This sample Economics of Health Insurance Research Paper is published for educational and informational purposes only. Like other free research paper examples, it is not a custom research paper. If you need help writing your assignment, please use our custom writing services and buy a paper on any of the economics research paper topics.

Despite the fact that the United States spends more money per capita than any other nation, not everyone is insured. Perhaps even more surprising, when one adds the various government indirect subsidizations of health care through the tax code to the direct expenditures on Medicare, Medicaid, and other programs, the total dollars spent per capita by the government on health care is also higher than any other industrialized nation, in which all achieve universal coverage (Woolhandler & Himmelstein, 2002).

Because financing of health care in the United States is achieved through a mix of public and private insurance, the system is complex. Health insurance markets are riddled with market failures, which have important implications for who is covered and how coverage is achieved. Other industrialized countries are able to achieve universal coverage, even in systems that also mix public and private coverage. What are the market problems in health insurance that lead to gaps in coverage we experience in the United States?

This research paper will focus on the economics underpinning the market for health insurance in the United States. The primary goal of the research paper is to understand the impact of the market failures in the financing of care. First we will model demand for insurance and outline the market failures in insurance. We will examine some of the market and policy solutions to these market failures. We will briefly examine the history of health insurance coverage in the United States and how tax policy affects where Americans obtain their coverage. We will outline some of the major features of the forms of publicly provided health insurance, Medicare and Medicaid/State Child Health Insurance Program (SCHIP). We will examine the characteristics of the uninsured population in the United States in relation to the institutions and market failures outlined in the research paper. We conclude with a case study on HIV/AIDS to illustrate some of the complexities in achieving health insurance coverage.

The Demand for Health Insurance

The perfectly competitive model in economics assumes perfect information, but in reality, there are many gaps in our information set. Kenneth Arrow’s (1963) article, the cornerstone of health economics, beautifully describes the problem of uncertainty. We cannot know the future, and we face the possibility of loss of income and assets from health problems. The loss of income and assets comes through lost work time and from medical bills. At the same time, most of us would prefer to not face this risk of loss. This feature of our preferences, risk aversion, arises because most people have decreasing marginal utility in wealth or income. That is, the increase in utility from the first dollar of income you receive is higher than the increase in utility from your hundredth dollar and so on. Because of this feature, we dislike losing a dollar more than we like gaining a dollar. In economic terms, the decrease in utility from losing a dollar is bigger than the increase in utility from a dollar.

Economists model planning in the face of uncertainty by using probabilities and expected values. Suppose you know you have a 10% chance of having a health problem that will cost you $10,000, and normally your income is $50,000. Therefore, 90% of the time, your income is $50,000, and 10% of the time, it is $40,000. Your expected income (EJincome]) for the year is therefore

E[income] = 0.90 * $50,000 + 0.10 * $40,000 = $49,000.

The expected loss in this case is the probability of loss times the amount of the loss. In this case, E[loss] = 0.10 * $10,000 = $1,000.

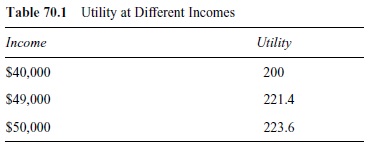

However, economists believe that it is expected utility that matters when you are planning for the future, not expected income. Because of risk aversion, expected utility with that uncertain 10% chance of a $10,000 loss is different from the utility one would have with a 100% chance of a loss of $1,000, even though the losses in expected income are equivalent. Let us assume that we can characterize the utility function as U = VI, where U is utility and I is income. This is a simple function that is consistent with risk aversion; in other words, there is a decreasing marginal utility of income. Table 70.1 shows the level of utility for each of the possible levels of income with this function.

Expected utility with the 10% chance of loss is

E[utility] = 0.10 * 200 + 0.90 * 223.6 = 221.24.

Compare the expected utility with an uncertain loss to the utility with certain income of $49,000. Utility in the latter case is 221.4, higher than the expectation with loss. We will not place any direct interpretation on what one unit of utility means; the important feature is that you would have higher utility losing $1,000 every year with 100% certainty than you have with a 10% chance of losing $10,000 each year. This decrease in utility is risk aversion. Because of risk aversion, consumers are willing to pay someone to take away some of the financial uncertainty; this product is insurance. The discomfort from risk aversion increases with the level of uncertainty (risks that are closer to 50/50 rather than 0% or 100% risks). The discomfort also increases with the possible loss. Insurance has therefore traditionally been more likely to cover high ticket expenses that are uncertain.

What Is Insurance?

Given that we dislike risk, the following question then arises: Is there a market to pay someone to take the risk for us? The answer is yes; this market is insurance. Essentially, insurance is a product where consumers pay a price, the premium, to some other entity, the insurer, who then assumes the financial risks. After the policy is purchased, if the consumer in our example has a lucky year, with noloss, the income available to spend on other things or to save is $50,000 minus the premium. In an unlucky year, where the consumer becomes ill and has $10,000 in medical bills, the insurance company pays the bills for the consumer. Disposable income remains $50,000 minus the premium for the insurance.

Table 70.1 Utility at Different Incomes

Table 70.1 Utility at Different Incomes

Assume for simplicity’s sake that there is an entire population of people just like our hypothetical consumer, with a 10% chance of a loss of $10,000. From the insurer’s perspective, if the premium they charge is $1,000, and they sell 10 policies, on average, they will collect $10,000 in premiums and pay out one claim of $10,000, and they break even. However, this scenario ignores the administrative costs of running an insurance company. The company incurs administrative costs in selling the policies, in paying claims, and in designing their policies. Given these costs, to make normal (zero economic) profits, the insurance company must charge a premium equal to the expected loss plus the administrative costs, also known as a loading factor.

Because of the gap in the expected utility of taking our chances with a loss and the expected utility with a constant loss, consumers are willing to pay a loading factor, up to a certain point. However, the analysis becomes more complicated when we realize that different people face different chances of illness and medical-related losses.

Types of Insurance

The market for insurance has evolved into many different forms. The traditional form of insurance is fee-forservice, where health care providers are reimbursed for each service performed. Because of the fast growth in expenses in the health care sector, insurers have experimented with other forms of insurance. Managed care organizations (MCOs) are one market response to this growth in expenses. These organizations may take many forms, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), and point-of-service (POS) plans. Cost savings are achieved through a variety of mechanisms. One mechanism is the use of monopsony (buyer) power to lower fees paid to the providers (hospitals, doctors, pharmacies, etc.). Because the insurer represents multiple potential patients, they may have market power to achieve price discounts. Another is capitated (prepayment) reimbursement mechanisms, which give incentives to providers to reduce the amount of care given. Other mechanisms are to emphasize preventive care and make use of information technologies to reduce the more expensive hospital care.

Market Failures in Insurance

To introduce the two main market failures in insurance, let us begin with an anecdote. Steve has a Mustang convertible, and the radio has been stolen. While shopping for a new radio, he finds a store with a 100% theft guarantee; if someone steals the radio, the store will replace it for free. Steve happily purchases the radio and begins to leave the top down on the car when he parks. After the third time the new radio is stolen, the store refunds his money and refuses to replace it again.

Steve’s story illustrates the two major problems facing both profit-maximizing insurance companies and the efficient working of the market: adverse selection and moral hazard. The replacement guarantee on the radio is a form of insurance; Steve no longer had to worry about the risk of loss. Since his radio had been stolen once before, Steve knew he had a high risk of theft, and therefore this insurance had more value to him than many other consumers. However, Steve was not one of the customers the electronics store would have preferred; they would prefer customers with a low risk of theft. The first part of the story is an example of adverse selection; the consumers with the highest demand for insurance at any given premium/price are those with the highest risk/expected losses, assuming that income and ability to pay are not an issue.

Once Steve had purchased the radio, his behavior changed. He began to leave the top down on the car because the guaranteed replacement meant he faced lower marginal cost of having his radio stolen. This behavior is indicative of moral hazard; the presence of insurance alters our incentives at the margin.

Market Failure 1: Adverse Selection

Translating this anecdote to the general issue of health insurance markets, we must first ask, how can adverse selection exist? The underlying problem is one of asymmetric information; one party in the transaction has more information than the other party. In this case, the consumer has more information about his or her risk than the seller (the insurer) does. The insurer cannot know with certainty the expected losses facing any individual, and the individual has an incentive to hide this information to avoid paying a higher premium for coverage. This type of market also has been termed a “lemons” market, by George Akerlof (1970), who coined it from the used car market.

When hidden differences in health risks exist between individuals, insurers have to figure out the profit-maximizing response. To examine this problem further, ignore the administrative costs and risk aversion for a moment and assume that one third of the population has a 15% chance of a $10,000 loss, another third has a 10% chance of the same loss, and the final third of the population has a 5% chance of loss. If an insurer offers a policy to cover the $10,000 loss based on the average population risk, the premium will be

Average population loss = (0.05 * $10,000 + 0.10 * $10,000 + 0.15 * $10,000)/3 = $1,000.

A consumer compares his or her expected losses without insurance to the premium he or she must pay to avoid the losses. If the premium is less than or equal to the consumer’s expected losses (remember, we are ignoring risk aversion at the moment), he or she will purchase the insurance; otherwise, he or she will not. Consumers with the 5% loss have an expected loss of only $500, so they will not purchase insurance, but the consumers with the two higher levels of risk will.

The insurance company will have negative profits. Half of their policies were sold to consumers with a 15% risk and half to consumers with a 10% risk. They collect $1,000 in premiums per person but make average expected payouts of (0.15 * $10,000 + 0.10 * $10,000) 2 = $1,250, for a per person loss of $250. If we imagine the company executives do not realize the problem of adverse selection and analyze their first profits, they might assume that the problem was that they miscalculated the population risk initially and feel they have better data now. In the following period, they might charge $1,250 in premiums. However, since consumers behave rationally, only those with a 15% chance of the loss will purchase the policies at the new price, resulting in still more losses for the insurer. As the cycle continues, the insurer will continue to raise premiums and insure fewer people, until the market itself might disappear. This process of increasing premiums and decreasing coverage has been called a death spiral and in extreme circumstances could lead to the disappearance of the entire market. Because of risk aversion, the lack of a market for insurance will decrease welfare (Arrow, 1963).

Solutions to Adverse Selection

Of course, insurers are not as naive as our above scenario would suggest. They are well aware of the problem of asymmetric information and the resulting adverse selection. The source of the death spiral is the free entry and exit of consumers in this market, combined with their hidden information. While you as a consumer do not have perfect information about your health risks, you do have more information about your own behaviors, family history, and so on than an insurer does. Because consumers are utility maximizing, the consumers who find it worthwhile to purchase insurance are the relatively high-risk consumers in this free entry and exit model. Insurers, consumers, and the public have developed mechanisms to at least partially solve the problems caused by adverse selection. We explore several of the most important solutions below, although this list is not exhaustive.

Market Solution 1: Group Insurance and Risk Pooling

If insurers could find a way to have a pool of consumers with both high and low risks, they could continue to make normal profits, and everyone would have access to insurance. Low-risk individuals would pay a higher premium than their average expected losses, and high-risk individuals would pay a lower premium than their average expected losses.

This risk pooling mechanism is essentially group insurance. In the United States, the grouping mechanism traditionally has been employers, for reasons we will explore more fully below. If we now remember that there are administrative costs to add to the premium, we can find one additional advantage above that of risk pooling to group insurance. Administrative costs decrease rapidly with the size of the group. If a salesperson contracts to insure a group of 250 employees, he or she has, in essence, sold 250 policies in one fell swoop, a less expensive alternative to selling 250 separate policies to 250 consumers. The employer offers the insurance to all employees as a work benefit.

Why would a low-risk individual be willing to, in effect, subsidize a high-risk individual through coverage at work? Several reasons exist; first, because of risk aversion, everyone is willing to pay something more than the value of their expected losses. Second, the cost of purchasing a dollar’s worth of health insurance at work is less than a dollar because of the tax treatment of these benefits and because of the lower administrative costs. Third, a low-risk individual today might be a high-risk individual tomorrow, and there might be barriers to purchasing insurance later. In this situation, workers will find it to their advantage to obtain coverage early.

Market Solution 2: Benefit Design and Risk Segmentation

Insurers can also offer multiple types of policies designed to make individuals “signal” their risk level by which policy they choose to purchase. In essence, insurers separate risks and price the policies appropriate to the risk level. They also make use of observable characteristics correlated with health care expenses in setting the availability of the product. To discuss these options, let us first define several characteristics or terms related to health insurance coverage.

The premium is the price the consumer pays in exchange for the insurance coverage. If the consumer has a loss, he or she makes a claim and is reimbursed, or providers are paid directly. Deductibles are exemptions from reimbursement for the first dollars of losses. As an example, someone with a $500 deductible and a $750 medical bill will pay the first $500 out-of-pocket (himself or herself), and the insurance company will pay the next $250. Coinsurance is an arrangement where the insurance company pays a certain percentage of the claims and the consumer pays the remaining percentage out-of-pocket. A co-payment is either a fixed-dollar payment made by the consumer or the actual out-of-pocket payment by the consumer resulting from a coinsurance arrangement.

As an example of how benefit design can separate risks, insurers may increase the premiums but also increase the level of benefits by decreasing the deductibles, co-payments, and coinsurance rates. Compared to a policy with a low premium but high deductibles and co-payments, the premiums of both policies can be designed jointly with the benefits so that relatively high-risk individuals will find one policy more attractive and relatively low-risk individuals will find the other policy more attractive.

Insurers also spend considerable effort identifying observable characteristics (age, gender, etc.) that are correlated with higher risks and pricing the policies accordingly, as young, unmarried males purchasing automobile insurance can certainly attest. These factors include past medical conditions and other risk behaviors such as smoking. In addition to charging different premiums to different groups, insurers have written in a number of preexisting conditions clauses that exempt coverage from medical bills related to health problems that have already been diagnosed.

All of these efforts at risk segmentation add considerable costs to the loading factor associated with health insurance. These costs are one reason why the administrative costs for private insurance in the United States are considerably higher than the administrative costs in Canada, which has universal coverage (Woolhandler, Campbell, & Himmelstein, 2003). These costs are partly incurred by the insurers themselves in their benefit design and pricing mechanisms, but they also add administrative costs to the providers, who must deal with multiple payers with different reimbursement mechanisms.

Policy Solutions to Adverse Selection

The underlying problem with asymmetric information is that healthy consumers opt out of policies, leaving sicker consumers in the pool. Insurers are wary of the very consumers who are most likely to want to purchase insurance. If everyone in the community is covered, however, and opting out can be prevented, then the problem of adverse selection is alleviated. Several policies can be used to address this problem. We will focus on three: individual mandates, employer mandates, and single-payer plans. The recent extensive health care reforms in Massachusetts rely in part on the use of both types of mandates, although the subsidization of risk pools for individuals and small groups is another feature of this plan.

Mandates essentially require individuals to purchase insurance and/or employers to offer insurance to their workforce. In this case, everyone is now forced to demand insurance, and the willingness to purchase insurance is no longer a signal of hidden high risk to the insurer. Single payer, where the government is the insurer, is an option where the entire population is in one risk pool.

Policy Solution 1: Individual Mandates

Minimum requirements for automobile insurance are one example of individual mandates. Car insurance differs from mandated health insurance, however, in that if one cannot afford to purchase the policy, one can simply not drive. Health insurance mandates, in contrast, require everyone to purchase a policy. Unlike driving, one cannot simply forego medical treatment in all cases because emergency rooms are required to give treatment in cases of potentially life-threatening health problems. Thus, policy proposals that include mandates typically also include some form of subsidization of coverage through the tax code and/or increased access to public insurance as part of the plan. Creating or fostering risk pools outside of the existing group market is another feature that enhances the success of individual mandates. Penalties for not purchasing insurance under a mandate plan are also typically enacted through the income tax code. But because everyone is required to purchase insurance, low-risk individuals cannot opt out of the pool. The desire to purchase insurance is no longer an indicator of adverse selection.

Policy Solution 2: Employer Mandates

Employer mandates differ from individual mandates in several ways. First, employers are typically required to offer insurance, but individuals are not necessarily required to accept, or “take up,” that offer. Individuals may have alternative access to insurance through a spouse, for example. Firms that do not offer coverage are expected to pay a financial penalty, which is then used by the government to subsidize public provision of health insurance to individuals without access to employer-provided insurance. By forcing the expansion of the group market, more consumers will get access to the benefits of risk pooling.

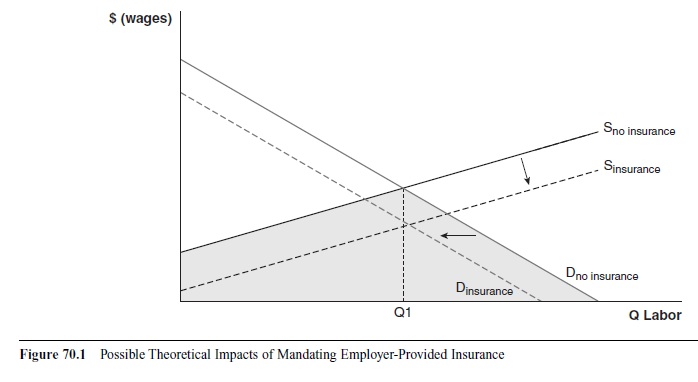

Employer mandates will certainly have additional impacts outside of health care on the market for labor. A simple theoretical analysis of mandates is presented in Summers (1989). Figure 70.1 shows one possible outcome in the labor market of an employer mandate. Requiring employers to provide insurance to their workers adds to the cost of hiring labor, which will reduce demand from D no insurance to D insurance . However, providing access to insurance at work may also increase the supply of labor from Sno insurance to Sinsurance. The overal impact on the market will be to lower wages to cover some fraction of the added costs of insurance.

As in any market where there is a simultaneous decrease in demand and increase in supply, the impact on the equilibrium number of workers hired is ambiguous. The new equilibrium could fall anywhere in the shaded area. Where exactly the new equilibrium falls depends on whether labor supply increases more, less, or the same amount as the decrease in demand for labor. If supply increases at the same rate as the demand decreases, the number of employed workers would remain unchanged and the wage offset exactly equals the cost of providing insurance. If supply increases more than demand decreases, which occurs if workers value the insurance more than it costs the employer to provide the insurance, the equilibrium quantity of workers could even increase. This latter effect could exist because of the benefits in risk pooling through group insurance in combination with the preferential tax treatment of health insurance purchased at work, which is described in more detail below.

Policy Solution 3: Single-Payer Financing

Even with mandates, adverse selection problems may remain, however, in the sorting of consumers and groups into different policies. Some insurers could attract relatively high-risk pools while others low-risk pools, reducing some of the subsidization of the high-risk individual. Mandates are not a complete answer to the market failure caused by asymmetric information. A single-payer system is one in which the public sector takes on the role of the only insurer. Financing of the care is typically through income taxes in which the healthy and wealthy subsidize the sick and poor. Universal health coverage is achievable without single-payer financing, but single payer has the advantage of virtually eliminating the problem of adverse selection, depending on how comprehensive the benefits associated with this form of financing are.

Figure 70.1 Possible Theoretical Impacts of Mandating Employer-Provided Insurance

Figure 70.1 Possible Theoretical Impacts of Mandating Employer-Provided Insurance

The Canadian health care system is one example of single-payer financing that retains private markets for the health care providers. In contrast, in the United Kingdom, the public sector is both the main financer and provider of health care. In the United States, Medicare is a single-payer financing mechanism for the elderly and disabled. In each of these examples, some private financing of health care coverage occurs through out-of-pocket payments by the patients themselves and the existence of supplementary insurance.

Market Failure 2: Moral Hazard

We now turn to the second major market failure in insurance: moral hazard. Remember Steve’s behavior after he purchased the radio? He was less careful about securing the car when he knew the radio would be replaced if stolen. Economists characterize this behavior as moral hazard. Economists do not generally view the problem of moral hazard in health insurance as being primarily related to the idea that people engage in riskier activities because they are insured, although this behavior could be one aspect of moral hazard. Rather, the main problem with moral hazard in health insurance is that once an individual is insured, the marginal private cost of receiving care is reduced from the true marginal resource (social) cost of production of that care. The price facing the insured patient could even be zero; in other cases, the price is reduced from the full cost to a modest co-payment or coinsurance rate.

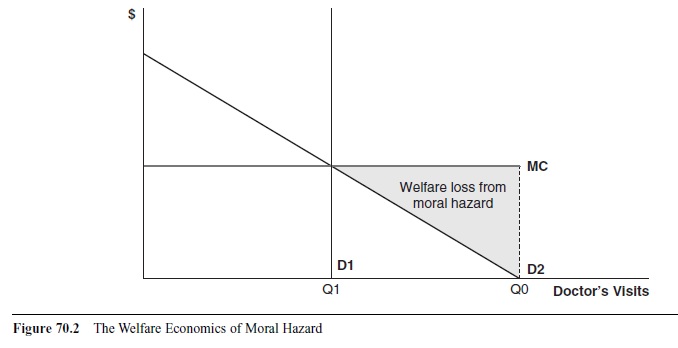

The efficiency, or welfare, costs of moral hazard are shown in Figure 70.2 for a sample market of doctor visits.

To keep things simple, we will assume constant marginal costs, which represent the true, social resource costs of production. In perfectly competitive markets, the equilibrium market price will also be equal to the marginal cost of production. The uninsured, whether their demand curve is represented by D1 or D2, pay the full marginal costs of care, and the quantity demanded for this group is Q1, where the market price (MC curve) intersects the demand curve. This point is the efficient level of production. Again for simplicity’s sake, assume for the moment that insurance is full coverage—there are no deductibles or co-payments.

Whether a deadweight loss from moral hazard exists depends on the elasticity of demand for health care. Figure 70.2 shows both scenarios; D1 represents the perfectly inelastic demand case, and D2 represents an elastic demand curve. Full insurance moves the marginal personal cost (price facing the individual) from the market price to zero. If demand is perfectly inelastic, the quantity demanded of health care remains the same, Q1, and the efficient level of consumption is maintained. When demand is elastic, the rational, utility-maximizing individual will optimally consume doctor visits up to Q0, where the demand curve intersects the x-axis. As is evident, Q0 is greater than Q1, and the individual is consuming an inefficiently high amount of medical care. The efficiency losses from moral hazard are greater the more elastic the demand for medical care.

What determines the elasticity of demand for health care? Demand tends to be more elastic for goods that are not considered necessities and goods with substitutes. Different types of medical care are likely to differ in their elasticity; one might have more elastic demand for the doctor with a sore throat versus a heart attack, for instance. With some sore throats, one can rest, use over-the-counter remedies, and eat chicken soup without significantly worse outcomes than one would receive from a doctor’s visit.

Figure 70.2 The Welfare Economics of Moral Hazard

Figure 70.2 The Welfare Economics of Moral Hazard

Even if it is a strep throat, which requires a prescription for antibiotics, consumers with no insurance may wait for a bit to determine whether the sore throat will get better on its own. Consumers with insurance are more likely to go to the doctor sooner, and in some of those cases, the doctor’s care is unnecessary because the illness would have resolved by itself. Because heart attacks are more life threatening and there are not many true substitutes to medical care, demand for cardiac care is likely to be more inelastic. The RAND health insurance experiment (discussed below) provides some evidence on the elasticity of demand for different types of health care services.

The overconsumption from moral hazard is rational for the individual, who receives positive marginal benefits from the additional care. The welfare problem is that his or her marginal benefits are less than the true resource cost of production. From a society’s view, this behavior is undesirable; the resources used to produce those doctor visits could be going to producing other goods with higher marginal benefits in other markets. The amount of the efficiency loss can be measured if the marginal benefits of care are known. The deadweight loss of moral hazard is shown by the area of the shaded triangle in Figure 70.2. The welfare losses are not equal to the full resource costs of production because we still do count the marginal benefits accruing to the individual.

Market Solution: Benefit Design

The problem of moral hazard can be minimized by patient cost-sharing mechanisms. If designed well, the addition of deductibles and coinsurance can reduce the amount of welfare loss produced by insurance by returning some of the costs back to the patient. The introduction and encouragement of consumer-directed health care is an example of a market solution intended to combat moral hazard. These plans are typically a very high deductible catastrophic insurance plan. These insurance policies are then priced more cheaply than more generous coverage. The deductibles in these plans force the patient to face the full marginal cost of the first few thousand dollars of care. Presumably, consumers will then be less likely to go to the doctor for minor problems like colds and to think about less expensive options for other types of care.

The success of patient cost sharing at reducing use of health care presupposes that the consumers know the true marginal benefits of the health care and that they fully direct their health care expenses. The problem with these assumptions is that there is asymmetric information in the health care markets as well. Physicians and other health care professionals have considerably more technical knowledge than patients, and patients therefore rely on them to be good agents when prescribing care. In addition, can the average patient distinguish between the medical problems that require medical intervention from those that will resolve on their own? The heart attack example is illustrative; perhaps the symptoms experienced by the patient are nothing more than heartburn, but without medical personnel to assess the patient, the consumer really does not know. To the extent that physicians direct the consumption of medical care, this limits the responsiveness of consumers to price. Patients may not be presented with a range of options for a particular health problem or may not possess the information to adequately assess the different costs and benefits of different options.

Cost containment mechanisms such as deductibles and coinsurance are common in the United States but rarer and/or more modest in other countries. While there is evidence that co-payments do reduce the quantity of care demanded, in a global sense, they seem to be fairly ineffective at reducing costs for the entire health care sector. Other countries, which rely more on cost containment strategies directed at the supply of health care, have lower per capita health care costs than the United States.

Income Taxes and Moral Hazard

The problem of moral hazard may be exacerbated by the differential treatment of health insurance “purchased” at work. In essence, total compensation received by workers in efficient markets is equal to the marginal revenue product that worker brings to the firm (his or her productivity). Workers could receive compensation in the form of wages or other benefits, including health insurance, pensions, and so on. To receive health insurance, workers must exchange wages for that benefit. The worker pays for the insurance directly through the employee share of the premium and indirectly in the form of lower raises and reduced wages.

The growth in employer-provided group health insurance in the United States has been fueled in part by the differential treatment of health insurance compensation versus wage and salary compensation. We are taxed on the latter but not the former at the federal and some state levels. This disparate handling in the tax code is rooted in the wage and price controls imposed during World War II. Having a large military mobilization increased both the domestic demand for goods and the domestic labor demand. Policy makers recognized that both factors would likely lead to considerable inflation. In the wartime environment, the government took a much more active role in regulating the economy, and one policy was the wage freeze. However, firms still required some means of trying to attract more workers in the tight labor market and began to offer additional, nonwage, fringe benefits. These were allowed and not considered part of the wage/salary freeze. This circumstance led to some questions about how nonwage compensation would be taxed. In 1954, the Internal Revenue Service (IRS) issued a judgment that these parts of compensation were not part of taxable income.

As a result, individuals who receive insurance at work pay less than a dollar for a dollar’s worth of coverage. In effect, the treatment acts like a tax deduction; it reduces taxable income by the value of the insurance. In addition, it reduces payroll taxes. Policies such as this one are termed tax expenditures; they represent foregone tax revenues for the government. How much the tax bill is reduced for the family depends on which tax bracket the household falls into. The value of a deduction is equal to the premium multiplied by the highest marginal tax rate the household faces.

Because of the artificial lowering of the price of health insurance at work, workers may demand more of their compensation in the form of health insurance than is optimal. Insurance policies traditionally covered rare, catastrophic events; now they often cover routine, smaller ticket items. In essence, health insurance now takes on an additional role beyond that of taking away uncertain risks; it becomes the predominant form of financing for health care.

Welfare and Equity Implications

If no market failures existed in health insurance, the special tax treatment would artificially reduce the price of health insurance and cause inefficiently high levels of health insurance coverage. However, asymmetric information does exist. Increasing the quantity of health insurance in this context may imply that the tax treatment improves efficiency. Second, equity considerations are also considered to be relevant. Society may view access to health care as being a special good that should not be allocated by the market. Many believe that low income should not prevent access to health care. If the tax treatment of health insurance improves access to health care for disadvantaged groups, society may value that outcome even if some efficiency costs exist in increasing the equity of outcomes (Okun, 1975). The tax treatment, however, does not appear to be accomplishing the goal of increasing equity of coverage.

Efficiency Impacts

Critics argue that the favorable tax treatment of employer-provided health insurance has led to an inefficiently high level of coverage. Health insurance has become less health insurance and more health care financing, with benefits including small, regular expenses such as checkups, in addition to the coverage of big-ticket, uncertain expenses. More generous benefits lead in turn to more potential for moral hazard, as patients become increasingly insulated from the full marginal cost of care. As discussed above, the amount of inefficiency caused by this moral hazard depends on how elastic the demand for medical care is.

What is the evidence on elasticity of demand for health care? Estimating the elasticity of demand for health care by varying the levels of co-payments patients pay is subject to selection bias since, as we have described above, individuals choose their level of coverage based in part on their health status. In other words, consumers who are relatively unhealthy are more likely to opt for fuller insurance coverage with lower patient out-of-pocket expenses. The RAND health insurance study provides the cleanest estimates of the elasticity of demand for health care. In this study, individuals were randomized to different levels of health insurance coverage, and their medical care use was tracked, so their level of insurance was uncorrelated with their health status. For most services, the estimated demand elasticities were quite inelastic (Newhouse & the Insurance Experiment Group, 1993). Inelastic demand for medical care then implies relatively small losses from moral hazard.

Equity Considerations

How the tax treatment affects access to disadvantaged groups (the poor or the sick, for instance) is another societal concern. The tax benefits are highly inequitably distributed and make the relative access to private health insurance worse. The reasons for the inequity are twofold. Workers must first have an offer of insurance from their employer to take advantage of the tax subsidy. In addition, the size of the tax subsidy depends on the marginal tax rate facing the household receiving the insurance. Because the U.S. income tax structure is progressive, higher income households receive a higher tax subsidy for the same policy relative to a lower income household. Sheils and Haught (2004) estimate that the bulk (71.5%) of the benefits of this tax expenditure goes to families with incomes of $50,000 or more, relative to the rest of the population. Looking at the data in a different way, the average benefit for families with incomes of $100,000 or more is $2,780, compared to a mere $102 on average for families with less than $10,000 in annual income.

A horizontal inequity is also created by the policy. Otherwise similar individuals are treated differently, depending on where they access health insurance. While self-employed individuals are also now able to deduct their insurance, the treatment for individuals purchasing insurance in the nongroup market is quite different. Individuals who have medical expenses exceeding 7.5% of their adjusted gross income may deduct these expenses from their taxes; insurance premiums may count as part of these medical expenses. In other words, individuals must have substantial expenses before they are able to take advantage of this deduction. In addition, the employer-provided health insurance exemption reduces individuals’ payroll tax (FICA) contributions, while the deduction for individual purchases of health insurance does not, reducing the relative value of the latter.

Public Insurance in the United States

Now that we have a better sense of the workings of the health insurance market, we turn our attention to the public insurance policies in the United States. The U.S. system of financing is a mix of private and public coverage. While there are a variety of government-run and funded health programs, including coverage for military personnel and veterans, this research paper will focus on the three main programs: Medicare, Medicaid, and SCHIP.

Medicare

Medicare, established in 1965, is the public coverage for individuals age 65 and older, individuals younger than age 65 with disabilities, and anyone with end-stage renal failure. In essence, for most recipients, it is a single-payer-type plan. The “traditional” Medicare policy is composed of two parts: Part A, essentially catastrophic coverage for inpatient hospital care and some temporary, limited coverage for hospice and long-term care coverage. These benefits are not subject to a premium. The second part, Part B, covers some outpatient and doctor’s services. Beneficiaries contribute premiums for this coverage. Other funding is from payroll taxes and general tax revenues.

Individuals can also opt out of traditional Medicare coverage and choose Part C, aka “Medicare Advantage” plan, which could be an HMO, PPO, or a private fee-forservice plan. The government pays the premium for the individual, and the private insurance plan takes over the insurance role. With the passage of the Medicare Modernization Act of 2003, prescription drug coverage was added in 2006. Part D includes some premiums for individuals. In addition to this basic level of coverage, elderly individuals may purchase supplemental, or gap, insurance to cover expenses that are not covered by Medicare. Retiree health insurance plans often fill this role, as does Medicaid coverage for the elderly poor. Individuals who receive both Medicare and Medicaid coverage are called dual eligibles.

Medicaid and State Child Health Insurance Program

Medicaid and SCHIP are means-tested programs to provide insurance for the very poor. They are jointly state and federally funded and administered insurance for the poor. Eligibility for Medicaid varies by state, with the federal government establishing minimum criteria. As a means-tested program, individuals must have incomes below a specific cutoff based on the federal poverty line and hold limited assets to qualify for the benefits. The income eligibility cutoffs also vary by characteristics of the individual, with higher thresholds for infants, children, and pregnant women, for example. Individuals with very high medical expenses may qualify under the medically needy category; Medicare dual eligibles often qualify through this route.

The Uninsured

Not everyone in the United States has access to coverage. Given the market failures and the structure of public coverage, it is possible to predict characteristics that will be associated with lack of insurance. Individuals with preexisting conditions who do not have access to the group market will be particularly vulnerable. The elderly receive coverage through Medicare, so the uninsured will be found among the nonelderly. Means-tested programs cover the very poor, and to receive health insurance compensation through an employer, the worker’s marginal revenue product must be high enough to pay for the insurance in lower wages.

The uninsured are by and large in families with one or more full-time workers and in families that are under or near the poverty line. They earn too much income to qualify for Medicaid/SCHIP or do not take up Medicaid, but they do not have enough income to purchase health insurance on their own. Since the benefits of risk pooling increase with the size of the group, uninsured workers are more likely to be employed at smaller firms, in occupations and industries with considerable job turnover, and in low-wage occupations.

The Evolution of HIV/AIDS and Insurance Coverage

On June 5, 1981, the Centers for Disease Control (CDC) reported a small cluster of deaths in Los Angeles from a form of pneumonia that was rarely fatal. After long investigations, the underlying cause was determined. Acquired immune deficiency syndrome (AIDS) was identified, an infectious disease caused by a retrovirus named human immunodeficiency virus (HIV). In the early years of the epidemic, HIV was a virtual death sentence, and until a blood test was approved by the Food and Drug Administration (FDA) in 1985, most cases were not identified until late in the disease stage, when the immune system had already been so compromised that opportunistic infections had already attacked the system. The disease has a long latency period, on aver-age 6 to 10 years, in which the individual is infected with the virus before developing full-blown AIDS. During the latency period, the individual may show few or no debilitating symptoms. An individual develops AIDS when his or her CD4 cell count (an important component of the immune system) drops below 200 and/or begins to contract opportunistic infections.

In the beginning of the epidemic, treatment of the opportunistic infections was the only course of action available until the introduction of azidothymidine (AZT), which inhibits the replication of the virus itself. However, because of HIV’s quick replication rate and high rate of mutations, AZT alone only temporarily extended the life expectancy of those infected before the virus developed resistance to the pharmaceutical. For many during this period, life expectancy was extended only a few months. It was not until the development of highly active antiretroviral therapy (HAART) in 1995 that medicine was able to significantly extend the life expectancy of HIV-positive individuals and the death rate from AIDS began to fall. HAART is characterized by treatment with more than one drug; each drug targets a different aspect of the viral infection and replication process. Success of the regimen depends on the strict adherence to the treatment; treatment cannot be stopped once started, or the virus may gain resistance, and the disease progression will resume.

The evolution of treatment for HIV/AIDS and the characteristics of the disease itself provide an important policy problem within the United States for the study of health insurance. As we have examined above, insurance “for insurance’s sake” should be focused on catastrophic (high-cost), unexpected health problems. AIDS fit this model quite well early on in the epidemic since it was an acute problem, although the outcome was often death and not recovery. It was not until the development of effective medical therapies that HIV/AIDS changed to a chronic condition with important implications for the financing of health care for HIV-positive individuals.

Once started, to be effective, the drugs must be taken daily for the rest of the patient’s life, to prevent the development of drug resistance. However, once an individual has become diagnosed with HIV, the level of uncertainty about the amount and costs of medical care required by the individual drops. One faces certain medical expenditures for many, many years. The HAART treatments alone are quite expensive, averaging $12,000 to $24,000 per year, not counting other treatments for opportunistic infections and toxicity-related side effects of the drugs themselves.

Individuals who have tested positive for HIV experience enormous difficulties in obtaining private coverage in the individual market. The presence of the virus is a preexisting condition with known, large current and future expenses. Pollitz, Sorian, and Thomas (2001) surveyed nongroup market insurers about premiums and policy restrictions for a set of hypothetical patients. In this study, even individuals who only had hay fever as a preexisting condition faced higher premiums and fewer offers of “clean” coverage (coverage without additional restrictions on the benefits); the hypothetical HIV-positive consumer received no offers of coverage at any price in any of the markets. To receive access to private group coverage, an individual must be able to work, find a job/employer that offers coverage, and be able to afford the employee share of the premium. If HIV/AIDS results in a disability for the individual, employment will become difficult or impossible.

The typical routes to public financing for HIV/AIDS care are through either Medicare under the low-income, disabled eligibility category or Medicaid as a low-income welfare, medically needy, or as a dual-eligible Medicare disability recipient. To qualify as a person with disabilities, one must have an employment history and wait for 2 years after the development of the disabling condition to become eligible. Once on the HAART therapy, HIV/AIDS can become less disabling, which then may disqualify the person from eligibility for the public coverage. If public coverage is lost, the patient may stop taking the drugs, become disabled again, and can then regain coverage. From a public health perspective, this on-again/off-again financing of care could contribute to the rise of drug resistance in the virus, a significant negative externality. See Laurence (2001) for further analysis of the policy debate.

Given the market solutions to adverse selection and the strong tie of private insurance to employment, one would expect to find a lower rate of private insurance coverage among the population of HIV-positive individuals. This trend away from private coverage toward public coverage should increase over time, as medical technology has transformed HIV/AIDS into a chronic, albeit often debilitating, disease model. Data in Goldman et al.’s (2003) analysis confirms this picture, as half of all HIV-positive individuals in the study are insured by Medicaid, Medicare, or both. The importance of the public sector as a safety net for persons living with HIV has disadvantages. During recessionary time periods, states face pressure to cut back on their outlays for Medicaid, which can hurt access to care for this population. Ghosh, Sood, and Leibowitz (2007) find that one state strategy for cutting costs, decreasing the income threshold to qualify for Medicaid, increases the rate of uninsurance and decreases the use of HAART.

Stability of coverage is another issue of great importance for HIV-positive individuals. To what extent do HIVpositive individuals move from being insured to losing coverage? How often do they switch from private to public coverage or vice versa? Do these transitions affect the quality of medical care received by this population? Fleishman (1998) provides some evidence from the 1990s; most individuals who changed coverage status were those who went from no insurance to public insurance; individuals who had developed AIDS were more likely to make such a switch. Relatively few individuals in this sample lost private coverage, perhaps reflecting the increase in the effectiveness of HAART therapy at keeping individuals from developing disabling symptoms. More recent evidence in Kelaher and Jessop (2006) in New York City also shows the same pattern. However, some individuals do lose coverage, which has important implications for their ability to afford therapy.

Conclusion

Health insurance markets do not fit the standard market model of perfect competition. They exist because of the information problem of uncertainty, in combination with our risk aversion. Once created, they face the market failure of asymmetric information. Being insured may alter the consumption of health care in inefficient ways through moral hazard. All of these problems have real consequences for who gets covered and how they are covered. When analyzing these markets, society considers not only the efficiency of the market, but because insurance finances health care, equity concerns are also prominent in the debate on the appropriate policy response.

See also:

Bibliography:

- Akerlof, G. A. (1970). The market for ‘lemons’: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488-500.

- Arrow, K. J. (1963). Uncertainty and the welfare economics of medical care. American Economic Review, 53, 941-973.

- Centers for Disease Control. (1981). Pneumocystis pneumonia— Los Angeles. Morbidity and Mortality Weekly Reports, 30, 250-252.

- Cutler, D. M., & Gruber, J. (1996). Does public insurance crowd out private insurance? Quarterly Journal of Economics, 111, 391-130.

- Fleishman, J. A. (1998). Transitions in insurance and employment among people with HIV infection. Inquiry, 35, 36-48.

- Ghosh, A., Sood, N., & Leibowitz, A. (2007). The effect of state cost containment strategies on the insurance status and use of anti-retroviral therapy (HAART) for HIV infected people. Forum for Health Economics & Policy, 10(2), Article 3. Retrieved February 24, 2009, from http://www.bepress.com/fhep

- Goldman, D. P., Leibowitz, A. A., Joyce, G. F., Fleishman, J. A., Bozzette, S. A., Duan, N., et al. (2003). Insurance status of HIV-infected adults in the post-HAART era: Evidence from the United States. Applied Health Economics and Health Policy, 2(2), 85-91.

- Kelaher, M., & Jessop, D. J. (2006). The impact of loss of Medicaid on health service utilization among persons with HIV/AIDS in New York City. Health Policy, 76, 80-92.

- Laurence, L. (2001, March 13). Special report: Medicaid’s catch-22. Kaiser Daily HIV/AIDS Report. Retrieved February 24, 2009, from http://www.kaisernetwork.org/daily_reports/ rep_index.cfm?DR_ID=3349

- Medicare Payment Advisory Commission (MedPAC). (2008, December 5). Medicare advantage program. Paper presented at the MedPAC Public Meeting, Washington, DC.

- Newhouse, J. P., & the Insurance Experiment Group. (1993). Free for all? Lessons from the RAND health insurance experiment. Cambridge, MA: Harvard University Press.

- Okun, A. (1975). Equality and efficiency: The big tradeoff. Washington, DC: Brookings Institution.

- Pollitz, K., Sorian, R., & Thomas, K. (2001). How accessible is individual health insurance for consumers in less-than-perfect health? Retrieved February 24, 2009, from http://www.kff.org/insurance/upload/How-Accessible-is-Individual-Health-Insurance-for-Consumer-in-Less-Than-Perfect-Health-Report.pdf

- Sheils, J., & Haught, R. (2004). The cost of tax-exempt health benefits in 2004. Health Affairs. Available at http:// content.healthaffairs.org/index.dtl

- Summers, L. H. (1989). Some simple economics of mandated benefits. American Economic Review: Papers and Proceedings, 79, 177-183.

- Woolhandler, S., Campbell, T., & Himmelstein, D. U. (2003). Costs of health care administration in the United States and Canada. New England Journal of Medicine, 349, 768-775.

- Woolhandler, S., & Himmelstein, D. U. (2002). Paying for national health insurance-and not getting it. Health Affairs, 27(4), 88-98.

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to buy a custom research paper on any topic and get your high quality paper at affordable price.