). Over the past three decades, he has refined his thinking, and other researchers have extended the empirical and theoretical reach of the theory. With fair warning to readers, it should be noted that the author still remembers reading the quote that introduced this research paper as a graduate student in a seminar taught by Williamson himself and has indeed seen her worldview of organizations irreversibly altered as a result. Thus, although every effort was made to be even-handed in discussing the current state of viewing economic problems of organization through a transaction cost lens, the reader should be aware that there may be some inadvertent bias.

Recall that in brief, the transaction cost approach works as follows: The decision makers within a firm begin by (a) understanding the trade-offs between different modes of governance. This relies on thinking of governance as falling on a spectrum with markets (arm’s-length contracts) on one end and hierarchy (a typical organization, e.g., Monsanto) on the other. Hybrid forms of organization such as joint ventures, long-term contracts, and franchising fall somewhere in the middle. The big differences between the two extremes have to do with the ability to adapt (coordinate), the incentive intensity (e.g., a manager’s ability to motivate people), and the way disputes are adjudicated. The next step has to do with (b) understanding the characteristics of the transaction. The three characteristics we think are critical are uncertainty, frequency (i.e., is this an exchange that the firm intends to repeat over time), and the primary driver of governance choice—asset specificity. Asset specificity is the degree to which an asset has become specialized for a given exchange. The next step is to (c) outline the contracting hazards that may arise, depending on the nature of the transaction and the features of potential governance solutions. Finally, (d) choose the governance structure that economizes on transaction costs. These are the costs that arise not only from the contracting hazards but also the costs of writing, monitoring, and haggling over contracts.

So, the immediate implications of transaction cost economics are that (a) as asset specificity increases, contracting hazards intensify; (b) as asset specificity increases and/or contracting hazards intensify, managers are likely to find that a hierarchical mode of governance is more efficient; and (c) in application, no form of governance is perfect. There are always trade-offs. The role of managers, then, is to assess those trade-offs in a systematic way and anticipate the shifts in trade-offs that will occur over time as the nature of the underlying transaction changes over time. One additional advantage of using a transaction cost economics approach: The theory forces researchers to be precise about what questions need to be asked, what the objectives of the exchange are, and what trade-offs can be tolerated.

Furthermore, note that even the oldest research puzzles are fair game for renewed discussion. For example, a recent series of papers revisiting Fisher Body-GM (e.g., Coase, 2000; Goldberg, 2008; Klein, 1988, 2007, 2008) suggests that debates regarding governance choices, contracting hazards, and transaction costs are far from settled. This does not mean that the theory itself is not valid. Quite the contrary, as the various literature reviews have documented. Instead, this renewed debate suggests that transaction cost theory remains a robust and active area of economics, law, and organization theory. It is hoped that the student of transaction cost economics will be inspired by this and, perhaps, contribute to the conversation.

Author’s Note: I thank Nick Argyres, Jackson Nickerson, and Todd Zenger for helpful discussions. Nonetheless, this manuscript reflects my own biases, and thus any inadvertent errors or omissions are solely the responsibility of this author.

See also:

Bibliography:

- Abernathy, W. J., & Utterback, J. (1978, June-July). Patterns of industrial innovation. Technology Review, pp. 40-47.

- Anderson, E. (1985). The salesperson as outside agent or employee: A transaction cost analysis. Marketing Science, 4, 234.

- Argyres, N., & Bigelow, L. (2007). Does transaction misalignment matter for firm survival across all stages of the industry lifecycle? Management Science, 53, 1332-1345.

- Argyres, N., & Mayer, K. (2004). Learning to contract: Evidence from the personal computer industry. Organization Science, 15, 394-410.

- Argyres, N., & Mayer, K. (2007). Contract design as a firm capability: An integration of learning and transaction cost perspectives. Academy of Management Review, 32, 1060-1077.

- Argyres, N. S., Bercovitz, J., & Mayer, K. J. (2007). Complementarity and evolution of contractual provisions: An empirical study of IT services contracts. Organization Science, 18, 3-19.

- Boerner, C., & Macher, J. (2000). Transaction cost economics: An assessment of empirical research in the social sciences (Working paper). Washington, DC: Georgetown University.

- Coase, R. H. (1937). The nature of the firm. Economica, 4, 386-405.

- Coase, R. H. (1972). Industrial organization: A proposal for research. In V R. Fuchs (Ed.), Policy issues and research opportunities in industrial organization (pp. 59-73). New York: National Bureau of Economic Research.

- Coase, R. H. (2000). The acquisition of Fisher Body by General Motors. Journal of Law & Economics, 43, 15-31.

- Delios, A., & Henisz, W. J. (2000). Japanese firms’ investment strategies in emerging economies. Academy of Management Journal, 43, 305-323.

- Delios, A., & Henisz, W. J. (2003). Political hazards, experience, and sequential entry strategies: The international expansion of Japanese firms 1980-1998. Strategic Management Journal, 24, 1153-1164.

- Dyer, J. (1996). Does governance matter? Keiretsu alliances and asset specificity as sources of Japanese competitive advantage. Organization Science, 7, 649-666.

- Goldberg, V P. (2008). Lawyers asleep at the wheel? The GM-Fisher Body contract. Industrial & Corporate Change, 17, 1071-1084.

- Grossman, S. J., & Hart, O. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94, 691-719.

- Gulati, R., Lawrence, P. R., & Puranam, P. (2005). Adaptation in vertical relationships: Beyond incentive conflict. Strategic Management Journal, 26, 415-440.

- Gulati, R., & Nickerson, J. A. (2008). Interorganizational trust, governance choice, and exchange performance. Organization Science, 19, 688-708.

- Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98, 1119-1159.

- Heide, J., & John, G. (1990). Alliances in industrial purchasing: The determinants of joint action in buyer-supplier relationships. Journal of Marketing Research, 27, 24-36.

- Henisz, W. J. (2000). The institutional environment for multinational investment. Journal of Law, Economics & Organization, 16, 334-364.

- Henisz, W. J., & Zelner, B. A. (2001). The institutional environment for telecommunications investment. Journal of Economics & Management Strategy, 10, 123-147.

- Henisz, W. J., & Zelner, B. A. (2005). Legitimacy, interest group pressures, and change in emergent institutions: The case of foreign investors and host country governments. Academy of Management Review, 30, 361-382.

- Joskow, P. (1985). Vertical integration and long-term contracts: The case of coal-burning electric generating plants. Journal of Law, Economics, and Organization, 1, 33-80.

- Joskow, P. (1987). Contract duration and relation specific investments: Empirical evidence from coal markets. American Economic Review, 17, 168-185.

- Joskow, P. (1990). The performance of long-term contracts: Further evidence from the coal markets. Rand Journal of Economics, 21, 251-274.

- Klein, B. (1988). Vertical integration as organizational ownership: The Fisher Body-General Motors relationship revisited. Journal of Law, Economics & Organization, 4, 199-214.

- Klein, B. (2007). The economic lessons of Fisher Body-General Motors. International Journal of the Economics of Business, 14, 1-36.

- Klein, B. (2008). The enforceability of the GM-Fisher Body contract: Comment on Goldberg. Industrial & Corporate Change, 17, 1085-1096.

- Klein, B., Crawford, V, & Alchian, A. (1978). Vertical integration, appropriable rents, and the competitive contracting process. Journal of Law and Economics, 21, 297-326.

- Klepper, S. (1996). Entry, exit, growth, and innovation over the product life cycle. American Economic Review, 86, 562-583.

- Klepper, S., & Miller, J. (1995). Entry, exit, and shakeouts in the United States in new manufactured products. International Journal of Industrial Organization, 13, 567-592.

- Leiblein, M. J., Reuer, J. J., & Dalsace, F. (2002). Do make or buy decisions matter? The influence of organizational governance on technological performance. Strategic Management Journal, 23, 817-834.

- Macaulay, S. (1963). Non-contractual relations in business. American Sociological Review, 28, 55-70.

- Macher, J. (2006). Technological development and the boundaries of the firm: A knowledge-based examination in semiconductor manufacturing. Management Science, 52, 826-843.

- Macher, J., & Richman, B. (2008). Transaction cost economics: An assessment of empirical research in the social sciences. Business and Politics, 10(1), 1-63.

- Masten, S. (1993). Transaction costs, mistakes and performance: Assessing the importance of governance. Managerial and Decision Economics, 14, 119-130.

- Masten, S., Meehan, M., & Snyder, E. (1991). The costs of organization. Journal of Law, Economics and Organization, 7, 1-25.

- Mayer, K. J., & Nickerson, J. A. (2005). Antecedents and performance implications of contracting for knowledge workers: Evidence from information technology services. Organization Science, 16, 225-242.

- Mellewigt, T., Madhok, A., & Weibel, A. (2007). Trust and formal contracts in interorganizational relationships: Substitutes and complements. Managerial & Decision Economics, 28, 833-847.

- Monteverde, K., &Teece, D. (1982). Supplier switching costs and vertical integration in the automobile industry. Bell Journal of Economics, 13, 206-213.

- Nickerson, J. A., & Bigelow, L. S. (2008). New institutional economics, organization, and strategy. In J.-M. Glachant & E. Brousseau (Eds.), New institutional economics: A guidebook (pp. 183-208). Cambridge, UK: Cambridge University Press.

- Nickerson, J., & Silverman, B. (2003a). Why firms want to organize efficiently and what keeps them from doing so: Evidence from the for-hire trucking industry. Administrative Science Quarterly, 3, 433-465.

- Nickerson, J. A., & Silverman, B. S. (2003b). Why firms want to organize efficiently and what keeps them from doing so: Inappropriate governance, performance, and adaptation in a deregulated industry. Administrative Science Quarterly, 48, 433-465.

- Oxley, J. (1999). Institutional environment and the mechanisms of governance: The impact of intellectual property. Journal of Economic Behavior & Organization, 38, 283-310.

- Oxley, J., & Wada, T. (2009). Alliance structure and the scope of knowledge transfer: Evidence from US-Japan agreements. Management Science, 55, 635-649.

- Palay, T. (1984). Comparative institutional economics: The governance of rail freight contracting. Journal of Legal Studies, 13, 265-288.

- Poppo, L., & Zenger, T. (1998). Testing alternative theories of the firm: Transaction cost, knowledge-based, and measurement explanations for make-or-buy decisions in IT services. Strategic Management Journal, 19, 853-877.

- Reuer, J. J. (2001). From hybrids to hierarchies: Shareholder wealth effects of joint venture partner buyouts. Strategic Management Journal, 22, 27-45.

- Reuer, J. J., Zollo, M., & Singh, H. (2002). Post-formation dynamics in strategic alliances. Strategic Management Journal, 23, 135-152.

- Riordan, M., & Williamson, O. E. (1985). Asset specificity and economic organization. International Journal of Industrial Organization, 3, 365-378.

- Sampson, R. C. (2004). The cost of misaligned governance in R&D alliances. Journal of Law, Economics & Organization, 20, 484-526.

- Shelanski, H., & Klein, P. (1995). Empirical research in transaction cost economics. Journal of Law, Economics and Organization, 11, 335-361.

- Silverman, B., Nickerson, J. A., & Freeman, J. (1997). Profitability, transactional alignment, and organizational mortality in the U.S. trucking industry. Strategic Management Journal, 18, 31-52.

- Simon, H. (1957). Administrative behavior (2nd ed.). New York: Macmillan.

- Simon, H. (1959). Theories of decision-making in economics and behavioral science. American Economic Review, 49, 253-284.

- Simon, H. (1962). New developments in the theory of the firm. American Economic Review, 52, 1-15.

- Stump, R. L., & Heide, J. B. (1996). Controlling supplier opportunism in industrial relationships. Journal of Marketing Research, 33, 431-441.

- Suarez, F., & Utterback, J. (1995). Dominant designs and the survival of firms. Strategic Management Journal, 16, 415-430.

- Walker, G., & Weber, D. (1987). Supplier competition, uncertainty, and make-or-buy decisions. Academy of Management Journal, 30, 589-596.

- Williamson, O. E. (1975). Markets and hierarchies. New York: Free Press.

- Williamson, O. E. (1985). The economic institutions of capitalism. New York: Free Press.

- Williamson, O. E. (1991). Comparative economic organization: The analysis of discrete structural alternatives. Administrative Science Quarterly, 36, 269-296.

- Williamson, O. E. (1996). The mechanisms of governance. New York: Oxford University Press.

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to buy a custom research paper on any topic and get your high quality paper at affordable price.