This sample Supply-Chain Management Research Paper is published for educational and informational purposes only. Free research papers are not written by our writers, they are contributed by users, so we are not responsible for the content of this free sample paper. If you want to buy a high quality research paper on any topic at affordable price please use custom research paper writing services.

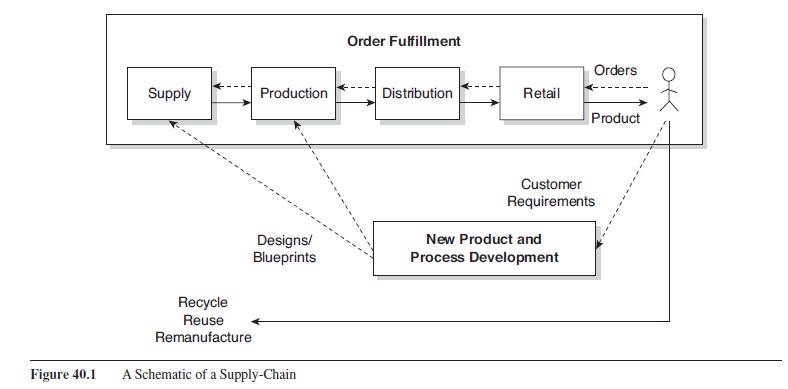

Supply-chain management (SCM) refers to the management of materials, information, and funds across the entire supply-chain, from suppliers through manufacturing and distribution, to the final consumer. It also includes aftersales service and reverse-product flows such as handling customer returns, recycling of packaging and discarded products (see Figure 40.1). In contrast to multiechelon inventory management, which coordinates inventories at multiple locations of a single firm, or traditional logistics management, SCM involves coordination of information, materials, and financial flows among multiple firms.

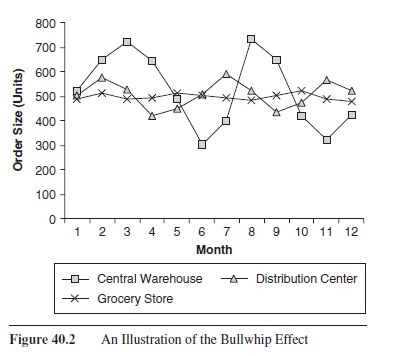

SCM has generated substantial interest in recent years for a number of reasons. Managers in many industries now realize that actions taken by one member of the chain can influence the profitability of all others in the chain. Competition has moved beyond firm-to-firm rivalry to supply-chain against supply-chain. Also, as firms successfully squeeze inefficiency from their own operations, the next opportunity for improvement is through better coordination with suppliers and customers. During the 1970s and 1980s, global competition forced many manufacturing companies to improve the quality of their products and reduce their manufacturing costs. With 20 years of progress, many of these manufacturers found that the biggest challenges they faced in the new millennium were outside of their immediate control, and solutions required better coordination with their upstream and downstream partners. While they have reduced their own costs, they found that costs of poor coordination could be very high. For example, both Procter & Gamble and Campbell Soup sell products whose consumer demand is fairly stable—the consumption of Pampers or Chicken Noodle Soup does not swing wildly from week to week. Yet both these firms faced extremely variable demand at their factories. After some investigation, they found that the wide swings in demand were caused by the ordering practices of retailers, wholesalers, and distributors. For example, a manager observing a small increase in consumer demand decided to place larger than usual orders at the retailer’s distribution center. The distribution center managers, not knowing the actual store demand, yet seeing the increase in orders, placed even larger orders with the wholesaler to ensure product availability. The snowballing effect was off and by the time it hit the factory, the demand was greatly exaggerated (see Figure 40.2).

Figure 40.1 A Schematic of a Supply-Chain

Figure 40.1 A Schematic of a Supply-Chain

This phenomenon—termed the bullwhip effect—has many causes. Sometimes it is caused by supply-chain members forecasting in isolation, as in the previous example. Order batching may also set the snowball rolling since changes in demand are hidden in the large batches. Some of these practices may be exacerbated by the marketing efforts of the company. For example, in the grocery industry, price promotions cause grocery chains to place very large orders, which is called forward buying. These spikes in demand ripple through the supply-chain causing shortages upstream while filling up downstream warehouses. Regardless of the cause, the end result is a greatly distorted demand signal for upstream members of the supply-chain. These large demand swings erode order fulfillment and drive up costs. Fortunately, as discussed next, the bullwhip can be tamed through an integrative approach that employs timely information shared by supply-chain partners and strong relationships that enable coordination.

Such interfirm integration, long the dream of management theorists, finally began gaining momentum in the late 1990s. Some would argue that managers have always been interested in integration, but the lack of information technology made it impossible to implement a more “systems-oriented” approach. Industrial-dynamics researchers dating back to the 1950s (Forrester, 1958) have maintained that supply-chains should be viewed as an integrated system. With the recent explosion of inexpensive information technology, it seems predictable that businesses would become more supply-chain focused. However, while information technology is clearly an enabler of integration, it alone cannot explain the radical organizational changes in both individual firms and whole industries. A sea change in management theory was needed as well.

Two fundamental catalysts have conspired over the past decade to initiate the required change in management theory. The first is the power shift from manufacturers to retailers. Wal-Mart, for instance, has forced many manufacturers to improve their inventory management, and even to manage inventories of their products in Wal-Mart stores and distribution centers. Following Wal-Mart’s lead, most major retailers are asking suppliers to tighten up their inventory management and improve their order-fulfillment capabilities. Second, the Internet and associated e-Business initiatives are forcing managers to rethink their supply-chain strategies. e-Business facilitates the virtual supply-chain, and as companies manage these virtual networks, the importance of integration is magnified. Firms like Cisco, HP, and Amazon.com are superb at managing the flow of information and funds, via the Internet and electronic funds transfer. The challenge is to efficiently manage the flow of products.

Figure 40.2 An Illustration of the Bullwhip Effect

Figure 40.2 An Illustration of the Bullwhip Effect

Today, the forces of globalization and technology are further changing supply-chains. In many cases, the supply-chains are literally disintegrating in a physical sense. Product designers, marketers, and manufacturers that were previously located in a single facility are now spread over several continents in organizations with different cultures, languages, and business objectives. For example, not long ago, apparel brands such as Levi’s did it all—operating their own U.S. production plants along with their core design and marketing activities. In the past few years, the company has shuttered the sewing plants that once dotted the southeastern United States and outsourced much of that production and even design. The same transition is also true for many other products, from PCs to lawn mowers. Ten years ago, Hewlett-Packard designed and manufactured PCs for regional markets in Europe and the United States. Now, designers, marketers, and assemblers are scattered across different geographies and firms.

These changes have brought new risks and challenges. Long-standing challenges, such as short product lives and uncertain demand, have become even more vexing. In some cases, the technologies and approaches for enhancing supply-chain competitiveness have been the subject corporate and public debate: supply-chain complexity leading to new risks of disruption; supply-chain efficiency generating complaints of price discrimination; low-cost sourcing creating job migration. Lean supply-chains reduce inventory cost but are more susceptible to such shocks as natural disasters or global pandemics; technologies that enable sophisticated pricing improve supply-chain efficiency but leave some customers crying foul; and outsourcing creates global winners and losers as shifting jobs leave some without work (Johnson, 2006).

Key Components Of Supply-Chain Management

Supply-chain management is really a whole set of topics covering multiple disciplines and employing many management and engineering tools (Johnson & Pyke, 2001). Within the last few years, several textbooks on supply-chain have arrived on the market providing both managerial overviews and detailed technical treatments. For examples of managerial introductions to supply-chain see (Chopra & Meindl, 2001) and for logistics texts see (Stock & Lambert, 2001). For more technical, model-based treatments see (Silver, Pyke & Peterson, 1998) and (Simchi-Levi, Kaminsky, & Simchi-Levi, 1998).

Research in SCM has identified 12 distinct management areas that are associated with the subject. Each area represents a supply-chain issue facing the firm. For each area, we provide a brief description of the basic content and refer the reader to a few articles that serve as good sources for further reading. We also mention likely quantitative tools that may aid analysis and decision support. See Johnson and Pyke 2000 for a more detailed description of these 12 areas with references to academic research, management and popular press stories, and related teaching cases. The 12 categories we define are

- inventory and forecasting;

- marketing and channel restructuring;

- service and aftersales support;

- reverse logistics and green issues;

- location;

- transportation and logistics;

- outsourcing and logistics alliances;

- product design and new product introduction;

- information and electronic mediated environments;

- metrics and incentives;

- sourcing and supplier management; and

- global issues

Inventory and Forecasting

Inventory and forecasting includes techniques for ongoing inventory management and demand forecasting. Key to inventory management is understanding uncertainty. In almost every aspect of supply-chain planning, we are faced with risk and uncertainty. The observed result of this uncertainty is variability throughout the supply-chain that wreaks havoc on the firms’ ability to serve customers and drives up costs. Uncertainty and the resulting variability we observe originate from several sources and then combine and propagate throughout the supply-chain. To begin with, planners are never absolutely certain when or what the customers will demand. This problem is further complicated by the fact that we do not know exactly what the competitors plan to do. On the other hand, partners in the supply-chain are not always as reliable. Suppliers often fail to meet delivery expectations, transportation providers run late, and logistics providers make mistakes. And, lest companies are tempted to blame others for their problems, internal processes are far from error free. Buyers forget to place orders or order the wrong quantities; warehouses lose materials; and factories ruin good parts. In the end, firms often find that we can’t always supply whatever it is the customers want. Failing the customer erodes a company’s brand equity in the market place and jeopardizes the value to all its stakeholders.

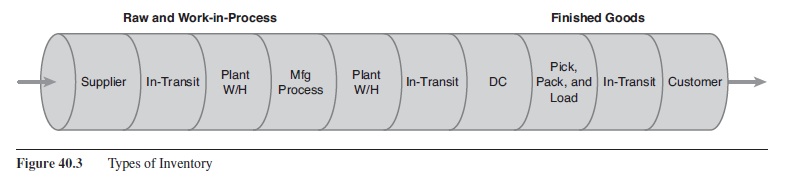

While we often refer to inventory in a generic way, there are actually many different types of inventory and ways to categorize it (Figure 40.3). Inventory helps companies achieve many different objectives including reducing costs, improving customer service, and financial hedging against market uncertainties. For a manufacturer, inventory arrives from suppliers as raw materials. Within the manufacturing process, the raw material is transformed through fabrications and assembly into finished good inventory. While in production, we usually refer to the inventory as work in process. The form of raw materials and work in process varies widely depending on the industry and product. For example, a glass manufacturer in the auto industry receives sand and other chemicals from suppliers, which is often transported by rail or barge. These materials are heated in a furnace to transform them into molten glass that is flowed into flat glass sheets. These sheets represent work in process. After cooling, these sheets are formed into finished products like windshields and side windows and transported by truck to the customer (an automotive assembler). For an assembly operation like PC manufacturing, the raw materials are subassemblies like hard disks, motherboards, CD/ DVD drives, and housings that are assembled into finished PCs for customers.

Figure 40.3 Types of Inventory

Figure 40.3 Types of Inventory

The American Production and Inventory Control Society (APICS) defines six key functions of inventory:

- Pipeline (transport)

- Cycle (lot sizing)

- Decoupling

- Anticipation (seasonal)

- Hedging

- Safety

Pipeline inventory is needed simply to move products within the supply-chain. Cycle stock is inventory that results from batch processes. For example, machines often require large setups, and thus, it is economical to produce large batches of product creating inventory. The function of decoupling inventory is to allow two different machines within a factory or even two different factories to produce at different rates. Anticipation is a special type of decoupling where inventory is produced in anticipation of seasonal demand. For some raw materials, fluctuating market prices induce companies to buy inventory as a hedge against price increases. Finally, the key function of safety stock is to buffer against unforeseen changes in demand or supply.

Industrial engineers and operations managers have long employed statistical models for forecasting and inventory planning. Statistical measures of variability, like the standard deviation of forecast error, are fundamental to forecast improvement initiatives or to rational inventory polices. Inventory costs are often the easiest to identify and reduce when attacking supply-chain problems. Stochastic inventory models can identify the potential cost savings from, for example, sharing information with supply-chain partners, but more complex models are required to coordinate multiple locations. Of course there are many full texts on the subject such as (Silver et al., 1998). Useful managerial articles focusing on inventory and forecasting include (Davis, 1993) and (Fisher, Hammond, Obermeyer, & Raman, 1994).

Marketing and Channel Restructuring

Supply-chain partners who resell products form the “distribution channel.” Marketing and channel restructuring focuses on these downstream partners. It includes critical decisions related to getting the products from a firm’s factories all the way into the customers’ hands. As with facility location, these decisions impact the supply-chain structure (Fisher, 1997) as well as define an interface with marketing (Narus & Anderson, 1996). While the inventory and forecasting category addresses the quantitative side of these relationships, this category covers relationship management, negotiations, and even the legal dimension. Most importantly, it examines the role of distribution strategy and channel management (Anderson, Day, & Rangan, 1997), affecting the availability of products at the retail level while defining the way information and materials flow through distribution.

Many industry initiatives (for example, efficient consumer response [ECR] in groceries or quick response in apparel) have focused on managing the channel as they strive to mitigate the bullwhip effect. The bullwhip effect has received enormous attention in the research literature. Many earlier studies argued that centralized warehouses are designed to buffer factories from variability in retail orders. The inventory held in these warehouses should allow factories to smooth production while meeting variable customer demand. However, empirical data suggests that exactly the opposite happens (see for example Baganha & Cohen, 1998). Orders seen at the higher levels of the supply-chain exhibit more variability than those at levels closer to the customer. In other words, the bullwhip effect is real and pervasive (see, Cachon, Randall, & Schmidt, 2005 for another view). Typical causes include those noted in the introduction, as well as the fact that retailers and distributors often overreact to shortages by ordering more than they need. H. L. Lee, Padmanabhan, and Whang (1997) show how four rational factors help to create the bullwhip effect: demand signal processing (if demand increases, firms order more in anticipation of further increases, thereby communicating an artificially high level of demand); the rationing game (there is, or might be, a shortage so a firm orders more than the actual forecast in the hope of receiving a larger share of the items in short supply); order batching (fixed costs at one location lead to batching of orders); and manufacturer price variations (which encourage bulk orders). The latter two factors generate large orders that are followed by small orders, which implies increased variability at upstream locations.

Some recent innovations such as increased communication about consumer demand via electronic data interchange (EDI) and the Internet, and everyday low pricing (EDLP) (to eliminate forward buying of bulk orders) can mitigate the bullwhip effect. In fact, the number of firms ordering and receiving orders via EDI and the Internet is exploding. The information available to supply-chain partners and the speed with which it is available has the potential to radically reduce inventories and increase customer service. Other initiatives can also mitigate the bullwhip effect. For example, changes in pricing and trade promotions and channel initiatives such as vendor-managed inventory (VMI), coordinated planning, forecasting, replenishment (CPFR), and continuous replenishment (Waller, Johnson, & Davis, 1999) can significantly reduce demand variance. VMI is one of the most widely discussed partnering initiatives for improving multifirm supply-chain efficiency. Popularized in the late 1980s by Wal-Mart and Procter & Gamble, VMI became one of the key programs in the grocery industry’s pursuit of ECR and the garment industry’s quick response. Successful VMI initiatives have been trumpeted by other companies in the United States including Johnson & Johnson and by European firms such as Barilla (the pasta manufacturer).

In a VMI partnership, the supplier—usually the manufacturer but sometimes a reseller or distributor—makes the inventory replenishment decisions for the consuming organization. This means the supplier monitors the buyer’s inventory levels (physically or via electronic messaging) and makes periodic resupply decisions regarding order quantities, shipping, and timing. Transactions customarily initiated by the buyer (i.e., purchase orders) are initiated by the supplier instead. Indeed, the purchase order acknowledgment from the supplier may be the first indication that a transaction is taking place; an advance shipping notice (ASN) informs the buyer of materials in transit. Thus, the manufacturer is responsible for both its own inventory and the inventory stored at its customers’ distribution centers.

Because many of these initiatives involve channel partnerships and distribution agreements, this category also contains important information on pricing, along with antitrust and other legal issues. These innovations require interfirm, and often intrafirm, cooperation and coordination that can be difficult to achieve.

Service And Aftersales Support

The service and aftersales support category covers the important, but often overlooked, issue of providing service and service parts after the sale of the original product. Effective management of service parts inventories is often critical to customer satisfaction. If a manufacturer of farm equipment stocks out of a key replacement part in the middle of harvest season, some farmers could face serious financial difficulties. Those farmers may never purchase equipment from that manufacturer again. Even worse, if the manufacturer develops a reputation for poor service, its market share will certainly decline dramatically. It seems evident, therefore, that companies would take service parts management very seriously. Unfortunately, this is often not true. The service parts management function is often sorely neglected with few resources, little senior management attention, and weak training for the people who are managing the day-to-day tasks. Some leading firms such as Saturn and Caterpillar build their reputations on their ability in this area, and this capability generates significant sales.

One might think that this is a standard inventory management problem that can be addressed with standard inventory models. The problem is that many service parts have very low demand rates. In one survey, for instance, researchers found that more than 50% of service parts had no global demand in 2 years, and the inventory turnover (the sales of a product divided by the average inventory) for all parts was between 1.0 and 3.5! Such low demand rates require models and procedures that differ from the standard approaches. A key difference is the appropriate probability distribution for slow demand rates. Furthermore, because many service parts systems have multiple tiers, requiring models of multilevel systems composed, say, of regional warehouses, local distribution centers, and dealers. While industry practice still shows much room for improvement, several well-known firms have shown how spare parts can be managed more effectively (Cohen, Agrawal, & Agrawal 2006).

Reverse Logistics And Green Issues

Reverse logistics and green issues are emerging dimensions of SCM. This area examines both reverse logistics issues of product returns (Rudi & Pyke, 2000) and environmental impact issues (Herzlinger, 1994). Direct shipment from products ordered over the Web has created many new and important problems in economically handling customer returns. For products such as home furniture, management of product returns has proven to be the most vexing issue facing online retailers (Pyke, Johnson, & Desmond, 2001). Growing regulatory pressures in many countries are forcing managers to consider the most efficient and environmentally friendly way to deal with product recovery.

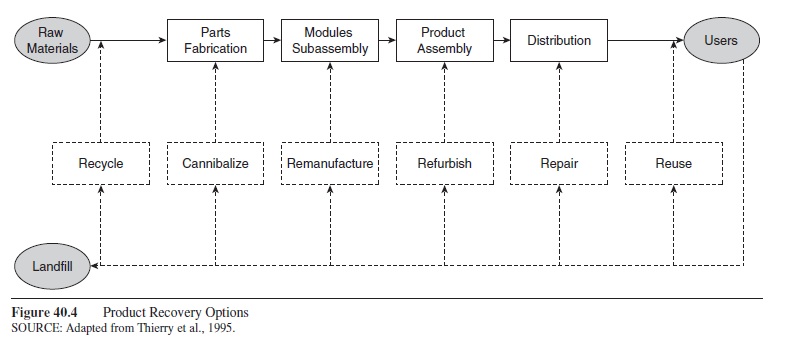

The term “product recovery” includes the handling of all used and discarded products, components, and materials. Product recovery management attempts to recover as much economic value as possible, while reducing the total amount of waste (Thierry, Salomon, Van Nunen, & Van Wassenhove, 1995). The authors also provide a framework and a set of definitions that can help managers think about the issues in an organized way (see Figure 40.4). These authors examine the differences among various product-recovery options including repair, refurbishing, remanufacturing, cannibalization, and recycling. A review of quantitative models for reverse logistics can be found in Fleischmann et al., 1997.

Figure 40.4 Product Recovery Options SOURCE: Adapted from Thierry et al., 1995.

Figure 40.4 Product Recovery Options SOURCE: Adapted from Thierry et al., 1995.

The analysis of the recovery situation is considerably more complicated than that of consumables. Normally, in a recovery situation some items cannot be recovered, so the number of units demanded is not balanced completely by the return of reusable units. Thus, in addition to recovered units, a firm must also purchase some new units from time to time. Consequently, even at a single location, there are five decision variables: (1) how often to review the stock status, (2) when to recover returned units, (3) how many to recover at a time, (4) when to order new units, and (5) how many to order. When there are multiple locations, the firm must decide how many good units to deploy to a central warehouse and how many to deploy to each retailer or field-stocking location.

Location

Location pertains to the vast set of issues facing a firm in a facility location decision. Of the 12 categories, decisions in this area have perhaps the longest time horizon. Decisions at this level set the physical structure of the supply-chain and thus create constraints for more tactical decisions, such as transportation, logistics, and inventory planning. Engineering tools such as mathematical models of facility location and geographic information systems (GIS) are very useful in sorting through the many important quantitative and qualitative differences between location choices including labor costs, taxes and duties, transportation costs associated with certain locations, and government incentives (Hammond & Kelly, 1990). Exchange-rate issues fall in this category, as do economies and diseconomies of scale and scope, labor availability and skill, and quality-of-life issues for employees. Decision-support tools such as mathematical optimization using binary-integer programming models play a role here, as do simple spreadsheet models and qualitative analyses. There are many advanced texts specially dedicated to the modeling aspects of location (Drezner, 1996), and most books on logistics also cover the subject. Simchi-Levi et al. (1998) present a substantial treatment of GIS while Dornier, Ernst, Fender, and Kouvelis (1998) dedicate a research-paper to issues of taxes, duties, exchange rates, and other global location issues. Ballou and Masters (1999) examine several software products that provide optimization tools for solving industrial-location problems.

Transportation and Logistics

Transportation and logistics includes all issues related to the physical flow of goods through the supply-chain including transportation, warehousing, and material handling. Decisions in this category assume that location decisions have been made; the firm has decided where to operate factories, distribution centers, and retail outlets. However, the two categories interact when managers determine which mode of transportation to use, and which factory, say, will supply a given distribution center. This category addresses many important choices related to transportation management including vehicle routing, dynamic fleet management with global positioning systems (GPS), and merge in transit. Also included are topics in warehousing and distribution such as cross-docking, vendor hubs, and materials-handling technologies for sorting, storing, and retrieving products.

Both deterministic models (such as linear programming and the traveling salesperson problem) and stochastic optimization models (stochastic routing and transportation models with queuing) are used here, as are spreadsheet models and qualitative analysis. Recent management literature has examined the changes within the logistics functions of many firms as the result of functional integration (Greis & Kasarda, 1997) and the role of logistics in gaining competitive advantage (Fuller, O’Conor, & Rawlinson, 1993). With growing numbers of firms involved with the global management of materials, outsourcing of logistics services has become very popular. However, because of the importance of logistics outsourcing, we devote a separate category specifically to it.

Outsourcing and Logistics Alliances

Outsourcing and logistics alliances examines the supply-chain impact of outsourcing logistics services. With the rapid growth in third-party logistics providers, there is a large and expanding group of technologies and services that firms can procure from outside vendors. These include fascinating initiatives such as supplier hubs managed by third parties. Supplier hubs are warehouses operated by a logistics firm that consolidate the inventories of many component suppliers and then deliver those components to a manufacturer for assembly. In some cases, large firms have transferred their internal logistics personnel to another firm who then manages the logistics as an outsourced service. The rush to create such strategic relationships with logistics providers suggests that issues in this category will be important for some time, and yet several well-published failures have raised questions about the future of such relationships (see Bowersox, 1990; Lieb & Maltz, 1998.)

Product Design And New Product Introduction

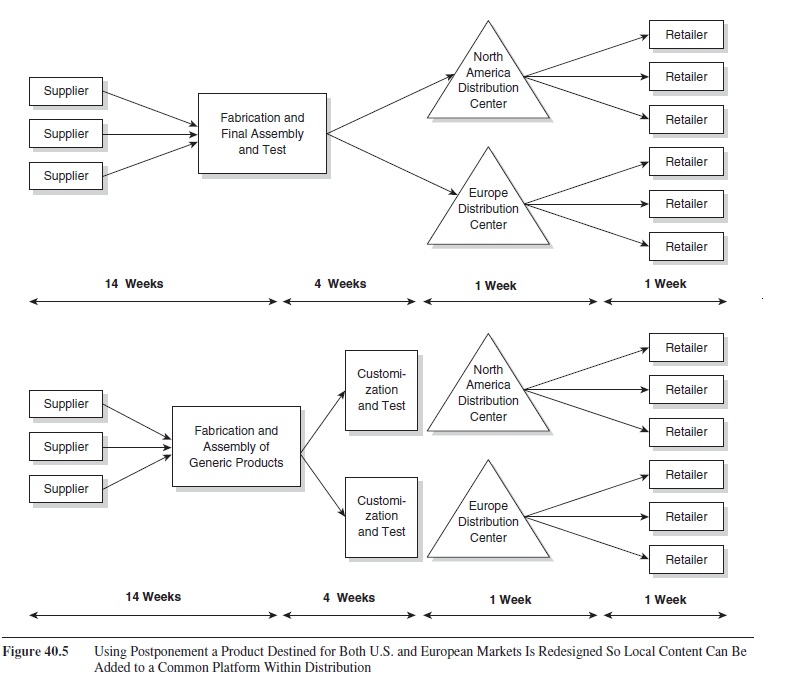

The product design and new product introduction category deals with design issues for mass customization, delayed differentiation, modularity, and other issues for new product introduction. With the increasing supply-chain demands of product variety and customization, there is an increasing body of research available. One of the most exciting applications of “supply-chain thinking” is the increased use of postponed product differentiation (Feitzinger & H. L. Lee, 1997). Traditionally, products destined for world markets would be customized at the factory to suit local market tastes. While a customized product is desirable, managing worldwide inventory is often a nightmare. Using postponement, the product is redesigned so that it can be customized for local tastes in the distribution channel. The same generic product is produced at the factory and held throughout the world (Figure 40.5). Thus, if the French version is selling well, but the German version is not, German products can be quickly shipped to France and customized for the French market. Many times products can even be customized for individual customers or sales channels (Johnson & Anderson, 2000).

In a fascinating interaction with the reverse logistics and green issues category, some firms are beginning to consider design for the environment (DFE) and design for disassembly (DFD) in their product development processes. Unfortunately, AT&T discovered that designing products for reuse could result in more materials and complexity, thereby violating other environmental goals. For further reading, on product take-back and recycling initiatives in numerous countries see Frankel (1996).

Initiatives in this category have clear implications for product cost (Robertson & Ulrich, 1998) and inventory savings. Inventory models are often used to identify some of the benefits of these initiatives. Also important are issues related to managing product variety (Fisher, Ramdas, & Ulrich, 1999) and managing new product introduction and product rollover (Billington, H. L. Lee, & Tang, 1998).

Information And Electronic Mediated Environments

The information and electronic mediated environments category addresses the impact of information technology to reduce inventory and the rapidly expanding area of electronic commerce. Often this subject takes a more systems orientation, examining the role of systems science and information within a supply-chain. Such a discussion naturally focuses attention on integrative enterprise resource planning (ERP) software such as SAP and Oracle, as well as supply-chain planning tools such as Manugistics, i2’s Rhythm and SAP’s APO. Supply-chain planning tools aid managers in planning shipments, purchasing materials, making production decisions, and moving inventory. The quality of these decisions is dependent on data—often stored in large ERP systems that track every transaction within the firm. Today, many of these supply-chain information tools are offered as services through easily accessible Web portals—eliminating the need to buy expensive software thus making it easier for both small firms and large firms to benefit.

Of course, the supply-chain changes wrought by electronic commerce are particularly interesting, including both the highly publicized retail channel changes (such as Amazon.com) and business-to-business innovations that are fundamentally changing the power structure in many supply-chains. In fact, the Web is enabling the disintegration of supply-chains by eliminating the cost advantages of large firms to stay together—owning component fabrication, assembly, and distribution. Long-standing reasons to remain vertically integrated, like high-transaction costs between partners, poor information availability, and the challenges of managing data between organizations are dissolving on the Web. For example, with the Web’s ability to move vast quantities of information at low-cost, point-of-sale data from a retailer can be shipped more often, making daily forecasting more accurate and reducing inventory requirements throughout the supply-chain. Better information reduces the need of the retailers to own large distribution centers to maintain supply, streamlining the flow of material from manufacturers to retail stores.

Figure 40.5 Using Postponement a Product Destined for Both U.S. and European Markets Is Redesigned So Local Content Can Be Added to a Common Platform Within Distribution

Figure 40.5 Using Postponement a Product Destined for Both U.S. and European Markets Is Redesigned So Local Content Can Be Added to a Common Platform Within Distribution

Another information breakthrough is the ability to track product through the supply-chain using technologies such as radio frequency identification (RFID). Until recently, the physical operating layer in logistics operated in disconnected isolation from the information layer of SCM. The movement of products within a manufacturing or distribution facility was nearly invisible. Of course, the supply-chain information systems could show that they were somewhere in the facility, and possibly the designated storage location, but little beyond that—particularly if the items were in transit. The same was even more true of outside facilities. Goods that were shipped to a warehouse were “on the road, boat, or air,” but little more was known other than possibly when they were received at their destinations. That is rapidly changing. The race to connect the physical logistics layer and the information layer is accelerating. Many technologies are emerging to close the gap including wireless devices (e.g., RFID tags, 802.11 and blue tooth-enabled devices, pagers, cellular), global positioning systems, and legacy-tracking technologies, including EDI and bar coding, all linked to the Internet. When the connection is complete, the ubiquitous communication capability will make physical items visible throughout the supply-chain. This will enable many new decision-support tools to plan and direct the movement of product, improving customer service and reducing inventory cost (Johnson in press).

Metrics and Incentives

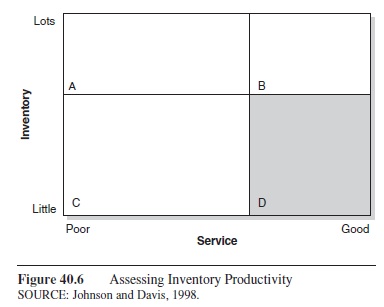

Metrics and incentives refer to the measurement of both engineering and organizational processes and the related economic motivations. Because metrics are fundamental to business management, there are many reading materials outside of the supply-chain literature, including accounting texts. Several recent articles concentrate on the link between performance measurement and supply-chain improvement (Johnson & Davis, 1998).

Figure 40.6 Assessing Inventory Productivity

Figure 40.6 Assessing Inventory Productivity

Successfully managing supply-chains requires several metrics. For example, firms often track service measures such as item-order fill rates, order-to-delivery cycle time, and order defects (wrong item shipped). On the other hand, we also must measure the costs of providing the customer service—for example, the inventory holdings or transportation costs. In addition to these tactical measures, firms need a general way to access aggregate performance—something that quickly indicates the overall performance of the supply-chain. A qualitative way to represent performance appears in Figure 40.6. By combining two metrics—one for service and one for inventory—we satisfy two constituencies.

- Customers—Service measures (e.g., reliable delivery to a customer’s desired delivery date) represent the customer’s view. Better service, we assume, means happier customers.

- Financial analysts—Quantifying the inventory investment, from raw materials to finished goods, serves the needs of the financial analysts. All else being equal, firms would rather hold less inventory.

With this view of service and inventory investment, we have an indication of whether we are making effective use of assets. If we are performing in quadrant A, we suffer from both too much inventory and poor customer service. Everything is going wrong—despite substantial investment in inventory, we are losing sales because of inadequate service. This problem could result from holding too much stock of unpopular products or components while stocking out of those in great demand. Another explanation might be that the order processing systems cannot turn stock around quickly enough to meet customer demand—or other operational difficulties.

In quadrant B, we see that it should be easy to provide good service by holding lots of inventory. Likewise, if you hold too little inventory (quadrant C), product availability will drop and customer service will suffer. However, this simple matrix does not capture all aspects of the delivery performance problem. While the poor service indicated by quadrant C might be explained by insufficient stocks, other factors might contribute. More specific measures of performance might help to reveal the underlying cause of the imbalance between inventory and service.

Quadrant D is where most firms hope to operate. Here we are able to achieve high levels of customer service with relatively low inventory investment—so inventory assets are being put to highly productive use. Of course, many operational factors could contribute to this success including fast cycle times, good customer information, or uniformly accurate forecasts.

Sourcing And Supplier Management

The sourcing and supplier management category addresses the issue in procuring components of a product and the management of the suppliers who provide it. Decisions to make a component or buy it from a supplier (Venkatesan, 1992) fall into this category. These decisions should involve top managers and strategic thinkers, because they can literally define the future of the firm. Witness the decision of IBM to outsource its PC-operating software to Microsoft and its central processing unit to Intel! Those two firms ended up with most of the power and profits generated by the PC industry.

Global sourcing also falls in the sourcing and supplier management area. While the location category addresses the location of a firm’s own facilities, this category pertains to the location of the firm’s suppliers. Once a decision is made to outsource a given component, and a supplier is chosen, the firm must carefully manage its relationship with the supplier (McMillan, 1990). We have observed two competing trends in recent years. On one hand, some firms are posting part specifications on the Internet so that dozens of suppliers can bid on jobs. GE, for instance, has developed a trading process network that allows many more suppliers to bid than was possible before. Many industries have developed similar capabilities housed in industry exchanges (e.g., Exostar for aerospace and defense or e20pen for high tech); and independent firms such as Ariba and Perfect Commerce provide tools and services for e-sourcing. On the other hand, some firms are reducing the number of suppliers, in some cases to a sole source (Helper & Sako, 1995). Determining the number of suppliers and the best way to structure supplier relationships is becoming an important topic in supply-chains (Dyer, 1996; Pyke, 1998).

Global Issues

Finally, the phrase global issues refers to the issues beyond local country-specific operating environments and encompasses issues related to cross-border distribution and sourcing. For example, currency exchange rates, duties and taxes, freight forwarding, customs issues, government regulation, and country comparisons are all included. Of course, the location category, when applied in a global context, also addresses some of these issues. As we mentioned earlier, there are several texts devoted to global management and many recent materials also examine challenges in specific regions of the world such as Asia (H. L. Lee & G. Y. Lee, 2007) or Europe (Sharman, 1997).

Many companies today are wondering what to do about China. Some firms’ sales are booming in Asia, while others are achieving radically lower cost by sourcing from China and other low-cost countries (LCCs). Competitors may be shifting operations to LCCs, highlighting the risk of not making a move. In many cases, customers are opening assembly operations in China and requiring their suppliers to be nearby. The question of how a firm should approach these issues has been addressed in a number of articles and books. For instance, Pyke (2007) presents a strategic framework for global sourcing that encompasses corporate and functional strategies, as well as tactical dimensions, such as total landed cost. He also introduces the issue of risk management due to the potentially catastrophic risk associated with suppliers located on the other side of the world. This latter issue is extremely important and is gaining significant traction with global companies. Some firms have risk-management departments whose job is to understand the many “events” that could impact their business and to prepare for them. Others may be just beginning this journey, but they are cognizant that it needs to be taken.

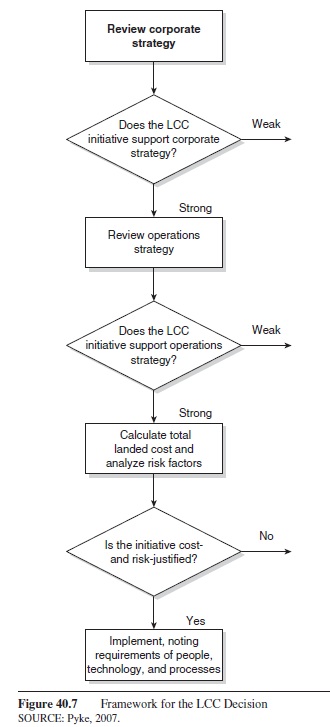

Too often, firms take a purely tactical approach to LCC sourcing. They focus entirely on unit cost and justify the decision on this factor alone. In our experience, this is the most common LCC sourcing pitfall, although implementation problems are common as well. In particular, due to inadequate preparation and analysis, managers are unhappily surprised by late deliveries, poor quality, insufficient capacity, culture or negotiation conflicts, and so on. Pyke (2007) presents a four-stage decision process described in this research-paper that captures a best practices approach (Figure 40.7).

First, the best firms approach the LCC decision in the context of a sweeping corporate strategy review. Is the sourcing decision consistent with the mission, values, and principles of the firm? Does the plan respond adequately to competition, global trends, and specific corporate performance targets? While it may not be necessary to undertake a full corporate strategy review for each LCC decision, managers should be very clear that it is consistent with existing strategy.

Second, these firms conduct a functional strategy review, focusing on operations and marketing, if appropriate. An analysis of the four operations objectives—cost, quality, delivery, and flexibility—helps managers focus on important operational considerations other than cost. As tempting as LCC unit costs may be, firms should carefully examine the effect of the decision on quality, delivery performance, and new product introduction. Furthermore, the best practice firms adjust their operating tactics for the new LCC source and ensure that they are consistent with each other and with the operations objectives.

Third, successful firms develop a comprehensive total landed cost model that includes easily quantifiable costs, such as customs, duties, inventory, and inbound and outbound logistics, as well as other soft costs, such as relationship management and management stress. If a cost is too difficult to quantify, it is still prudent to include it in the list, even without a specific number attached. It can thus serve as a caution sign for decision makers.

Figure 40.7 Framework for the LCC Decision

Figure 40.7 Framework for the LCC Decision

Finally, these firms also examine the risk factors that arise with an LCC decision. For ones they can quantify, such as increased lead-time variability, they adjust the relevant cost accordingly. For real, but difficult to quantify, risks, they employ tools including explicit backup plans and alternate sources of supply to mitigate risk.

The LCC sourcing decision is often a difficult and sometimes emotionally charged experience. The four-stage decision process described in Pyke (2007) will not eliminate the anxiety that workers and managers may feel, but it should reduce it. More importantly, it will ensure that the decision is grounded in careful quantitative and qualitative analysis.

Conclusion

SCM is indeed a large and growing field for both engineers and managers. Nearly all major management-consulting firms have developed large practices in the supply-chain field, and the number of books and academic research papers in the field is growing rapidly. In fact, each of the 12 areas covered in our treatment of supply-chains are important in themselves. While these areas may appear to be somewhat disparate, they are all linked by the integrated nature of the problems at hand. Large firms today operate in global environments, deal with multiple suppliers and customers, are required to manage inventories in new and innovative ways, and are faced with possible channel restructuring. Finally, the Internet continues to change many fundamental assumptions about business, pushing managers to continue to evolve their supply-chain practices or find themselves driven out of the market.

References:

- Anderson, E., Day, G. S., & Rangan, V. K. (1997, Summer). Strategic channel design. Sloan Management Review, 38(4), 59-69.

- Baganha, M. P., & Cohen, M. A. (1998). The stabilizing effect of inventory in supply-chains. Operations Research, 46(Supp. 3), S72-S83.

- Ballou, R. H., & Masters, J. M. (1999). Facility location commercial software survey. Journal of Business Logistics, 20(1), 215-232.

- Billington, C., Lee, H. L., & Tang, C. S. (1998, Spring). Successful strategies for product rollovers. Sloan Management Review, 39(3), 23-30.

- Bowersox, D. J. (1990, July/August). The strategic benefits of logistics alliances. Harvard Business Review, 68(4), 36-45.

- Cachon, G. P., Randall, T., & Schmidt, G. M. (2005). In search of the bullwhip effect (Unpublished Working paper 19104). University of Pennsylvania, Philadelphia.

- Chopra, S., & Meindl, P. (2001). Supply-chain management: Strategy, planning, and operation. Upper Saddle River, NJ: Prentice Hall.

- Cohen, M. A., Agrawal, N., & Agrawal, V. (2006, May). Winning in the aftermarket. Harvard Business Review, 84(5), 129-138.

- Davis, T. (1993, Summer). Effective supply-chain management. Sloan Management Review, 34(4), 35-46.

- Dornier, P., Ernst, R., Fender, M., & Kouvelis, P. (1998). Global operations and logistics: Text and cases. New York: John Wiley & Sons.

- Drezner, Z. (1996). Facility location: A survey of applications and methods. New York: Springer Verlag.

- Dyer, J. H. (1996, July/August). How Chrysler created an American Keiretsu. Harvard Business Review, 74(4), 42-56.

- Feitzinger, E., & Lee, H. L. (1997, January/February). Mass customization at Hewlett-Packard: The power of postponement. Harvard Business Review, 75(1), 116-121.

- Fisher, M. L. (1997, March/April). What is the right supply-chain for your product? Harvard Business Review, 75(2), 105-116.

- Fisher, M. L., Hammond, J. H., Obermeyer, W. R., & Raman, A. (1994, May/June). Making supply meet demand in an uncertain world. Harvard Business Review, 72(3), 83-93.

- Fisher, M. L., Ramdas, K., & Ulrich, K. (1999). Component sharing in the management of product variety: A study of automotive braking systems. Management Science, 45(3), 297-315.

- Fleischmann, M., Bloemhof-Ruwaard, J. M., Dekker, R., van der Laan, E., van Nunen, J. A. E. E., & Van Wassenhove, L. N. (1997). Quantitative models for reverse logistics: A review. European Journal of Operational Research, 103(1), 1-17.

- Forrester, J. W. (1958, July/August). Industrial dynamics: A major breakthrough for decision makers. Harvard Business Review, 36(4), 37-66.

- Frankel, C. (1996, January). The environment. IEEE Spectrum, 33(1) 76-81.

- Fuller, J. B., O’Conor, J., & Rawlinson, R. (1993, May/June). Tailored logistics: The next advantage. Harvard Business Review, 71(3), 87-93.

- Greis, N. P., & Kasarda, J. D. (1997). Enterprise logistics in the information era. California Management Review, 39(4), 55-78.

- Hammond, J. H., & Kelly, M. (1990). Note on facility location. Unpublished note, Harvard University, Cambridge, MA.

- Helper, S., & Sako, M. (1995, Spring). Supplier relations in Japan and the United States: Are they converging? Sloan Management Review, 36(3), 77-84.

- Herzlinger, R. (1994, July/August). The challenges of going green. Harvard Business Review, 72(4), 37-50.

- Johnson, M. E. (2006, May/June). Supply-chain management: Technology, globalization, and policy at a crossroads. Interfaces, 36(3), 191-193.

- Johnson, M. E. (in press). Ubiquitous communication: Tracking technologies within the supply-chain. In G. D. Taylor (Ed.), Logistics Engineering Handbook. Boca Raton, FL: CRC Press.

- Johnson, M. E., & Anderson, E. (2000). Postponement strategies for channel derivatives. International Journal of Logistics Management, 11(1), 19-35.

- Johnson, M. E., & Davis, T. (1998, Summer). Improving supply-chain performance using order fulfillment metrics. National Productivity Review, 17(3), 3-16

- Johnson, M. E., & Pyke, D. F. (2000). A framework for teaching supply-chain management. Production and Operations Management, 9(1), 2-18.

- Johnson, M. E., & Pyke, D. F. (2001). Supply-chain management. In C. M. Harris & S. I. Gass (Eds.), Encyclopedia of operations research and management science (pp. 794-806). Boston: Kluwer Academic Publishers.

- Lee, H. L., & Lee, C.-Y. (Eds.). (2007). Building supply-chain excellence in emerging economies. New York: Springer.

- Lee, H. L., Padmanabhan, P., & Whang, S. (1997). The bullwhip effect in supply-chains. Sloan Management Review, 38(3), 93-102.

- Lieb, R. C., & Maltz, A. (1998). What is the future of third-party logistics. Supply-chain Management Review, 2(1).

- McMillan, J. (1990, Summer). Managing suppliers: Incentive systems in Japanese and U.S. industry. California Management Review, 32(4), 38-55.

- Narus, J. A., & Anderson, J. C. (1996, July/August). Rethinking distribution. Harvard Business Review, 74(4), 112-120.

- Pyke, D. F. (1998, February 20). Strategies for global sourcing. Financial Times, pp. 2-4.

- Pyke, D. F. (2007). Shanghai or Charlotte? The decision to outsource to China and other low cost countries. In H. L. Lee & C.-Y. Lee (Eds.), Supply-chain excellence in emerging economies. New York: Springer.

- Pyke, D. F., Johnson, M. E., & Desmond, P. (2001, January/ February). efulfillment: It’s harder than it looks. Supply-chain Management Review, 5(1), 26-32.

- Robertson, D., & Ulrich, K. (1998, Summer). Planning for product platforms. Sloan Management Review, 39(4), 19-31.

- Rudi, N., & Pyke, D. F. (2000). Product recovery at the Norwegian Health Insurance Administration. Interfaces, 30(3), 166-179.

- Sharman, G. J. (1997, Fall). Supply-chain lessons from Europe. Supply-chain Management Review, 1(3), 11-13.

- Silver, E. A., Pyke, D. F., & Peterson, R. (1998). Inventory management and production planning and scheduling (3rd ed.). New York: John Wiley & Sons.

- Simchi-Levi, D., Kaminsky, P., & Simchi-Levi, E. (1998). Designing and managing the supply-chain. New York: Irwin/McGraw-Hill.

- Stock, J. R., & Lambert, D. M. (2001). Strategic logistics management (4th ed.). New York,: McGraw-Hill Irwin.

- Thierry, M., Salomon, M., Van Nunen, J., & Van Wassenhove, L. V. (1995). Strategic issues in product recovery management. California Management Review, 37(2), 114-135.

- Venkatesan, R. (1992, November/December). Strategic sourcing: To make or not to make. Harvard Business Review, 70(6), 98-107.

- Waller, M., Johnson, M. E., & Davis, T. (1999). Vendor-managed inventory in the retail supply-chain. Journal of Business Logistics, 20(1), 183-203.

See also:

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to order a custom research paper on any topic and get your high quality paper at affordable price.