This sample Stocks and Flows Research Paper is published for educational and informational purposes only. If you need help writing your assignment, please use our research paper writing service and buy a paper on any topic at affordable price. Also check our tips on how to write a research paper, see the lists of research paper topics, and browse research paper examples.

In economics and business, the concept of stocks and flows is crucial to understanding the development of economic variables. It is most commonly used in macroeconomics, labor economics, and accounting. More generally, the concept of stocks and flows is central in system dynamics theory, which describes the development of complex systems.

Most economic variables are either stocks or flows. Stock variables describe the state of the economy at a given point in time, whereas flow variables describe the changes in the economy over a period of time. If one looks at an extremely small period of time, flows will be close to zero, whereas stocks could have any value. Stocks are accumulated or depleted over time by flows, whereas flows represent the rate of movement of items in and out of stocks. Frequently, stocks are characterized by nouns and flows, which represent processes, by verbs.

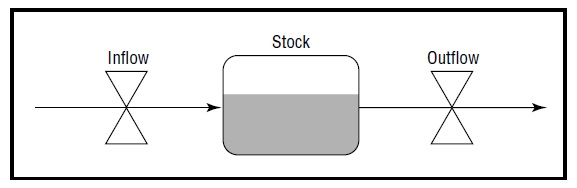

Flows can be divided into inflows—flows that add to stocks—and outflows—flows that deplete the stocks. The difference between inflows and outflows is called net inflows. The figure illustrates the relationship between stocks and flows. If the inflow is greater than the outflow or net inflow is positive, the stock will be rising; if the inflow is less than the outflow, net inflow is negative, and the stock will be falling.

The simplest illustration of stocks and flows is a bathtub. The level of water in the bathtub is a stock, the water coming from the faucet is an inflow, and the draining of the water through the drain is an outflow. If we plug the drain and turn on the faucet, the net inflow will be positive, and the stock of water in the bathtub will be rising. If, instead, we close the faucet and open the drain, the net inflow of water will be negative, and the stock of water in the bathtub will fall.

Stocks And Flows In Macroeconomics

Economic development cannot be well described or understood without knowledge of which variables represent stock and which variables represent flows. Most macroeconomic variables reported by statistical agencies are flow variables. Gross Domestic Product (GDP) represents the value of final goods produced by the economy during a given year. GDP is a flow that is measured in dollars, euros, or other currency units per year. GDP is an inflow to the stock of inventory in the economy. The stock of inventory is not large as most of GDP is either consumed by individuals or by the government, invested in production by firms, or exported. Consumption, government spending, and exports are outflows. The remaining GDP is accumulated as additional inventory.

An important stock that plays a big role in macroeconomics is a stock of government debt. It is accumulated by the flows of government budget deficits (the difference between budget spending and budget revenues); it is depleted by the repayment of the debt, through budget surplus (negative budget deficit). If the government runs a budget deficit for many years in a row, it will accumulate a large stock of government debt. Because the interest needs to be paid on the stock of debt and the interest payments are part of budget spending, it becomes harder to stop accumulating the debt when the stock is already large. This provides an example of how the stocks themselves can affect the flows: the larger the stock of debt, the larger the interest spending that is a flow contributing to the stock of debt.

Another important example of stocks and flows in macroeconomics is unemployment. At any given point in time a number of people in the economy are unemployed. The total number of unemployed is a stock. In each period a number of people lose their jobs and join the ranks of unemployed, representing an inflow to unemployment, and a number of unemployed people find jobs and leave unemployment, representing an outflow from the unemployment. If the rate at which workers lose their jobs (job separation rate) is higher than the rate at which unemployed find jobs (job finding rate), unemployment will increase because the net inflow to unemployment will be positive. Thus policies designed to lower the unemployment rate must take into account the effects of certain measures on both job finding rate and job separation rate. For example, if a policy makes it harder for firms to fire workers, it would lower the job separation rate. However, such a policy would also make firms more reluctant to hire new workers, lowering the job finding rate. The overall effect of such a policy on unemployment is uncertain.

Stocks And Flows In Microeconomics

Each individual’s wealth is a stock. It is accumulated by the inflow of income and depleted by the outflow of spending. The best way to picture this is by thinking about a bank account. The balances in the bank account represent the stock of cash available to the individual; the direct deposit of the salary is an inflow to the account, and check and cash withdrawals are the outflow. If the net inflow is positive, the balances in the bank account will rise. Of course, individuals can hold other assets in addition to bank accounts. Frequently, the largest portion of an individual’s wealth is the value of his or her house. Economists believe that the stock of wealth affects the flow of consumer spending—the higher the wealth, the larger portion of income the consumers are willing to spend, which lowers the net inflow of income. This is a mechanism through which economists at the beginning of the 2000s linked the U.S. housing boom to the nation’s low savings rate.

Firms also have a stock of wealth, usually referred to as the firm’s net worth, or capital stock, which is the difference between a firm’s assets and liabilities. If a firm is publicly traded, individuals and financial institutions can buy shares of that firm’s stock, which would give the buyer an ownership share of the stock of the firm’s wealth. Firms accumulate their capital through the inflow of investment. The stock of capital depletes through the outflow of depreciation and capital that is used up in production.

Bibliography:

- Jensen, Michael, and William Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 11: 5–50.

- Miller, Merton. 1977. Debt and Taxes. Journal of Finance 32: 261–275.

- Modigliani, Franco, and Merton Miller. 1958. The Cost of Capital, Corporation Finance and the Theory of Investment American Economic Review 48 (3): 261–297.

See also:

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to buy a custom research paper on any topic and get your high quality paper at affordable price.