This sample Holistic Approaches To Business Planning Research Paper is published for educational and informational purposes only. Free research papers are not written by our writers, they are contributed by users, so we are not responsible for the content of this free sample paper. If you want to buy a high quality research paper on any topic at affordable price please use custom research paper writing services.

Rosabeth Moss Kanter (1990) stated that thinking across boundaries, or integrative thinking, is the ultimate entrepreneurial act. She called it holistic thinking. Blurring boundaries and challenging the categories permitted new possibilities to emerge, like twisting a kaleidoscope to see the endless patterns that could be created from the same set of fragments.

“Thinking across boundaries” when formulating business strategy is our ultimate aim. But to think across boundaries we must consider not just those psychological boundaries that exist based on our experiences but also the physical boundaries of a company—the supply-chain boundaries. In order to do this, we must first define each boundary.

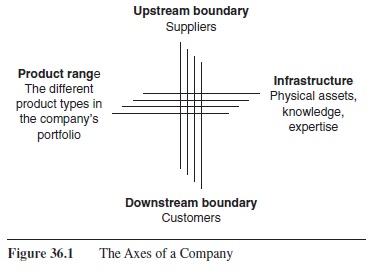

A company can be defined as existing along two axes— vertical and horizontal. This terminology comes from the concept of “vertical supply chain,” which stems from the supply-chain literature and principally a definition put forward by Christopher (1992) that described upstream and downstream linkages; and from the marketing literature in the area of positioning (cf. Ries & Trout, 2000), which uses the term “horizontal integration” to denote a company’s position based on its maintenance, expansion, or contraction plans for its products or services.

The vertical axis describes the value the company generates—it buys goods or services, uses them, and in doing so creates its own products or services of higher value; for example, in moving the upstream boundary toward a supplier, we off-load more of what we do to that supplier. The upstream vertical boundary is therefore defined by what we chose to buy from suppliers. The vertical axis can be described as “upstream” and “downstream.” Products and services flow from upstream to downstream.

The level of product or service we offer to our customers therefore defines the downstream vertical boundary; for example, in moving the downstream boundary toward a customer, we would adopt tasks previously done by that customer.

The horizontal axis describes the balance between product range and the infrastructure required to maintain, grow, or reduce that product range. Figure 36.1 illustrates the interrelationship of axes.

A company may exhibit a variety of different infrastructure depending upon the complexity of the product range. Similarly, the upstream and downstream boundaries may also be product-dependent. For example, within a product range, a company may choose to outsource those products that are no longer sustainable internally, while retaining those that have inherent value. Similarly, a product or service may be dropped where the intellectual property for the product no longer resides with the company or where obsolescence in infrastructure forces it. The business strategy therefore must look to strive for efficiency and effectiveness in balancing the vertical and horizontal features.

Figure 36.1 The Axes of a Company

Figure 36.1 The Axes of a Company

This research-paper overviews the key tools and techniques used to help define strategy in the past and considers how these tools have related to the concept of axes. In determining what constitutes a strategy tool, the author concurs with Knott (2006), who describes strategy tools as guides to thinking and starting points for structuring activity. The research-paper then goes on to explain how the axes concept can be used to facilitate holistic business planning in the 21st century by considering strategic choices and how they apply at an operational level.

Theory

Business planning tools in general have been criticized because of the lack of analytical techniques employed and the failure to keep up with the dynamism of business markets. For example, tools that were designed for production industries in some cases have little relevance to new service business models both in statistical pedigree and in language relevance. Authors have added to these criticisms by critiquing the tools’ detachment from practical experience and their short-term, cost-reduction approach. The inference being that to ensure business sustainability one cannot rely on myopic decision making. Later debate on the subject has been concerned with the problem of “framing,” where the tool itself incorrectly generates a focus on some elements of a company’s strategic environment at the expense of others.

Later contributors to the field appeared to address some of these issues with a different approach. Porter’s (1998) value chain, and the concept of relating specific activities to competitive position remains a useful tool for addressing the vertical axis and infrastructure boundary of the firm, but cannot address fully the company position on product range. Likewise, it can be used to identify potential sources of differentiation on the downstream vertical boundary, but cannot by virtue of its scope inform where the boundary should be, that is, how far a company should go in taking on activities previously undertaken by its customers.

The Porter approach of trading cost with differentiation does not directly help practitioners with risk decisions associated with boundary changes, nor does it help the user in comparing radically different business models including Web-based models such as virtual supplier networks and technology-based services.

Where competitors are moving downstream, a comparison of the traditional forms of activity is insufficient. A comparison of resources becomes necessary because companies are increasingly selling a combination of products and services.

Porter’s value chain cannot take account of the change in the range of relationship types possible with suppliers— technology licensing, cross-licensing, factory-in-factory arrangements—where a support activity is abdicated to a supplier. In these instances, the boundary of the firm, and who obtains value from it, is in effect blurred.

Existing tools also do not appear to recognize at a strategic level the risk-sharing approaches advocated in collaborative forms of working, despite theory on the importance of this aspect having been available for 20 years. Those interested in this area should consult Butler and Carney’s (1983) work that introduced “managed market theory.” Butler and Carney’s work in effect incorporated trust and interaction complexity into “transaction theory” first outlined by Williamson (1981).

There is, then, still a lack of practical tools that marry the soft issues of trust—made manifest in the relationships at boundaries—and the relationship diversity, with the hard performance-related issues of strategy formulation. Further, conventional tools addressing the vertical-integration axis, appear to address, “invest and make,” “make,” “divest and buy,” but generally omit the “invest and rent” option, where a company chooses to rent external capacity while developing capability of its own.

This research-paper describes research undertaken to explore and develop the use of holistic tools to address these issues in strategy formulation.

Methods

The research-paper starts by providing an overview of commonly used strategy tools and showing how they relate to the multiple axes concept. It then progresses to show how this has informed new tool specification by the incorporation of useful approaches and how a subsequent holistic tool was developed. The results of six case studies are overviewed that outline the need for new tools and finally the development of a tool is described and a prototype tool is introduced.

The Key Literature

Core competence (Pralahad & Hamel, 1990), activity (Porter, 1998) and resource-based views of the firm (Barney, 1996; Peteraf, 1993; Wernerfelt, 1984) now feature largely in the management literature in formulating business strategy. Theorists now largely concur that business people wishing to form effective strategy must understand their companies in terms of competence, resource, and activity. It is by doing this that they are able to address more fully decisions in the upstream and downstream vertical axis (buy/make and adopt), and horizontal axis (product range, required skills, and infrastructure).

More recently, other aspects have been considered worthy of consideration in formulating strategy. Fine addresses the “clock speed” of an industry in which a business is to operate. Novak and Eppinger (2001) consider complexity. Beach, Muhlemann, Price, Sharp, and Iterson (1999), Christiensen (2001), and Ramdas and Spekman (2000) consider the innovative or flexible product nature to be important. This view is further explored by Fischer (1997) who contests that functional demand requires an efficient process or supply chain while innovative demand requires a responsive process.

The implication from all this work is that certain product types may be better suited to particular vertical and horizontal axis decisions than others. For example, a low-complexity product with low margins designed and manufactured by a company with high infrastructure costs may be outsourced. Comparatively, a highly complex product with high margins and high infrastructure costs may have value added by a strategy that attracts services from a customer, thereby adding further value to itself.

Hayes, Wheelwright, and Clark (1988) stated that the most important step in developing and pursuing an integration strategy is to identify the capabilities that are required to support the firm’s desired competitive advantage. In formulating its strategy, a firm must position itself along two key dimensions—one relating to products and the other to production processes. This approach assigns dimensions to decision making along one axis only—horizontal.

Hill took this theory further by pointing out the importance of process positioning, which considers the width of a firm’s internal span of process, the degree and direction of vertical-integration alternatives, and its links and relationships with suppliers, distributors, and customers. The introduction of directional vertical integration and the incorporation of customers and distributors are in line with the concept of the horizontal axis having a relationship with both the upstream and downstream vertical axis.

Lehtinen (1999) pointed out that the literature on process positioning had until this point concentrated on the problems of make or buy decisions (upstream vertical), largely ignoring the managerial questions, which followed from the changes in a firm’s span of process (product range). He further pointed out that changes in the span of process would invariably lead to a change in the total management task within a business and that changes to span of process would bring corresponding changes in the task of manufac-turing management (infrastructure). This further reiterated the relationship between the vertical and horizontal axes.

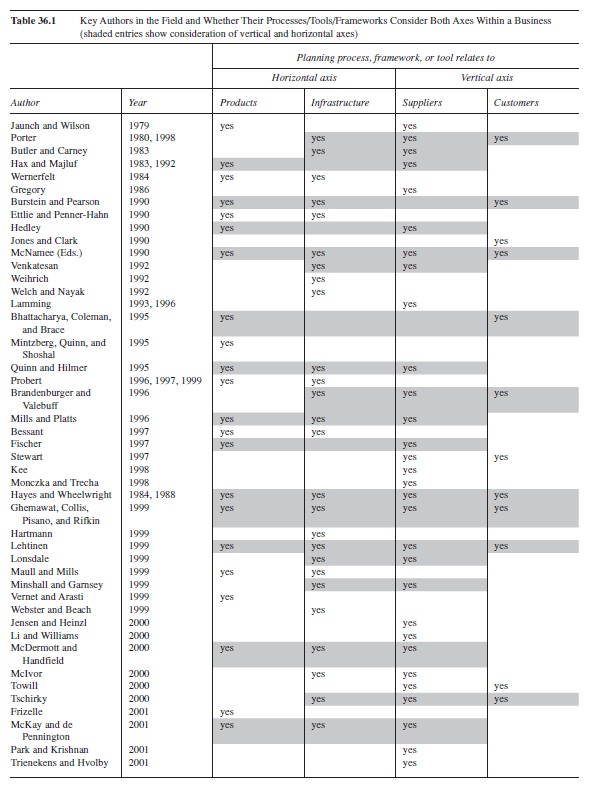

Table 36.1 overviews the key tools available and how they relate to the vertical and horizontal axes.

It would appear therefore that there is a case for defining the interrelationship of axes more fully. Consideration of the interrelationship of axes becomes necessary when attempting to understand the cost implications of strategic decisions. This is evidenced where increased outsourcing of components or services formerly done internally has resulted in unexpected cost increases as overhead is carried by fewer functions/products. Decisions made in the upstream vertical axis can therefore affect infrastructure decisions.

It would appear then that the task of formulating business strategy is often fragmented in as much as current tools and business models address vertical integration with product integration or more recently, product and infrastructure integration. Rarely do tools address all aspects in a holistic manner. Where tools, processes, and frameworks are in evidence, they are high level, axes-specific, or unaccommodating, to current business challenges.

Based on the literature then, strategy formulation needs to embrace product range, upstream and downstream supply decisions, and infrastructure needs. A holistic tool must allow a company to look at itself from both the resource and activity perspectives. It must handle risk and supplier-dependency issues in terms of market uncertainty and product nature. It must reflect the interrelationships of existing activities and resources as well as the interdependencies of decisions made and their effect on the overall aim. Finally, it must accommodate new and emerging business models.

Case-Study Contextualization

In order to investigate the need for such a tool, six case studies were conducted to investigate formal and intuitive tools currently in use for formulating manufacturing-business strategy. The companies were selected based on whether they were supply-chain leaders or followers. Four companies were leaders and two were followers.

A typical case study company was based in the southeast of England, had 200 to 300 people in manufacturing, and 500 people in the business unit. The companies were either original equipment manufacturers or first-tier suppliers and produced electromechanical products.

A semistructured interview approach was used to confirm the business context and to explore product integration, infrastructure integration, and upstream and downstream vertical integration. Open discussion was used to understand company priorities and whether a holistic tool that addressed the interrelationship of axes would be of use.

The study revealed that the product-integration management varied from being purely reactive and historical to proactive management of new product development, introduction, and withdrawal. Few formal tools were in evidence and decisions were largely based on experience and intuition. Infrastructure management was mainly reactive, with tools only used in the process-improvement context. However, one company did use a form of technology road mapping. Downstream vertical-integration management showed little evidence of formal tools other than in the area of service-level measurement. There was differing awareness of the concept of moving the downstream boundary, for example, taking on additional activities previously done by the customer.

Table 36.1 Key Authors in the Field and Whether Their Processes/Tools/Frameworks Consider Both Axes Within a Business (shaded entries show consideration of vertical and horizontal axes)

Table 36.1 Key Authors in the Field and Whether Their Processes/Tools/Frameworks Consider Both Axes Within a Business (shaded entries show consideration of vertical and horizontal axes)

The trend to move proactively downstream, which is now being evidenced in the literature, did not appear to be important for the companies in the study, which ranged from low complexity, high margin, low volume to low complexity, low margin, high volume. The companies did, however, consider themselves reactive to big customers. The findings from the case studies were as follows:

- Few companies formally used detailed analysis tools to make decisions about firm boundaries.

- Practitioners at the least successful companies tended to focus on individual boundaries such as product range, infrastructure, upstream vertical, and downstream vertical.

- Practitioners in the more successful firms tended to think about boundaries more holistically.

- Companies wanted to move toward greater integration with their key suppliers; for example, they concentrated on the upstream vertical boundary and wanted to make greater use of analytical tools to achieve their goals.

- The least successful companies were the most ambitious

- A holistic tool would be welcome but it should be easy to use (perhaps a workbook), and preferably facilitated to ensure focus and leadership.

When introduced to the idea of thinking about a company in terms of its boundaries, the case-study companies agreed that such a concept would be useful. Therefore, the need for “joined-up thinking” appeared to have some validity based on the case studies and literature.

A valuable aid to practitioners would therefore be a tool that would help them take a holistic view of their supply-chain practices, while at the same time considering the impact that the external environment and internal capabilities would have on competitive position over time. Furthermore, such an aid should be documented in a short guidebook and should be appropriate for use within the company with appropriate facilitation. To this end, a tool specification was developed.

Holistic Tool Specification

The purpose of a holistic tool would be to help organizations realize competitive supply-chain positioning by considering all relevant forces influencing their business. To achieve this, the tool would aid practitioners during the ongoing strategic design of their supply-chain strategy and help them to analyze the impact of change. Through this understanding, the practitioner should be able to decide which activities the organization should retain in full, which it should expand/adopt in support of customers’ needs, and those where greater integration with suppliers would be preferred, or where integration with customers could be the most value-adding option.

Applications: Tool Development

Using current theory on competitive positioning, literature-derived tools, and processes were consolidated into a fledgling process for validation with industrial collaborators. The results of which could be used to form the basis of a useable tool for strategy formulation.

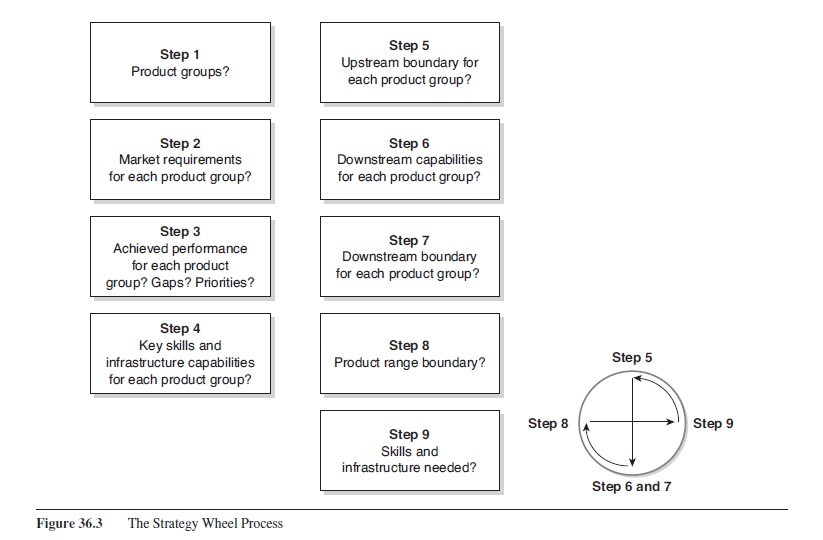

The fledgling process became the topic of academic debate over many months and the original process was reiterated many times to ensure axes interactivity and efficient process flow. The logic within the process is based on the use of appropriate tools for each axis (see Table 36.1). The inputs and outputs of these tools were then analyzed and the frequency that inputs were used sequenced the new process. For example, the need to define product groups and the company’s product/service competitive criteria would come early in a workshop process, because they were consistently required in later stages of axes integration.

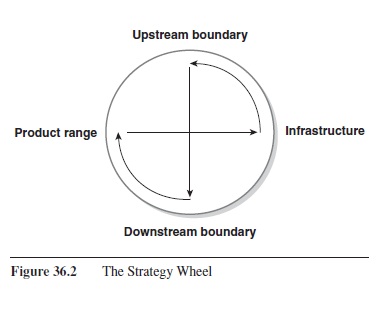

Once process stages were sequenced, it became apparent that a process would need to be defined in two phases, the first of which would be a preparation phase where relevant company information was mined. Product information, current performance levels against competitors, and company skills and infrastructure would need to be defined and agreed upon. The second phase would take this information and apply developed methods to review the firm’s boundary decisions in terms of infrastructure, upstream and downstream vertical decisions, and product range. It became apparent that the evolving process could be described in terms of a Strategy Wheel.

Once process stages were sequenced, it became apparent that a process would need to be defined in two phases, the first of which would be a preparation phase where relevant company information was mined. Product information, current performance levels against competitors, and company skills and infrastructure would need to be defined and agreed upon. The second phase would take this information and apply developed methods to review the firm’s boundary decisions in terms of infrastructure, upstream and downstream vertical decisions, and product range. It became apparent that the evolving process could be described in terms of a Strategy Wheel.

The Strategy Wheel

The Strategy Wheel describes the order in which issues are considered in the workshop process. It is possible to start the process at the point of greatest relevance to the company. For example, companies such as the case-study companies, which wished to address the upstream vertical boundary (supplier integration), could start the process there and then move on to the downstream boundary, product range, and then infrastructure. However, it is necessary to

- complete the wheel, and

- undertake the necessary preparation for the steps used.

It is also assumed that companies using the Strategy Wheel would have a manufacturing or service history.

Figure 36.3 The Strategy Wheel Process

A start-up company wishing to provide a service with no product history may require an updated form of the process. It is also envisaged that the wheel be applied by small- to medium-sized companies as opposed to large companies because of the product range complexity, availability of data required, and need for effective workshops; although, larger companies wishing to apply this to autonomous business units may also find it useful. The Strategy Wheel image serves as an aide-mémoire and reiterates the holistic nature of strategy formulation. The simplicity of the image allows it to be applied to a variety of business models, thereby countering some of the criticisms of earlier tools which have been critiqued for failing to be dynamic enough, myopic, or presented in a way that “frames” or skews outcomes to predefined outcomes. With this approach, the company itself can decide the degree of focus based on its own unique product, infrastructure or supply-chain requirements.

Figure 36.3 illustrates the process that applies the Strategy Wheel concept.

In line with the user requirements defined in the case studies, the process needed to be documented in a short guidebook and be appropriate for use within a company with appropriate facilitation. A two-day workshop with an industrial collaborator helped to validate the approach and fine-tune the workbook. The validated process of applying the strategy wheel is now described. Phase 1 describes the preparation for a workshop. Phase 2 describes the workshop steps in line with the Strategy Wheel approach.

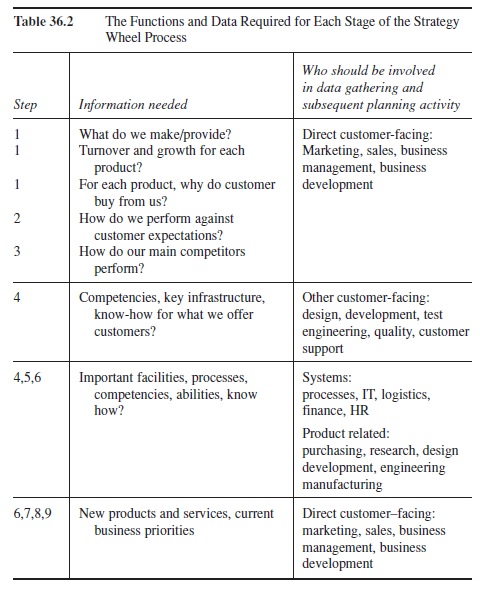

Phase 1: Preparation—Data Mining

Data collection requires the company to gather company and market information as described in Table 36.2. Table 36.2 also shows the types of functions that should be involved at each stage of the Strategy Wheel process and the type of data and know-how required of those functions. Function descriptions are advisory only. Individual companies may have different functional names for the same sorts of activity.

Cross-functional involvement ensures a robust view of the company and eventual acceptance of change based on decisions made. However, a full communication plan should be developed in conjunction with the outcomes of the process.

Phase 2: The Strategy Wheel Process

The Strategy Wheel process is best conducted as a 1 to 2 day facilitated workshop. Professional facilitation is recommended. The facilitator’s role is to ensure that the process is followed to an appropriate timetable, that all workshop participants are fully involved, to recap the findings of each workshop, and to ensure that all decisions are recorded.

Steps 1 to 9 of the Strategy Wheel process are now described. “Participants” refers to a selection of personnel as defined in Table 36.2 who participate in a workshop.

Table 36.2 The Functions and Data Required for Each Stage of the Strategy Wheel Process

Table 36.2 The Functions and Data Required for Each Stage of the Strategy Wheel Process

Step 1: Understand Product Groups and Define Competitive Criteria

The aim of Step 1 is to understand the different competitive situations of each product group and their relative importance to the company. The objective of the activity is to understand the product-group priorities now and in the future and to identify competitive criteria for each group.

The method used to do this is as follows. Product groups and competitive criteria are decided by participants. Competitive criteria is then ranked as to importance for each product group. This activity often presents a second opportunity to recognize product groups that are similar and perhaps to consider consolidating similar groups where appropriate. The importance ranking is assigned for the present and for the future based on turnover or contribution.

Step 2: Understand Market Requirements

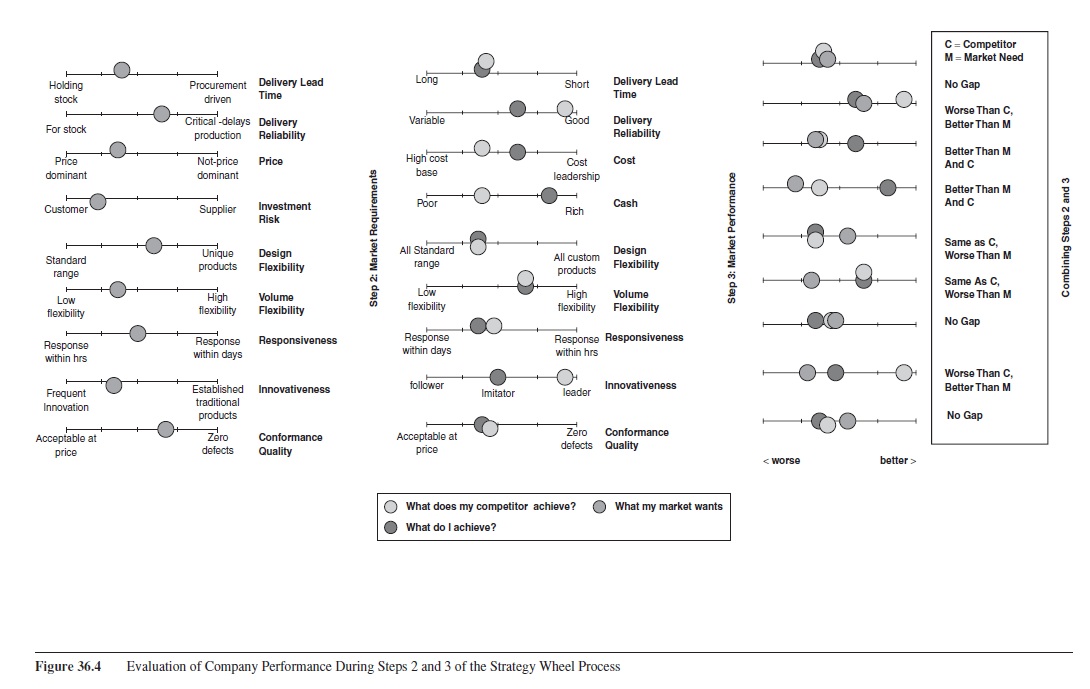

The aim of Step 2 is to capture formally the current position for each product group in terms of market requirements. The objective is to achieve a common understanding of detailed market requirements for each product group. The method used to do this is as follows. Having already de

fined product groups and important competitive criteria for each, participants are asked to give their perceptions of current market requirements based on their own knowledge and experience. Participants are asked to do this separately without conferring, and then the facilitator consolidates a consensus view. Common competitive criteria are delivery time, delivery reliability, price, investment risk, design flexibility, volume flexibility, responsiveness, innovativeness, and conformance/quality. Other additional criteria may have been identified in Step 1.

Step 3: Understand Achieved Performance in the Market and Against Competitors

The aim of Step 3 is to capture formally the current performance and that of competitors for each product group. The objective is to achieve a common understanding of company performance and threats. The method used is as follows. Participants are asked to give their perceptions of current market performance based on their own experience. Participants are asked to do this separately without conferring and the facilitator captures the consensus. Participants are then asked to consider the major competitor’s performance for each product group using the competitive criteria defined earlier. Once complete, the facilitator captures the consensus position for the group for both the company’s current market performance and the competitors’ performance.

The facilitator can then compare the market requirements from Step 2 with the output from Step 3. Gaps can be identified and translated into whether the company leads or lags the market/specific competitors with respect to performance criteria. Figure 36.4 shows an example comparison of Steps 2 and 3.

Step 4: Relate Company Skills and Infrastructure to Performance Gaps

The aim of Step 4 is to relate the company skills and infrastructure to the performance gaps identified in Step 3 and to define ownership risk associated with critical skills and infrastructure. The objective is to achieve a common understanding of performance gaps in terms of threats and opportunities and their relationship to important skills and infrastructure. This exercise should define critical skills and infrastructure priorities and thereby allow an appreciation of how it may lose its lead or monopolize an advantage.

The method used to do this is as follows. The facilitator overviews the critical performance criteria and performance gaps. The facilitator then reviews the critical skills and infrastructure identified in Step 1 in this context. Natural groups of skills and infrastructure are given common headings. Skills and infrastructure are then weighted by the groups as important, very important, or essential.

By using a scoring system, key skills, and infrastructure can be prioritized. The resulting list can then be used during strategy implementation.

Figure 36.4 Evaluation of Company Performance During Step 2 and 3

Figure 36.4 Evaluation of Company Performance During Step 2 and 3

The groups of skills and infrastructure are then revisited to understand whether they actually reside in company control (captive) or outside company control (uncaptive): they are with contractors or partners.

An exercise can then be undertaken to understand the risks associated with each scenario. Captive risk may be due to poor standards with respect to “best in class,” aging manufacturing infrastructure or personnel, high levels of tacit knowledge, or known skills shortages in the market. Uncaptive risk may be due to a supplier threat, the prospect of poor supply continuity, or allegiances between suppliers and competitors.

Each skill and infrastructure group can then be explored in relation to risk and documented for further use.

Step 5: Explore the Impact of Moving the Upstream Boundary to Reduce Risk

Having defined key skills and infrastructure with relation to competitive criteria, the aim of Step 5 is to understand the impact of moving the upstream boundary to reduce risk. The objective is to highlight areas where activities currently done by suppliers are better done by the company, and where activities done by the company are better done by suppliers. The method used is to consider each skill and infrastructure group in terms of know-how, assets, and materials and services and explore whether moving the boundary would improve or degrade the competitive performance. Again, a scoring system can be used to determine whether the impact of moving the boundary would be positive or negative. Wider implications of moving the boundary can also be captured at this time, for example, loss of economies of scale, implementation costs, and so forth.

Step 6: Explore the Impact of Moving the Downstream Boundary to Improve Performance

Having considered the implication for moving the upstream boundary with respect to competitive criteria, Step 7 defines the impact of moving the downstream boundary and explores the potential for moving it in terms of systems integration, operations integration, value-added services, and investment. The objective of the activity is to achieve a common understanding of major customer needs in each area and any gaps between customer requirements and company current/potential performance. Gaps in a downstream sense may be considered as opportunities or threats in that competitors may be able to meet a particular customer’s needs better than you can.

Using participant input, consideration is given to the company’s downstream skills, capabilities, and resources. These are then classed as (a) in use, (b) not in use but have ability, or (c) not in use and would need to procure.

Participants must then explore what customers value; for example, what the customers can do themselves and what they are looking to outsource. This is a reactive approach. A proactive approach would entail keeping abreast of customers’ skills, captive risk, and market needs in order to preempt a customer’s decision to move upstream boundaries.

Once customer needs and in-house capabilities are defined, possible additional services can be identified.

Step 7: Prioritisation of Downstream Skills and Infrastructure in Terms of Possible New Services

The aim of Step 7 is to prioritize the downstream skills and infrastructure in terms of identifying possible new services. The objective is to understand the impact on existing product performance of moving the downstream boundary. Once this is known, downstream possibilities can be prioritized.

Each downstream skill/infrastructure is considered in turn as to whether its provision to the customer would be of benefit to the company; for example, it should be considered whether it would provide greater influence over the customer’s product and your own company’s existing product or whether it would have a negative impact such as drawing resources away from important existing products.

For each skill/infrastructure, participants can decide whether there will be a positive impact, a very positive impact, a negative impact, or a very negative impact. These results can then be used to prioritize skills and infrastructure for downstream use. Skills and infrastructure that are considered to have an overall negative impact should be removed from the potential downstream offering. The remaining downstream skills and infrastructure are ranked as to whether they will have significant impact on competitive criteria in the areas identified as gaps. Effort should then be concentrated on downstream skills and infrastructure that are highly prioritized.

There is an underlying assumption here that upstream and downstream competitive criteria are consistent. Depending on a company’s position in its supply chain and the complexity and number of product groups supported, this may not be the case. In such an event, the participants should consider repeating Step 1 for the downstream boundary once product/service opportunities have been identified.

Step 8: Exploring the Impact of Newly Prioritized Skills and Infrastructure on the Expansion of Existing Product Range

The aim of Step 8 is to reconcile the newly prioritized skills and infrastructure for both upstream and downstream boundaries with expansion of the existing product range. The objective of this step is to consolidate findings for upstream and downstream skills and infrastructure so that

they may be used in expansion decisions. The method used here is to simply discuss products that are candidates for expansion, capture key skills and infrastructure required, and compare this with the outputs of Steps 4 and 7.

The group then considers each potential new product and whether there is a fit with existing prioritized skills and infrastructure. If there is a fit, then this product is a candidate for expansion. If there is not a fit, then this product should not be a candidate for expansion.

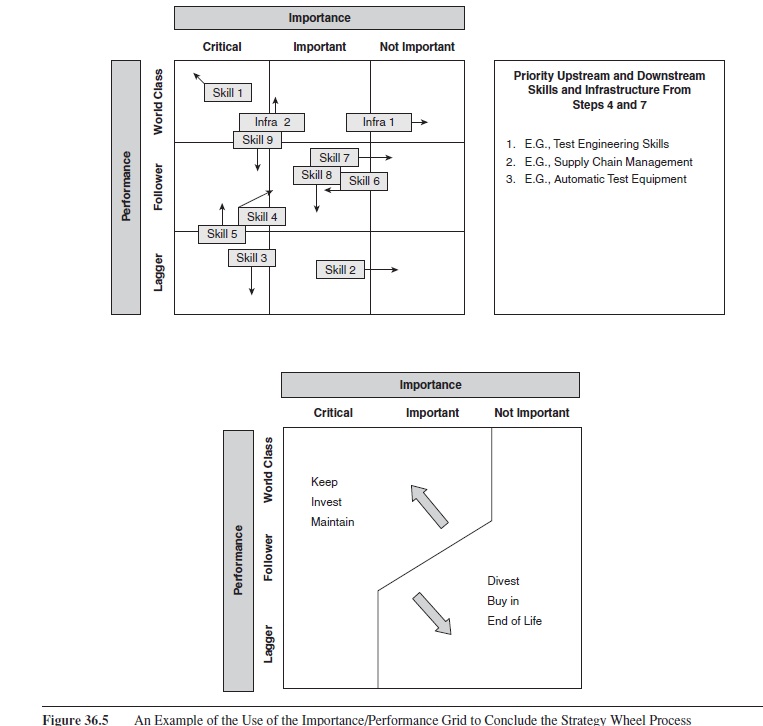

Step 9: Defining Which Skills and Infrastructure Need to Change

Having established upstream boundary, downstream boundary, and the product range possible, the process now sets out to identify skills and infrastructure that need to change. The objective of this step is to consolidate prioritized skills and infrastructure from Step 8 and to place them in a matrix of importance/performance.

Each skill/infrastructure is recapped and participants decide whether the company is achieving performance excellence for each and to place it in the matrix of performance/importance. Participants are then asked to indicate in which direction it is moving. This is an opportunity for participants to share investment plans and development initiatives. Participants then consider what would be needed for the company to do better. One example of such an improvement might be to invest in manufacturing or business-process infrastructure or to bring expertise into the business by recruitment. Figure 36.5 illustrates an example of how the performance/importance grid can be used to conclude the Strategy Wheel process.

Figure 36.5 An Example of the Use of the Importance/Performance Grid to Conclude the Strategy Wheel Process

Figure 36.5 An Example of the Use of the Importance/Performance Grid to Conclude the Strategy Wheel Process

Future Directions

This process has been tested using real participants whose inputs were used to produce and revise a workbook. Practitioners who took part in the process testing completed an assessment questionnaire. This addressed the overall perceived success of the process and the value generated. The process was well received, which suggests that other companies may also find the tool and workshop process of use.

Process efficiency requires facilitation. Facilitation ensures that the required data mining has taken place, ensures that the outputs of each stage correctly inform the inputs of following stages, and ensures that all relevant issues are discussed at the appropriate points. The workbook includes preparation sheets and instruction on participant mix as well as pro forma worksheets for each step of the Strategy Wheel process.

The Strategy Wheel on which the process is based serves as a memorable image that encourages companies to think in a “joined-up” context.

Summary

This research-paper has described how a business can be described along two axes—vertical and horizontal—and how the interrelationship of these axes is crucial in relating strategic decisions to operational practicalities (see Figure 36.1.) The research-paper overviews key strategy tools in terms of whether they relate to the axes model, and Table 36.1 shows the tools used to inform the development of a holistic process. This table shows how case-study feedback and literature review were used to develop a useable tool to assist companies in strategic decisions that affect their supply-chain positioning. The process developed is summarized in the Strategy Wheel in Figure 36.2, which is a simple but effective tool that acts as an aide-mémoire for business planning. It can be used by business owners as a reminder of the interrelationship of business issues or by business advisors and academics to demonstrate the same: it shows clearly the holistic nature of the decision-making process.

Figure 36.3 describes the steps that need to be taken to review business strategy in a holistic manner and shows how these steps relate to the concept of axes. Table 36.2 shows the functions and data required for each stage of the Strategy Wheel process.

Figures 36.4 and 36.5 show how key stages in the Strategy Wheel Process can be implemented.

The process described can be applied to any business wishing to review strategy holistically or can be used by undergraduates setting out to evaluate business cases for academic output. The authors referred to in Table 36.1 should be regarded as candidates for further reading at undergraduate level.

References:

- Barney, J. B. (1996). The resource-based theory of the firm. Organisation Science, 7(5), 469-502.

- Beach, R., Muhlemann, A. P., Price, D. H. R., Sharp, J. A., & Iterson, A. (1999). Strategic flexibility and outsourcing in global networks (Working Paper 9913). Bradford, UK: University of Bradford School of Management.

- Brandenburger, A., & Valebuff, B. J. (1996). Co-opetition. New York: Doubleday.

- Butler, R., & Carney, M. G. (1983). Managing markets: Implications for the make-buy decision. Journal of Management Studies, 20(2).

- Christiensen, C. M. (2001). The past and future of competitive advantage. MIT Sloan Management Review, 42(2), 105-109.

- Christopher, M. L. (1992). Logistics and supply chain management. London: Pitman.

- Ettlie, J. E., & Penner-Hahn, J. D. (1990). Focus, modernisation, and manufacturing technology policy. In Manufacturing strategy: The research agenda for the next decade. Ann Arbor, MI: Kluwer Academic Press.

- Fine, C. H. (1999). Clockspeed. London: Little Brown & Company.

- Fisher, M. (1997, March/April). What is the right supply chain for your product? Harvard Business Review, 75(2), 105.

- Hayes, R., Wheelwright, S. C., & Clark, K. B. (1988). Dynamic manufacturing: Creating the learning organisation. New York: Simon & Schuster.

- Hill, T. (1993). Manufacturing strategy: The strategic management of the manufacturing function (2nd ed.). London: The McMillan Press.

- Hill, T. (2000). Manufacturing strategy: Text and cases. London: The McMillan Press.

- Kanter, R. M. (1990, November/December). Thinking across boundaries. Harvard Business Review, 68(6), 9-10.

- Knott, P. (2006). A typology of strategy tool applications. Management Decision, 44(8), 1090-1105.

- Lehtinen, U. (1999, June 7). Manufacturing strategy for subcontractors: Challenges and choices in managing networks. In Bartezzaghi, Filippini, Spina, & Vinelli (Eds.), Proceedings of the 1999 EuroMA conference on Managing Operations Networks (pp. 637-644). Venice, Italy: EUROMA.

- McNamee, P. (1990). Developing strategies for competitive advantage. Oxford, UK: Pergamon Press.

- Mintzberg, H., Lampel, J., Quinn, J. B., & Ghoshal, S. (2003). The strategy process: Concepts contexts cases. Harlow, UK: Pearson Education.

- Mintzberg, H., Quinn, J. B., & Shosal, S. (1995). The strategy process: European edition. Hemel Hempstead, UK: Prentice Hall International.

- Novak, S., & Eppinger, S. D. (2001). Sourcing by design: Product complexity and the supply chain. Management Science, 47(1), 189-204.

- Peteraf, M. A. (1993). The cornerstones of competitive advantage. Strategic Management Journal, 14, 179-191.

- Porter, M. E. (1998). Competitive advantage: Creating and sustaining superior performance. New York: The Free Press.

- Pralahad, C. K., & Hamel, G. (1990, July/August). The core competencies of the corporation. Harvard Business Review, 68(3), 79-91.

- Ramdas, K., & Spekman, R. E. (2000). Chain or shackles: Understanding what drives supply-chain performance. Interfaces, 30(4), 3-21.

- Ries, A., & Trout, J. (2000). Positioning: The battle for your mind, 20th anniversary edition. Columbus, OH: McGraw.

- Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5, 171-180.

- Williamson, O. E. (1981). The economics of organization: The transaction cost approach. American Journal of Sociology, 87, 548-577.

See also:

Free research papers are not written to satisfy your specific instructions. You can use our professional writing services to order a custom research paper on any topic and get your high quality paper at affordable price.