Behaviors and perceptions sometimes disconnect. This is evident when the words outsourcing and offshoring—which mean the placement of U.S. jobs in foreign countries— raise the hackles of the public that appears to benefit from the lower consumer prices and mortgage rates occurring as a result of globalization. Consumers economize by buying the least expensive item that they believe meets their needs. Store owners recognize that and ask their suppliers to provide those items at the lowest cost. The wholesalers, in turn, seek out the least expensive producers for the given quality of the good in question. Since the 1960s, the least expensive producer has increasingly been overseas, and U.S. manufacturers have moved abroad. Meanwhile, foreign investors have supplied capital to U.S. capital markets and have helped keep interest rates lower than otherwise possible.

So how does the same globalization phenomenon generate economy-wide benefits, yet there are still winners and losers on an individual level? How do changes in the domestic economy interact with the patterns of globalization? Finally, why is there a disconnect between economic benefits and public perceptions?

Outline

I. Macro Benefits and Micro Winners and Losers in a Dynamic Economy

II. Global Labor Market

III. Insourcing Services

IV. Global Capital Markets: Inflow of Capital to the United States

V. What Should Be Done about Globalization?

Macro Benefits and Micro Winners and Losers in a Dynamic Economy

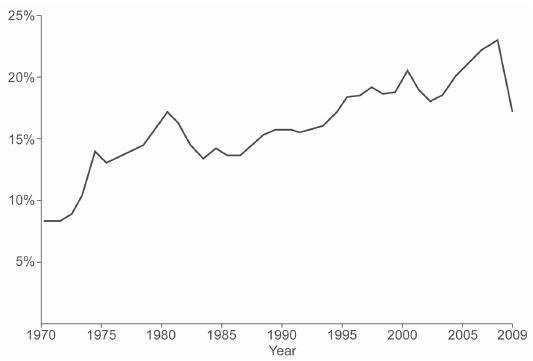

Economies grow and change over time. This growth increases the standard of living for a society, but not all participants benefit equally, and there are often losers in the process, as owners of once-valuable resources (e.g., real estate in the old ghost towns of the West and riverfront mills in the industrial Northeast) find that the demand for those resources has declined. Yet the globalization of the U.S. economy has been a long-term trend, as exhibited in Figure 1, which shows combined exports and imports as a percentage of annual national income. Today this measure of globalization stands near 20 percent of the U.S. economy.

Figure 1. Globalization: U.S. Exports and Imports as a Percentage of Nominal GDP (U.S. Department of Commerce)

The theme underlying any effective Western economic system is that each consumer acts in her or his own interest to minimize costs, while each producer seeks to maximize profit. Consumers maximize their welfare subject to income limitations. Producers, meanwhile, act to offer the least expensive product that will meet the customer’s needs. The boom in discount and Internet shopping over the past 10 years reflects the consumer’s desire to minimize expense of dollars, time, or both. In response, producers have sought to minimize costs in order to maximize profit and thereby have an incentive to seek international sourcing of goods and services that many in the popular press call outsourcing.

Global Labor Market

Trade allows for the division of labor across countries. This division of labor in turn allows for economies of scale and scope and the development of specialized skills. Specialization encourages innovation and promotes dynamism. Economies of scale, scope, and specialization allow production to be more efficient and therefore lower cost. Historically, we have seen the migration of production in the United States in agriculture and textile production. The opening of the Midwest made New England farms high cost and led to a shift of major agricultural production from the Northeast to the Midwest. As for textile production, there has been a migration from England to New England, then to the Southeast, and then on to Mexico and China, and now to Vietnam. Over time, this industry has moved to locations where manufacturers can economize on their biggest cost—labor.

Geographical migration of production has benefited consumers by providing a greater supply of goods and services at a lower price. The lower prices mean that consumers have more real income to be spent elsewhere. In turn, consumers’ standard of living has increased.

The shift in the locus of manufacturing production also means that there are gainers and losers in jobs and land values over time. Southern cities and low-skilled workers have benefited, while New England cities and higher-wage union workers have been the losers. The process of production relocation generally benefits society at large, as less expensive goods are produced for all consumers in the nation, while there is also a regional redistribution of jobs and wealth within the economy.

In recent years, there has been a global redistribution of production, with lower- wage manufacturing jobs in textiles and apparel relocating to Asia. Meanwhile, states like North Carolina increased their exports of high-valued manufactures such as chemicals and electronic products. Today, these two sectors, along with vehicles and machinery, comprise the state’s top four export industries. The globalization of product markets has led to an expansion of world trade. Durable goods manufacturers, such as construction, farm, and industrial machinery, have seen a global increase in demand for their products. Yet as production has grown, there are many physical as well as practical barriers to labor mobility. Therefore, manufacturers that wish to be close to their customers are finding that they cannot source all production from their U.S. base and, as a result, must outsource production to other countries to remain competitive.

Trade does lead to both losses and gains of jobs—both directly in the affected community and indirectly in the surrounding community. As discussed below, policies encouraging the retraining of workers are more likely to be successful than those increasing the prices to consumers. On net, however, lower consumer prices provided by more efficient global production result in an increase in household purchasing power and a broader variety of goods and services for consumers in general. It is helpful to recall that the United States is the world’s largest exporter as well as a major beneficiary of foreign direct investment, which provides jobs in this country. This inflow of foreign capital is seen in the form of a Japanese aircraft manufacturer in North Carolina and a German auto manufacturer in South Carolina.

Unfortunately, those who lose jobs due to trade are not necessarily the same people who get jobs created by trade. Short-term adjustments are painful and represent economic and social challenges. However, our focus should be on the worker, not the job.

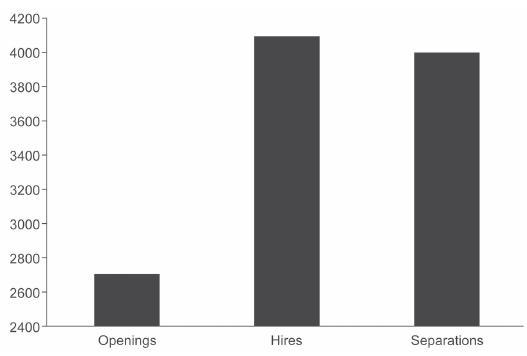

Overall, trade has a small net effect on employment, and this trade effect on employment is overwhelmed by the normal massive turnover in the labor market (see Figure 2). Rather than trade, it is population, education and training, labor force participation, institutions, and flexibility of the labor force that determine long-term employment growth. Labor markets evolve over time, and trade is just one of many influences. We do know that trade often leads to structural change in the labor markets with consequential effects on the mix of jobs across industries, the skill levels required, and the ultimate locations of job growth. For example, in recent years, lower transaction costs and improvements in international communications have led to a rising global demand for computerization and digitalization of business services, which has boosted the fortunes of U.S.-based software and hardware firms.

Figure 2. Job Market Dynamics, March 2010 (thousands of jobs) (U.S. Department of Commerce)

Meanwhile, the customer service of many of these software and hardware products and services has increased the global demand for educated English-speaking workers abroad in places such as Ireland and India. This demand for foreign workers is driven by the consumer who wants 24-hour service at the touch of a button. Therefore, companies are more likely to meet that demand at lower wages and benefit costs by hiring first-shift workers in India or Ireland than second- and third-shift workers in the United States.

In contrast, attempts to manipulate the economic theme of markets by tariff s, quotas, or labor regulations may temporarily slow job loss, but at the cost of higher prices to consumers and a misallocation of resources toward inefficient production in the rest of society. In the past, this inefficient production has been seen in subsidies to steel and textile industries and in the tariff s imposed in the 19th century to protect inefficient agriculture. In the end, the steel and textile mills still closed, and many Eastern and Southern farms became suburbs. Government interference in the economic process only increased short-term costs to the rest of the economy through higher prices. Moreover, over the long term, government interference frequently prevented the proper reallocation of resources to more productive uses. Protectionism on trade provoked retaliation from foreign governments and a retreat from competition. As a result, protectionism leads to bloated, inefficient industries that decrease productivity and engender a lower standard of living.

Insourcing Services

Balanced discussions on trade issues are often interrupted by emotional outbursts or political grandstanding. While some manufacturing jobs are disappearing, many higher- paid service positions are being created here as foreigners increase their demand for U.S.-based services. These high-value services provided to users abroad include legal, financial, engineering, architectural, and software development services. This insourcing of professional services to the United States generates a surplus in the service component of our balance of payments accounts. The economic market-based system provides a wider array of goods and services at a lower cost than the alternatives. Greater global competition provides such benefits to society overall. There are costs of globalization that should be addressed, but by means other than preventing trade.

Global Capital Markets: Inflow of Capital to the United States

Another variation on the theme is the pattern of global capital (financial) flows and the globalization of capital markets. In contrast to labor, capital crosses borders fairly easily. In sympathy with labor, the return of capital provides an incentive to allocate capital to its best use. U.S. consumers benefit from an inflow of capital that lowers the price of credit interest rates—relative to what they would be otherwise (this reduces the interest rates on home mortgages, for example).

In addition, global capital markets lead to the development of new financial instruments that provide greater liquidity to international investors. We see this in the development of instruments such as mortgage-backed and asset-backed securities. Globalization of product markets has meant the introduction of new brands and products from foreign countries into the U.S. consumer market in particular. With capital markets, globalization has meant that U.S. financial assets such as mortgage-backed securities are now available for sale across the globe, while foreign investors with excess cash can now direct that cash toward U.S. markets.

Globalization of products leads to an expansion of world trade. The globalization of capital markets is also leading to an expansion of financial markets. For the United States, particularly in nonrecessionary times, this means a broader demand for mortgages, car loans, and business credit, which thereby effectively lowers interest rates for the U.S. consumer. In this case, the consumer comes out the winner from globalization. Consumers find that credit is more readily available at lower interest rates.

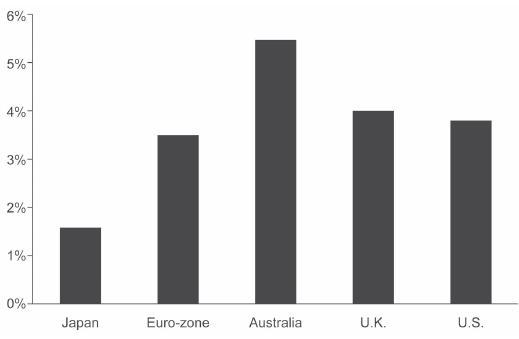

Foreign investors benefit by purchasing U.S. financial assets that are perceived to offer higher returns and lower risks than many foreign assets. This is particularly true when you view the benchmark interest rates between countries (Figure 3). Prior to the economic crisis of 2008–2009, which hit the U.S. financial sector particularly hard, the United States led the pack, rating above 5 percent in the years immediately preceding the crisis.

Figure 3. 10-year Government Bond Rates (Q1 2010) (Federal Reserve System)

Public policy in the United States has promoted these capital flows by reducing taxes on dividend and capital gains, while also lowering barriers to cross-border investment by foreign investors. This has helped promote capital flows into the United States, even while other nations limit capital flows into or out of their own nations.

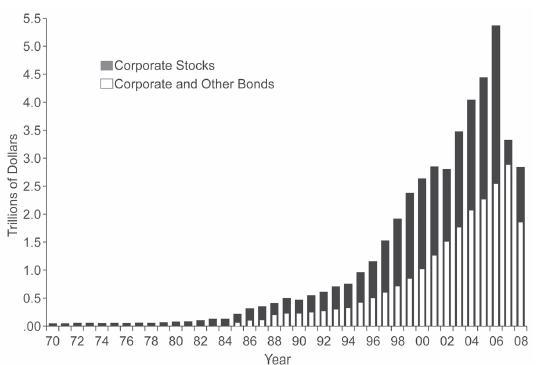

Just as trade alters the global distribution of production, capital flows alter the global distribution of financial investment. Over recent years, with the exception of the 2008– 2009 economic crisis, the United States has experienced growth of financial instruments and market values. Therefore, the United States benefits from the globalization of financial markets. Global savings migrate to higher return on U.S. investments (Figure 4) and thereby raise output and incomes.

Figure 4. U.S. Securities Held Abroad (Bureau of Economic Analysis)

What Should Be Done about Globalization?

Globalization is a product of economic incentives, not the result of some great conspiracy. Households have a limited budget and attempt to save money when they shop. Producers attempt to meet consumer demands by supplying products at a price that meets their budget. Meanwhile, many U.S. firms cannot meet their global demand by production solely in the United States and thereby locate production facilities near their customers. On the financial side, the globalization of capital markets has led to an increase in financial flows to the United States and has thereby increased the availability of credit and lowered interest rates. Lower rates mean that more families are able to purchase homes and businesses can finance expansion. This process is unlikely to stop.

Policymakers and voters need to recognize the dislocation costs associated with the global reallocation of production and financial flows along with the benefits that derive from such reallocation. For U.S. workers, the cost disincentives of retaining labor in many facilities in the United States may be too large to retain the old jobs in the old facilities. This may be particularly true for labor-intensive manufacturing and service jobs that require low- or semiskilled workers. In U.S. history, we have seen the migration of jobs before, from the agricultural work forces in rural areas to the manufacturing facilities of the pre–World War II era. Technological and communication changes have made many low-skilled jobs obsolete and therefore not viable economically over the long run. Certainly many workers can no longer build careers upon these jobs. Recall that consumer preferences have also shifted, with more consumer dollars going toward services—for example, eating out as opposed to buying groceries at the store to prepare all the household’s meals.

While jobs may go, workers remain, and this should be our focus. Public and private programs need to be directed at worker retraining—not factory retention—in cases where the economics are clear. Labor markets are becoming increasingly flexible so that jobs are more likely to come and go, but the workers remain. Public policy is better served by the improvement of the skills of workers rather than the preservation of specific jobs. Many states have seen the emergence of programs at community colleges with a dedicated focus on worker retraining. Of course, it is incumbent upon the worker to recognize that there is a responsibility to develop those skills and to be willing to move or change jobs more in the future than was necessary in the past.

As for manufacturing, it is important to note that many public policy decisions are aimed at discouraging production in the United States. Whatever their intentions may be, many communities simply do not want a factory in their backyard. As a result, firms are outsourcing production abroad simply because they cannot produce the gasoline, plastics, rubber, metals, textiles, and the like in this country.

On the other hand, large capital inflows into the United States also offer a solution by which incentives can be directed to foreign firms to allocate capital to areas where there is a viable workforce. We have seen this in many states where incentives are offered to locate firms in certain communities.

Off shoring creates value for the U.S. economy by passing on the efficiency that results in lower costs of goods and services to the U.S. consumer. This consumer then takes the extra money saved at the store and spends it elsewhere. U.S. companies benefit by being able to meet consumer demand by supplying the goods or services at a lower cost. Economic resources can be used then for more value-added products and services. Redeployed labor and capital to other manufacturing and service-sector activities will be more productive and have a longer economic life than those production activities and jobs in declining industries. U.S. workers and consumers benefit from specialization. Final assembly can often occur in the United States, while component production takes place around the globe. Production of goods and services is not carried on for its own sake but is undertaken to serve the demands of the consumer. Therefore, the value of any product is determined by consumers and then works its way down into the factors of production. It is impossible to governmentally control trade and consumer choice without distorting economic activity.

When a less costly way to make a good is discovered, the value of all factors used in making that good also changes. The national standard of living cannot rise when states attempt to force up the price of some factors so that the owners of those factors used in production gain an artificial advantage that results in the inefficient allocation of scarce resources in the economy. Globalization reflects the demands of the consumer. Attempts to alter that trend will only diminish the welfare of the average consumer.

Also check the list of 100 most popular argumentative research paper topics.

Bibliography:

- Burkholder, Nicholas C., Outsourcing: The Definitive View, Applications and Implications. Hoboken, NJ: John Wiley, 2006.

- Feenstra, Robert C., Offshoring in the Global Economy: Microeconomic Structures and Macroeconomic Implications. Cambridge, MA: MIT Press, 2010.

- Freeman, Jodi, and Martha Minnow, Government by Contract: Outsourcing and American Democracy. Cambridge, MA: Harvard University Press, 2009.

- Mol, Michael, Outsourcing: Design, Process and Performance. New York: Cambridge University Press, 2007.

- Oshri, Ilan, Julia Kotlarsky, and Leslie P. Willcocks, The Handbook of Global Outsourcing and Off – shoring. New York: Palgrave Macmillan, 2009.